- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO) Earnings Surge 107.5%, Reinforcing Bullish Growth Narrative Despite Lofty Valuation

Reviewed by Simply Wall St

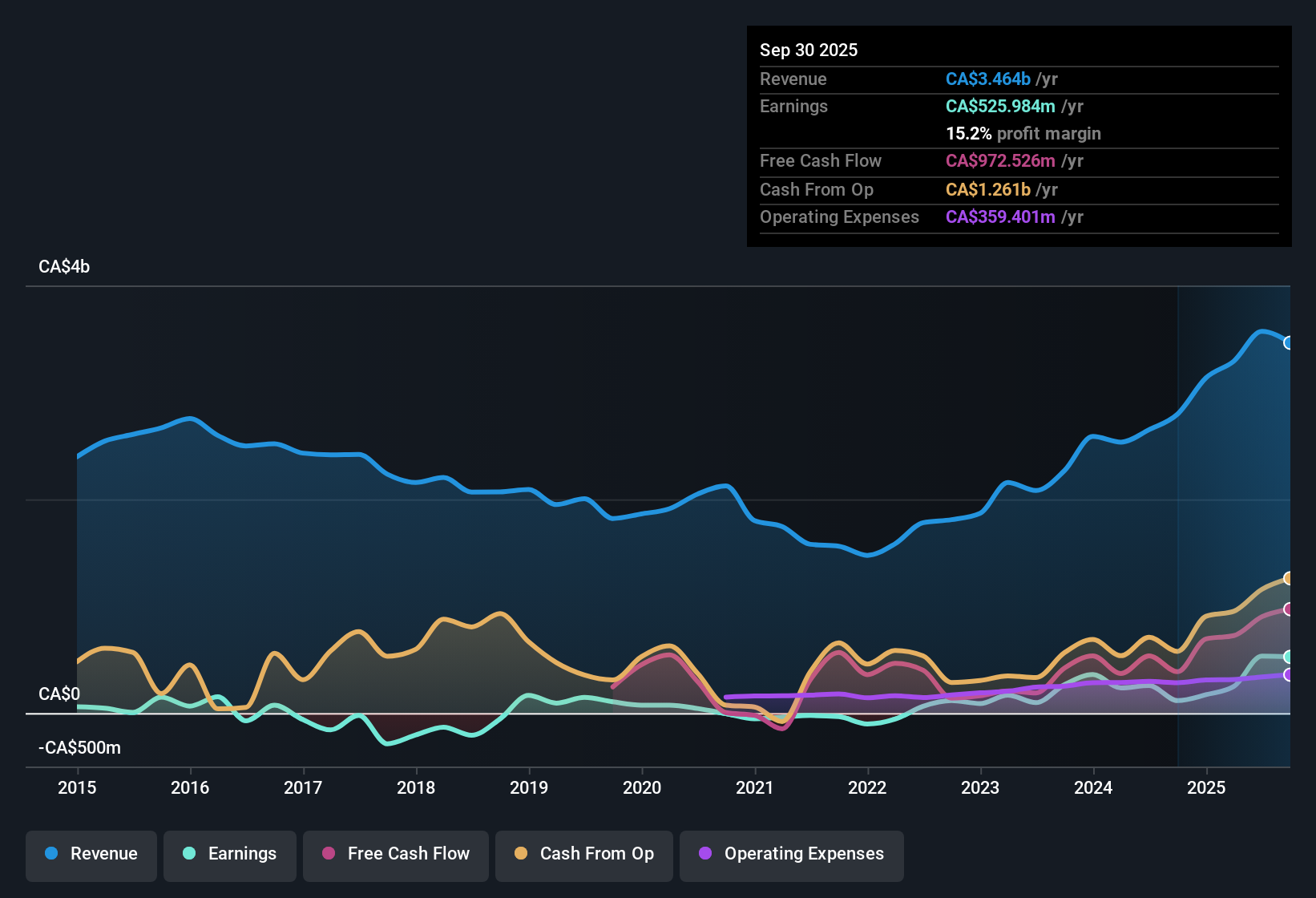

Cameco (TSX:CCO) posted standout numbers, delivering earnings growth of 60.5% per year over the past five years, with its most recent annual EPS growth accelerating to 107.5%, well ahead of its longer-term average. Net profit margin climbed to 14.9%, up notably from last year's 9.7%. Revenue is forecast to rise 6.2% per year and earnings at 22.1% per year, both outpacing the broader Canadian market. For investors, these results underscore a strong phase of earnings momentum and operational progress. However, Cameco's elevated price-to-earnings ratio of 109.7x and a current share price of CA$134.45 suggest optimism is already heavily reflected in the stock.

See our full analysis for Cameco.The next step is to put these headline results up against the narratives investors follow most closely. Let’s see where the data reinforces market stories and where it provokes fresh debate.

See what the community is saying about Cameco

Profit Margins Poised for Expansion

- Analysts forecast Cameco’s profit margins rising from 14.9% now to 31.6% in three years, nearly doubling operating profitability during the growth cycle.

- According to the analysts' consensus view, margin expansion is driven by rising long-term nuclear energy demand and Cameco's disciplined supply approach.

- Higher margins are expected as a wave of reactor approvals and government energy policy supports uranium pricing. This reinforces bullish expectations for durable profit growth.

- However, the consensus also highlights that these projections rely on timely final investment decisions and improved utility contracting volumes, which are not yet fully reflected in current business forecasts.

- Momentum in margin growth faces its biggest test if sector-wide project delays or supply chain snags materialize. This could put upside at risk.

Long-Term Earnings Growth Needs Project Approvals

- Analysts estimate earnings will climb from CA$533.6 million today to CA$1.2 billion by late 2028, but there is significant disagreement, with bulls seeing up to CA$1.3 billion while bears expect as low as CA$873 million.

- The consensus narrative flags that earnings projections are highly sensitive to the pace of new nuclear reactor project approvals globally.

- Delays in these key projects would leave much of the expected upside out of reach, tempering the growth story.

- Still, if government policies accelerate and term-contracting improves as anticipated, Cameco could capture revenue from a growing backlog of uncovered utility demand through 2045.

Want to see how analysts are weighing Cameco's future given both the growth forecast and the sector risks? 📊 Read the full Cameco Consensus Narrative.

Valuation Seen as a Key Hurdle at 109.7x PE

- Cameco currently trades at a price-to-earnings ratio of 109.7x, well above both the Canadian industry average (12.5x) and its estimated DCF fair value of CA$97.23. Its share price of CA$134.45 is below the current analyst price target of CA$143.06.

- The analysts' consensus view emphasizes that despite strong fundamentals, the modest gap between today’s share price and the price target means further upside relies on sentiment remaining bullish and future earnings targets being met.

- These lofty valuation multiples challenge bears’ skepticism, as the stock’s premium pricing continues to reflect high confidence in Cameco’s growth profile and nuclear sector resilience.

- If margins or revenue growth fall short, Cameco’s elevated valuation could compress rapidly, exposing any disappointment relative to these assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cameco on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on Cameco's results? Share your angle and build your version of the story in just a few minutes. Do it your way

A great starting point for your Cameco research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Cameco’s premium valuation creates real downside risk if margins or revenue growth fall short of the market’s bullish expectations over the coming years.

If reaching for growth at any price makes you uneasy, use our these 850 undervalued stocks based on cash flows to find companies trading at more attractive valuations with solid upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives