- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO): Examining Valuation Following Recent Share Price Pullback

Reviewed by Simply Wall St

Cameco (TSX:CCO) shares have seen a mixed stretch lately, catching the attention of investors tracking the uranium sector. After a strong run this year, recent weeks have brought some profit-taking and renewed questions about valuations.

See our latest analysis for Cameco.

Cameco’s share price has experienced plenty of action this year, with strong momentum pushing shares up over 55% year-to-date before recent gains cooled, leading to some pullback in the past week. Even so, long-term investors have seen their patience rewarded handsomely, with Cameco delivering a staggering 267% total shareholder return over the past three years and more than 780% over five years. This highlights just how powerful the uranium revival narrative has been.

If market shifts in the energy sector have you curious, now could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But the question now is whether Cameco’s impressive run reflects true underlying value, or if recent gains mean that all future growth is already factored in and there is little room for upside. Is this a new buying opportunity, or has the market already accounted for what’s next?

Most Popular Narrative: 20.5% Undervalued

Cameco’s widely followed narrative assigns a fair value that is noticeably above the latest closing price. This perspective stands out by emphasizing business fundamentals and projected growth rather than current market prices.

Cameco stands to benefit from a global wave of new nuclear construction, driven by heightened government policy support, net-zero emission mandates, and growing energy security concerns. These factors are likely to accelerate demand for uranium and nuclear fuel, directly supporting higher long-term revenues. Ongoing structural supply constraints in the uranium sector, combined with years of underinvestment and the need for Western-aligned, geopolitically secure fuel suppliers, further enhance Cameco's long-term volume and pricing opportunities. This underpins stronger forecast cash flows and sustained profitability.

Want to know why this narrative puts Cameco’s value far above today’s price? There’s a surprising mix of aggressive margin forecasts and sector-driven optimism fueling the story. Dig into what’s driving analysts to assign such a rich valuation. One critical projection could flip your investment thesis.

Result: Fair Value of $146.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in major nuclear reactor projects or persistent production challenges at key mines could slow the growth that currently supports Cameco’s optimistic outlook.

Find out about the key risks to this Cameco narrative.

Another View: Are the Multiples Telling a Different Story?

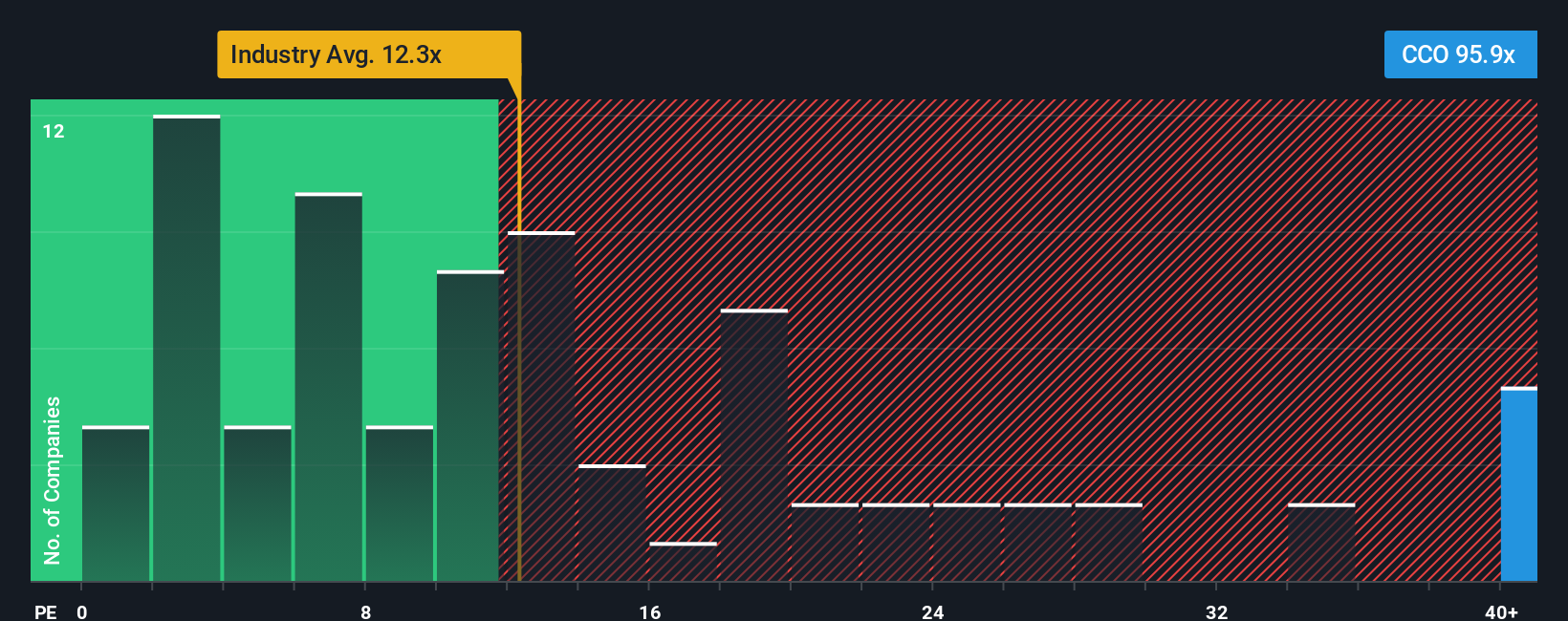

While analyst models point to upside, there is a very different picture if you look at valuation multiples. Cameco trades at a price-to-earnings ratio of 96.4x, much higher than both its peer average of 17.2x and the Canadian oil and gas industry average of 15.5x. Even compared to the fair ratio of 18.9x, the market is pricing in huge expectations, which raises the risk that gains may already be baked in. Could this premium hold up, or will reality catch up with sentiment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cameco Narrative

If you see things differently, or want to dig into the numbers yourself, you can shape your own Cameco story in just a few quick steps. Do it your way.

A great starting point for your Cameco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Unlock even more opportunities and stay ahead by using the Simply Wall Street Screener. If you only watch Cameco, you could miss out on hidden gems in thriving sectors.

- Capture the potential of artificial intelligence by targeting these 27 AI penny stocks, which are revolutionizing industries with breakthroughs in automation and machine learning innovations.

- Secure steady income with these 18 dividend stocks with yields > 3%, offering reliable yields to strengthen your portfolio with consistent cash flow.

- Embrace the next financial frontier through these 81 cryptocurrency and blockchain stocks, leading the way in blockchain and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives