- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Undiscovered Gems In Canada Featuring Birchcliff Energy And Two More Small Caps

Reviewed by Simply Wall St

In Canada, recent economic indicators show signs of stabilization, with the August labor market report reflecting a relative steadiness and inflation figures aligning with expectations. Amidst this backdrop of cautious optimism and potential market volatility, investors may find opportunities in small-cap stocks that demonstrate resilience and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| GR Silver Mining | NA | nan | 23.15% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Birchcliff Energy (TSX:BIR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company focused on the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of approximately CA$1.61 billion.

Operations: Revenue for Birchcliff Energy comes primarily from its oil and gas exploration and production segment, totaling CA$648.22 million.

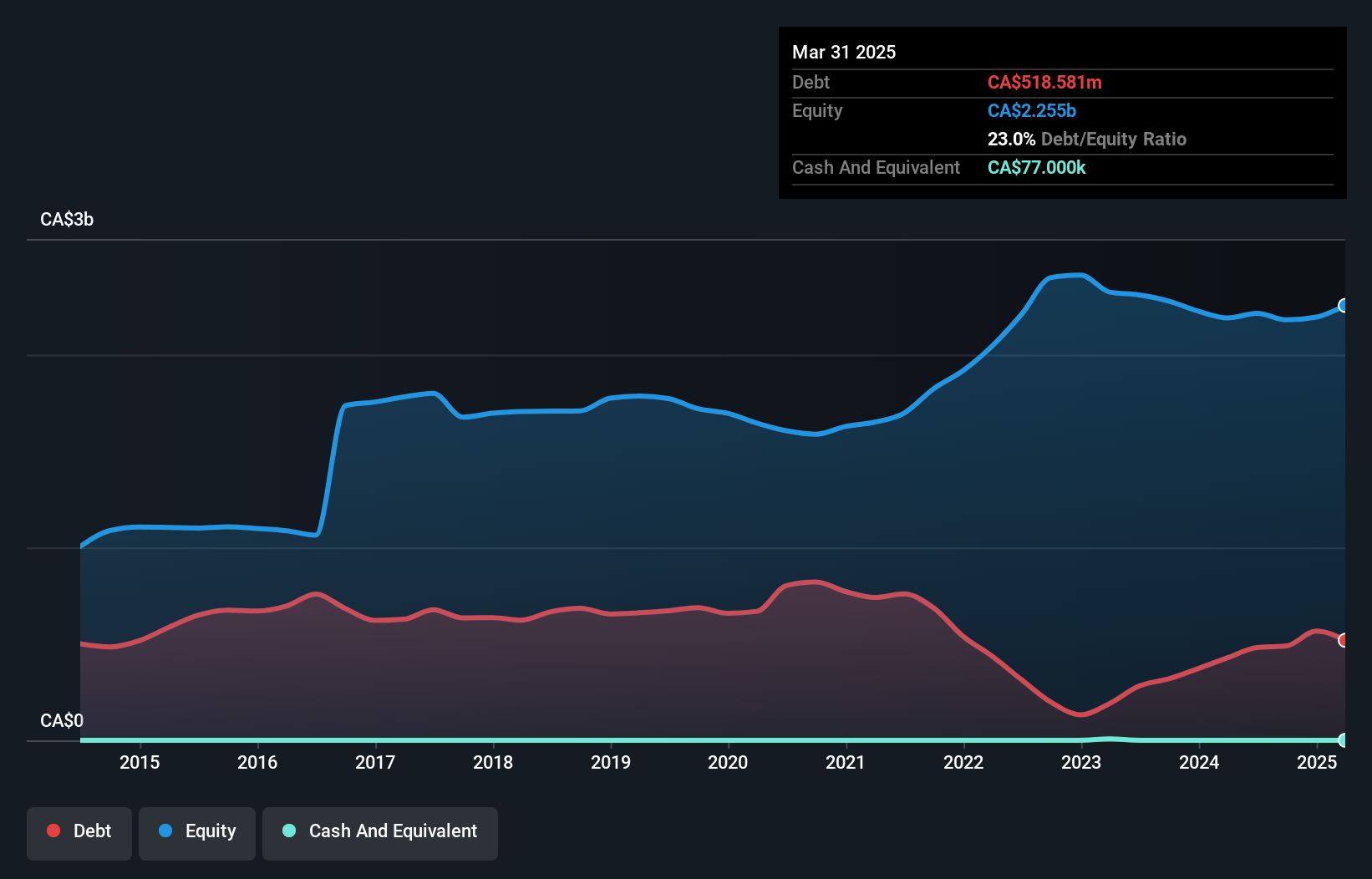

Birchcliff Energy, a smaller player in the Canadian oil and gas sector, has shown impressive earnings growth of 87.2% over the past year, outpacing the industry's 7.8%. The company boasts high-quality earnings and maintains a satisfactory net debt to equity ratio of 23.6%, down from 50% five years ago. Despite reporting a second-quarter net loss of CAD 13.9 million against last year's income of CAD 46.38 million, Birchcliff remains profitable with well-covered interest payments at three times EBIT coverage. Additionally, revenue for six months increased to CAD 379.05 million from CAD 352.02 million previously, showcasing resilience amidst fluctuating production figures.

- Click here and access our complete health analysis report to understand the dynamics of Birchcliff Energy.

Examine Birchcliff Energy's past performance report to understand how it has performed in the past.

Kiwetinohk Energy (TSX:KEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kiwetinohk Energy Corp. is involved in the production of natural gas, natural gas liquids, oil, and condensate in Canada with a market capitalization of approximately CA$1.03 billion.

