- Canada

- /

- Oil and Gas

- /

- TSX:BIR

The Bull Case For Birchcliff Energy (TSX:BIR) Could Change Following Raised Production Guidance and Debt Reduction Plans – Learn Why

Reviewed by Sasha Jovanovic

- Birchcliff Energy Ltd. recently announced its third quarter 2025 results, highlighting an increase in oil and gas production and raising its full-year production guidance following strong operational performance, while also affirming a quarterly dividend of $0.03 per share.

- An interesting insight is that despite reporting a quarterly net loss, the company anticipates significant free funds flow in the fourth quarter, which it plans to use to reduce debt by approximately 14% from 2024 year-end.

- We'll now explore how Birchcliff’s higher production guidance and focus on debt reduction influence its overall investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Birchcliff Energy's Investment Narrative?

To be a Birchcliff Energy shareholder, you really have to believe in the company’s ability to translate its strong operational execution and rising production into improved profitability, while managing the volatility that comes with fluctuating commodity prices and variable earnings. The latest update, a bump in full-year production guidance and a clear plan to use anticipated free funds flow to reduce debt, reflects management’s priority on operational resilience and balance sheet strength. This is a positive catalyst in the short term, as it signals greater predictability to the business, even as Q3 posted a net loss. Importantly, the focus on debt reduction may also act as a buffer against future market or pricing shocks. However, the fact that net losses have persisted, even with higher output, keeps execution risk and commodity price sensitivity front and centre as ongoing concerns. Recent price moves show the market is paying attention, but the company’s ability to meaningfully grow earnings and defend margins now depends on continued delivery against these improved targets.

But, with persistent net losses in the near term, debt reduction remains a risk to watch.

Exploring Other Perspectives

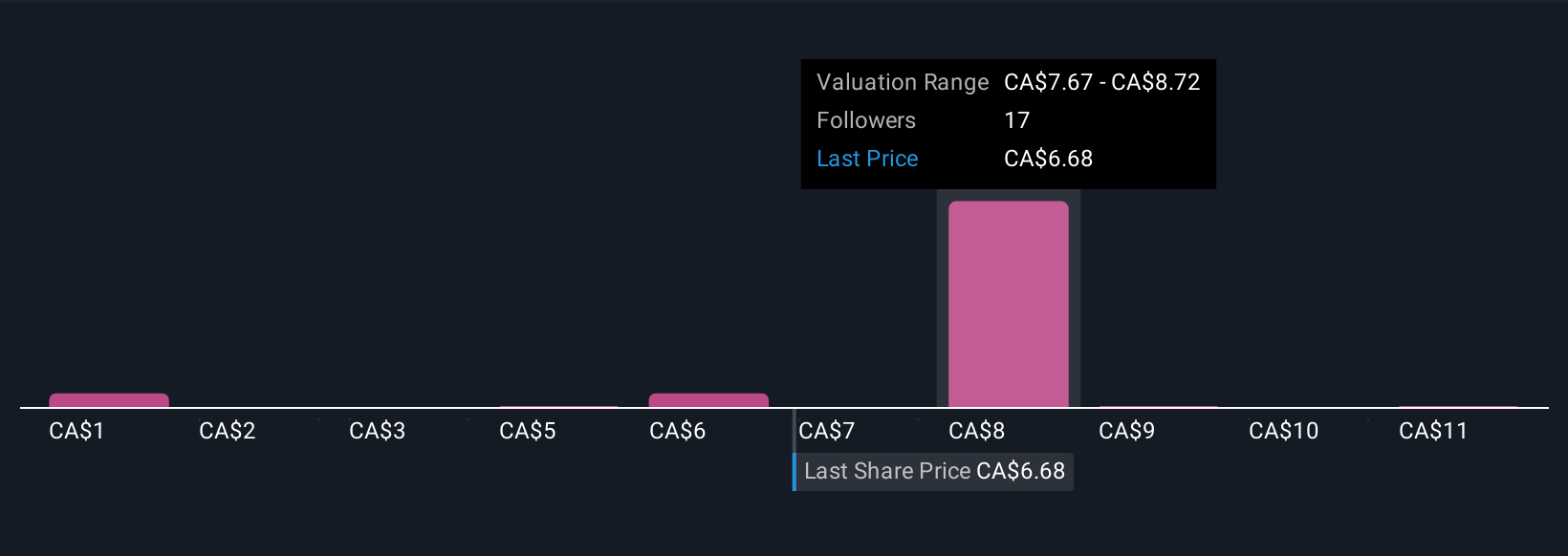

Explore 7 other fair value estimates on Birchcliff Energy - why the stock might be worth 31% less than the current price!

Build Your Own Birchcliff Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Birchcliff Energy research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Birchcliff Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Birchcliff Energy's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Birchcliff Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BIR

Birchcliff Energy

An intermediate oil and natural gas company, engages in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives