- Canada

- /

- Oil and Gas

- /

- TSX:BNE

Easy Come, Easy Go: How Bonterra Energy (TSE:BNE) Shareholders Got Unlucky And Saw 91% Of Their Cash Evaporate

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Bonterra Energy Corp. (TSE:BNE) for five whole years - as the share price tanked 91%. And some of the more recent buyers are probably worried, too, with the stock falling 67% in the last year. Unfortunately the share price momentum is still quite negative, with prices down 21% in thirty days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Bonterra Energy

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Bonterra Energy became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 9.0% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

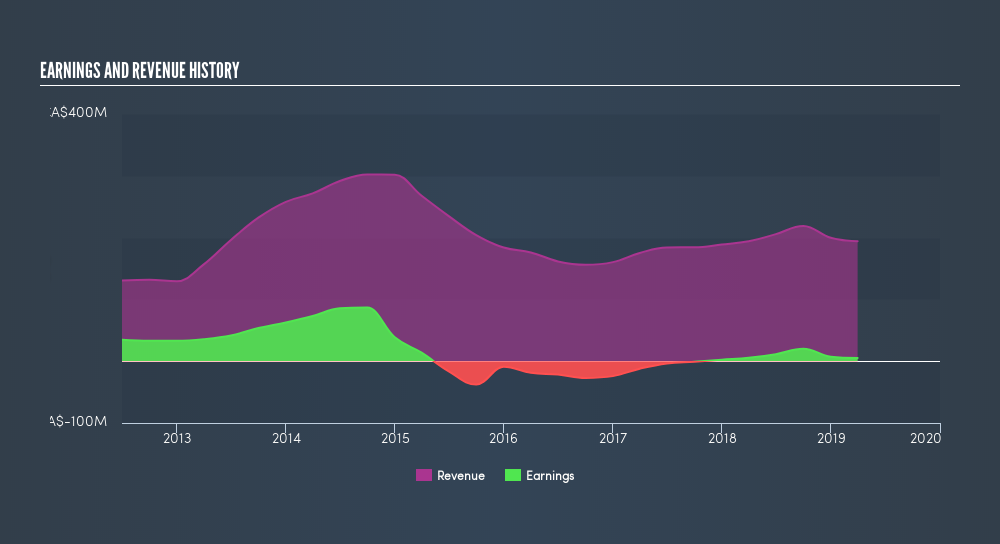

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Bonterra Energy will earn in the future (free profit forecasts).

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Bonterra Energy the TSR over the last 5 years was -88%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that Bonterra Energy shareholders are down 66% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 35% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Bonterra Energy is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:BNE

Bonterra Energy

A conventional oil and gas company, engages in the development and production of oil and natural gas in Canada.

Slight and fair value.

Market Insights

Community Narratives