Operations: Kiwetinohk Energy Corp. generates revenue primarily from the exploration and development of petroleum and natural gas, amounting to CA$559.56 million.

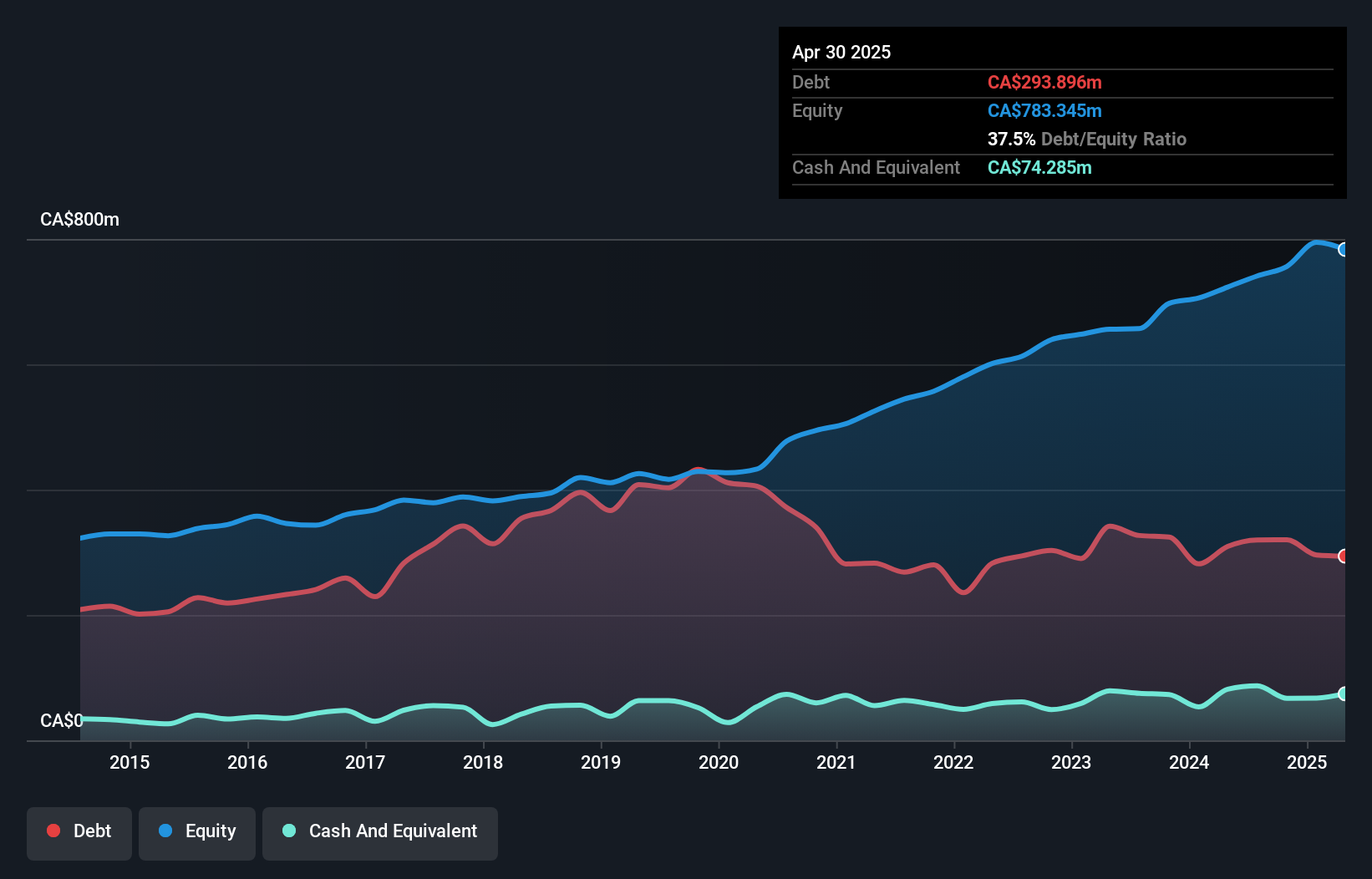

Kiwetinohk Energy, a Canadian oil and gas player, is making waves with its impressive earnings growth of 528.5% over the past year, outpacing the industry average of 7.8%. Trading at 77.6% below its estimated fair value, it offers potential value for investors. The company's net debt to equity ratio stands at a satisfactory 24.4%, with interest payments well covered by EBIT at 7.8 times coverage. Recent quarterly results show revenue jumping to CAD 195 million from CAD 91 million last year, while net income soared to CAD 59 million from a loss of CAD 27 million previously.

- Click to explore a detailed breakdown of our findings in Kiwetinohk Energy's health report.

Understand Kiwetinohk Energy's track record by examining our Past report.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services across northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market capitalization of approximately CA$2.30 billion.

Operations: North West generates revenue primarily from retailing food and everyday products and services, reporting CA$2.60 billion in this segment.

North West Company, with its solid financial footing, boasts a net debt to equity ratio of 31%, which is deemed satisfactory. Over the past five years, the company has effectively reduced its debt to equity from 77.9% to 39.6%. Although earnings have seen a slight annual decline of 1% over this period, North West maintains high-quality earnings and impressive interest coverage at 11.9 times EBIT. Recent developments include a modest increase in quarterly dividends and share repurchases worth CAD 4.5 million for about 0.19% of shares, reflecting prudent capital management strategies amidst stable revenue growth forecasts at around 5%.

- Unlock comprehensive insights into our analysis of North West stock in this health report.

Explore historical data to track North West's performance over time in our Past section.

Key Takeaways

- Explore the 46 names from our TSX Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives