- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Is the Cameco Rally Justified After Global Nuclear Energy News and a 54% Surge?

Reviewed by Bailey Pemberton

- Curious if Cameco is trading at a bargain or riding a wave of optimism? You are not alone, as investors everywhere are eyeing its potential value.

- Recently, Cameco's stock price has seen a 4.1% dip over the past week. It remains up a remarkable 54.0% year-to-date and 36.2% over the past year, hinting at both rapid growth and shifting risk perceptions.

- Fueling these moves, Cameco has been in the spotlight following news of expanding global nuclear initiatives and new long-term supply contracts. This reflects a changing energy landscape and renewed interest in nuclear as a clean energy source. These industry trends are keeping the stock on many watchlists.

- On our value scorecard, Cameco registers a 1 out of 6, signaling there is more to uncover below the surface. Next, we will walk through the major valuation approaches. Plus, stay tuned for the most insightful way to judge if Cameco is truly undervalued.

Cameco scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cameco Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its expected future cash flows and discounting them back to their present value. This method is widely used for understanding what a business is really worth based on its ability to generate cash in the future.

For Cameco, the DCF uses a two-stage Free Cash Flow to Equity approach. The latest reported Free Cash Flow (FCF) stands at approximately CA$1.01 billion. Analyst estimates project FCF to reach about CA$1.07 billion by year-end 2029, with most of the next decade's forecasts showing annual cash flows in the range of CA$0.8 billion to CA$1.4 billion. Notably, only the first five years are supported by analyst predictions, while figures beyond that point are extrapolated using industry models.

Based on these cash flow projections, the calculated intrinsic value of Cameco shares is CA$42.14. However, compared to the current share price, this implies Cameco is trading at a 174.4% premium to its fair value according to this DCF model. This signals significant overvaluation at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cameco may be overvalued by 174.4%. Discover 919 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cameco Price vs Earnings

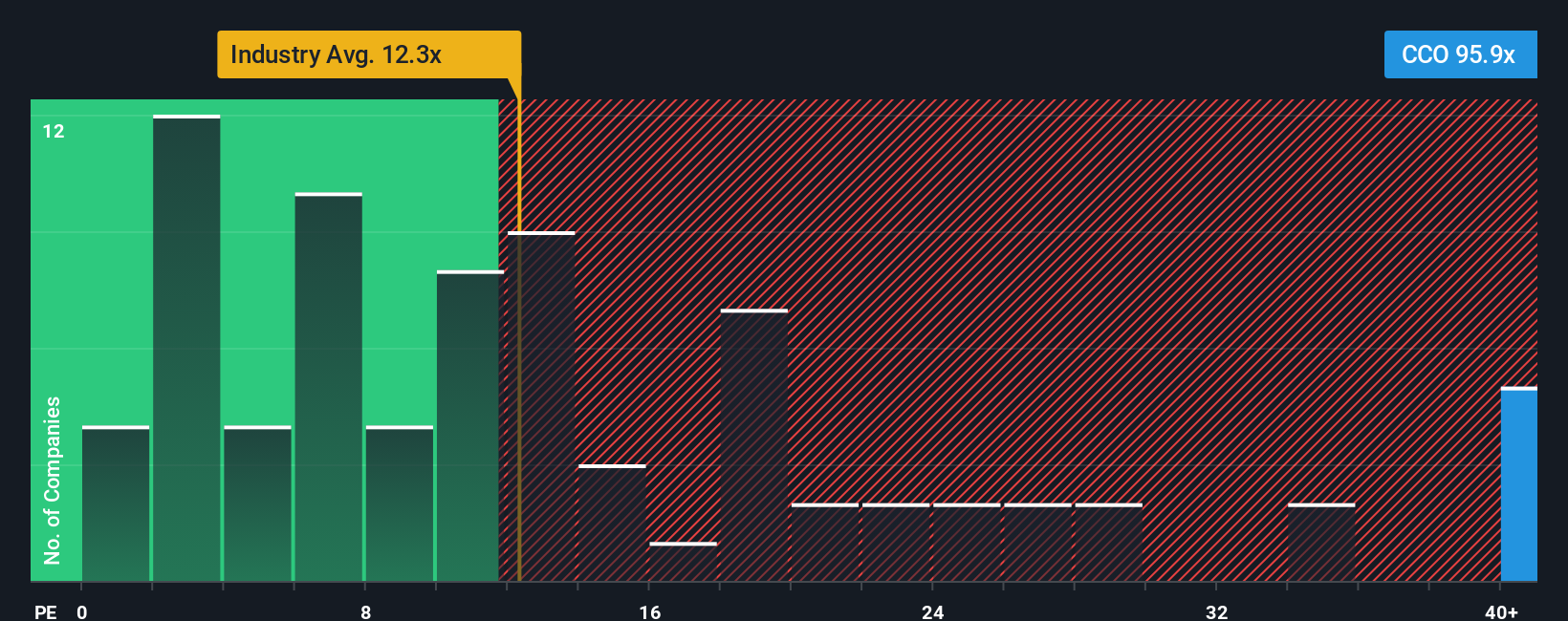

The price-to-earnings (PE) ratio is a key valuation tool for profitable companies like Cameco because it tells investors how much they are paying for each dollar of earnings. A higher PE ratio typically signals that the market expects faster future growth or sees lower risk, while a lower PE ratio may indicate caution or lower expectations for expansion.

Currently, Cameco trades at a PE ratio of 95.7x, which is significantly above both the oil and gas industry average of 15.0x and its closest peer average of 17.1x. On the surface, this suggests the market is factoring in exceptional future growth or perhaps pricing in reduced risks compared to its sector and peers.

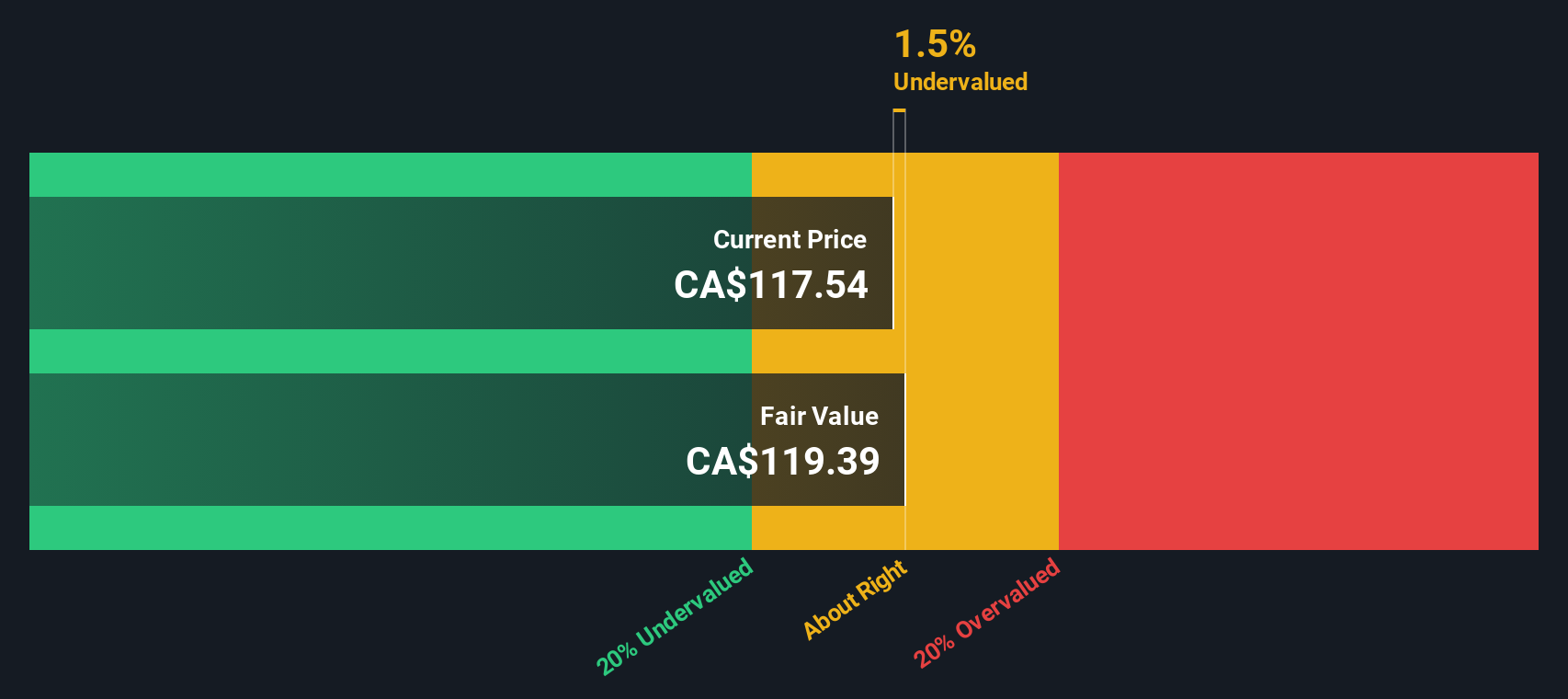

However, to get a more nuanced view, Simply Wall St calculates a "Fair Ratio," an individualized valuation multiple that considers Cameco’s unique growth prospects, profit margins, risk profile, and market standing. This approach goes beyond simply lining up against peers or the broader industry by adjusting for the real drivers behind a company's expected future performance.

For Cameco, the Fair Ratio is 18.9x. Comparing this to the actual PE ratio of 95.7x reveals that the stock is currently priced much higher than what would be justified by its fundamentals, even after accounting for its specific strengths and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cameco Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a dynamic and accessible tool that helps you look beyond the numbers and add your own story to any company, including Cameco.

A Narrative is simply your perspective on what makes a business tick, blending your expectations for its future (like revenue, margins, and fair value) with the key trends and risks you believe matter most.

By connecting the dots between Cameco’s business story, your financial forecasts, and what you think the shares are worth, Narratives empower you to make decisions that reflect your personal investment outlook.

On Simply Wall St’s Community page, Narratives are used by millions of investors to compare their fair value to the current share price, helping them decide when to consider buying or selling.

The best part? Your Narrative automatically updates when news breaks or new financial results come out, so your investment view stays relevant and up to date.

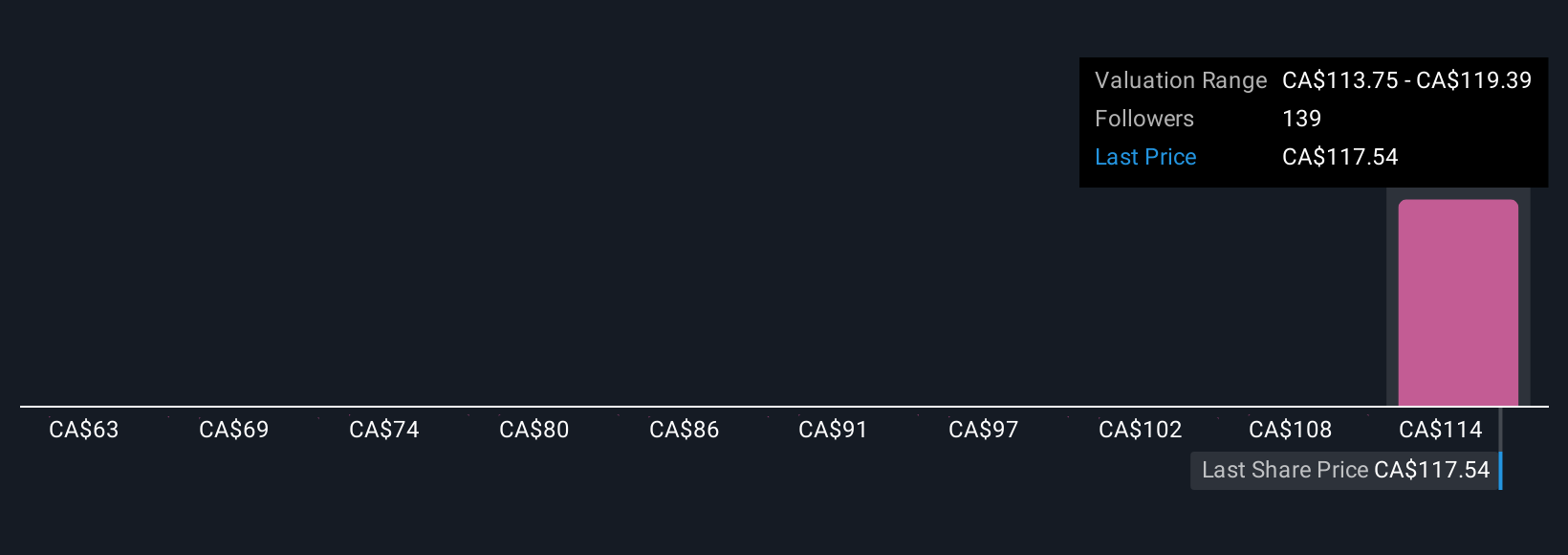

For example, some Cameco investors believe the company is worth as much as CA$146.44, seeing huge potential in the nuclear industry, while others are more cautious with estimates as low as CA$100.00. This highlights the power of Narratives to reflect diverse outlooks and help you invest on your terms.

Do you think there's more to the story for Cameco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives