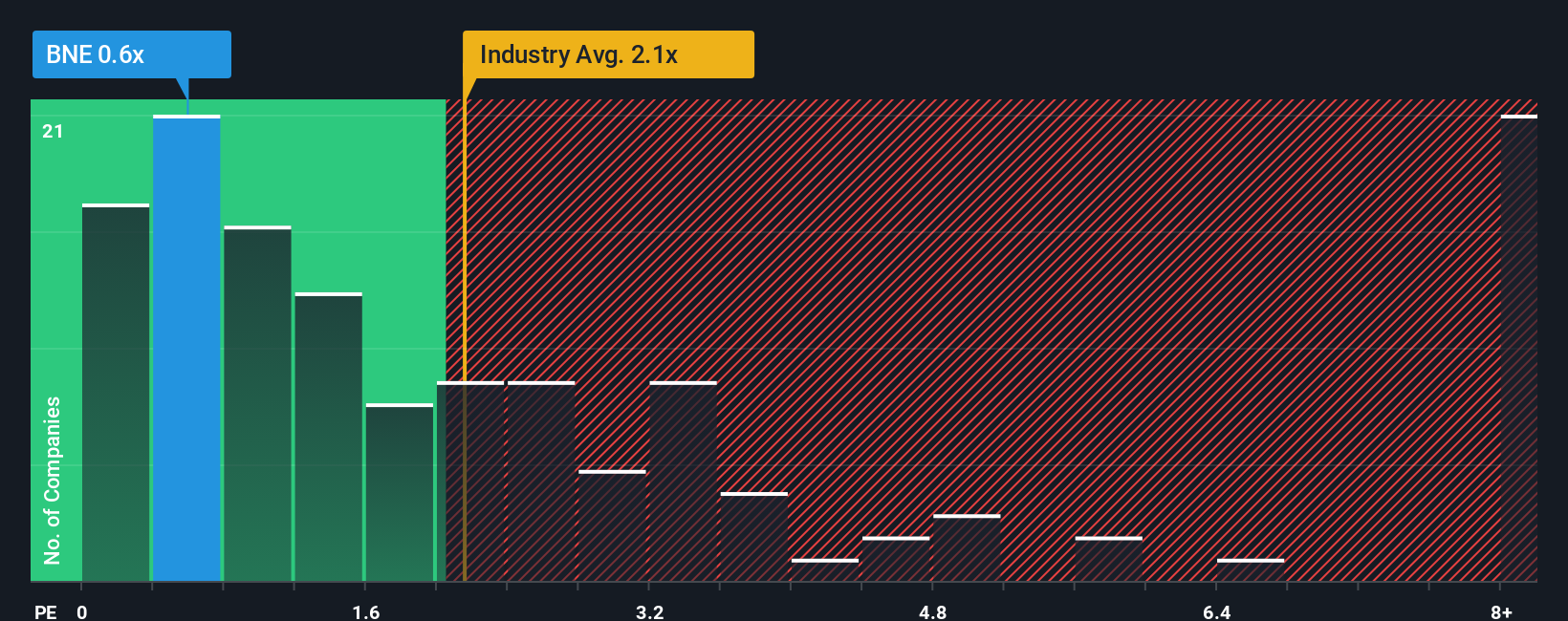

With a price-to-sales (or "P/S") ratio of 0.6x Bonterra Energy Corp. (TSE:BNE) may be sending bullish signals at the moment, given that almost half of all the Oil and Gas companies in Canada have P/S ratios greater than 2.1x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Bonterra Energy

How Has Bonterra Energy Performed Recently?

Bonterra Energy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bonterra Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Bonterra Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 7.8% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 3.6% over the next year. With the industry predicted to deliver 5.3% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Bonterra Energy's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Bonterra Energy's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Bonterra Energy (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bonterra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BNE

Bonterra Energy

A conventional oil and gas company, engages in the development and production of oil and natural gas in Canada.

Very undervalued with mediocre balance sheet.

Market Insights

Community Narratives