- Canada

- /

- Oil and Gas

- /

- TSX:KEI

Some BNK Petroleum (TSE:BKX) Shareholders Have Taken A Painful 83% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

This week we saw the BNK Petroleum Inc. (TSE:BKX) share price climb by 16%. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Indeed, the share price is down a whopping 83% in that time. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for BNK Petroleum

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

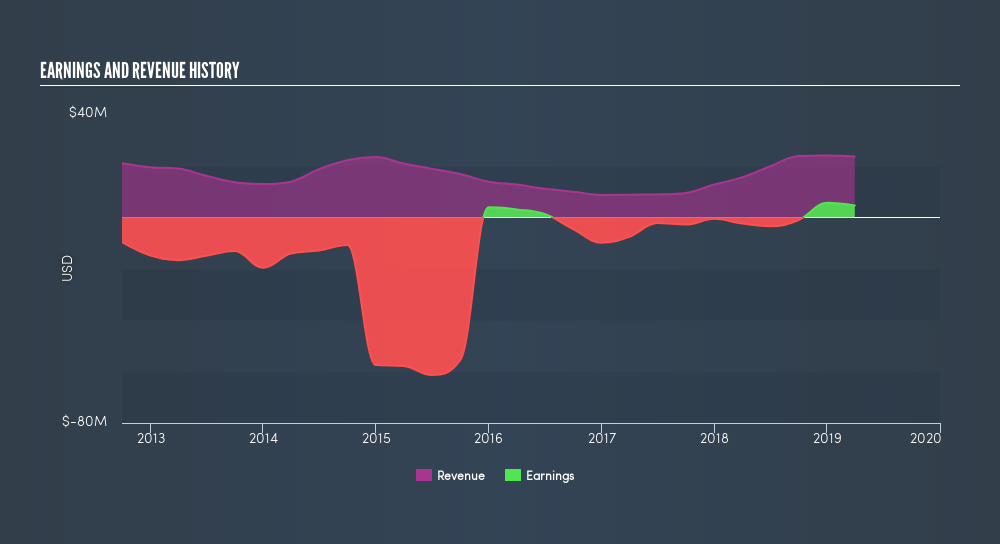

BNK Petroleum became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Revenue is actually up 0.5% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

If you are thinking of buying or selling BNK Petroleum stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in BNK Petroleum had a tough year, with a total loss of 44%, against a market gain of about 1.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 29% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Is BNK Petroleum cheap compared to other companies? These 3 valuation measures might help you decide.

But note: BNK Petroleum may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:KEI

Kolibri Global Energy

Engages in the exploration and exploitation of oil, gas, and clean and sustainable energy reserves in the United States.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives