- Canada

- /

- Oil and Gas

- /

- TSX:BIR

Birchcliff Energy (TSX:BIR): Assessing Valuation After Announced Private Placement and New Capital Raise

Reviewed by Simply Wall St

Birchcliff Energy (TSX:BIR) took center stage this week by announcing a non-brokered private placement for 43 million shares at CA$0.02 each, raising CA$860,000 in new capital. This move typically prompts investors to weigh the effects of share dilution along with the company’s financing strategy.

See our latest analysis for Birchcliff Energy.

Birchcliff Energy’s private placement has drawn fresh attention as the stock shows real momentum, with a 16.8% share price return in the past month and a robust 23.4% gain year-to-date. While short-term moves signal renewed optimism, longer-term total shareholder returns reveal a tale of resilience, with a stellar 301% five-year gain despite past volatility.

If news around this capital raise has you thinking about other opportunities, now might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With strong recent gains and fresh capital in hand, investors may be wondering if Birchcliff Energy still trades below its true value or if the market is already factoring in all the company’s future growth prospects.

Price-to-Earnings of 24.3x: Is it justified?

Birchcliff Energy trades at a price-to-earnings (P/E) ratio of 24.3x, sitting below its peer average of 27.6x but notably above the Canadian Oil and Gas industry average of 12.2x. With the stock closing at CA$6.81, the market appears to be pricing in optimism compared to direct peers, while also displaying a significant premium to the sector as a whole.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings and is central to how energy stocks are valued. Higher P/E values can indicate investor expectations for faster growth, a cycle upswing, or perceived quality of earnings.

Birchcliff Energy’s current valuation is supported by a period of exceptional profit growth. Its earnings soared 87.2% year-over-year, easily outpacing both its five-year average and overall industry benchmarks. The company also boasts high quality earnings, though its return on equity remains low by typical standards. This blend of strong profitability metrics and a rapidly rising share price gives context for the P/E premium. Yet, compared to the wider energy industry, the valuation does stand out as relatively rich.

Relative to the sector average, Birchcliff’s P/E ratio is substantially higher, signaling that the market has placed a higher value on its recent results than on most of its Canadian Oil and Gas peers. Investors should note this premium and consider whether ongoing earnings momentum can justify it in the long run.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 24.3x (ABOUT RIGHT)

However, further share dilution or a slowdown in revenue growth could pose challenges to Birchcliff Energy’s premium valuation and disrupt its current momentum.

Find out about the key risks to this Birchcliff Energy narrative.

Another View: Discounted Cash Flow Gives a Different Signal

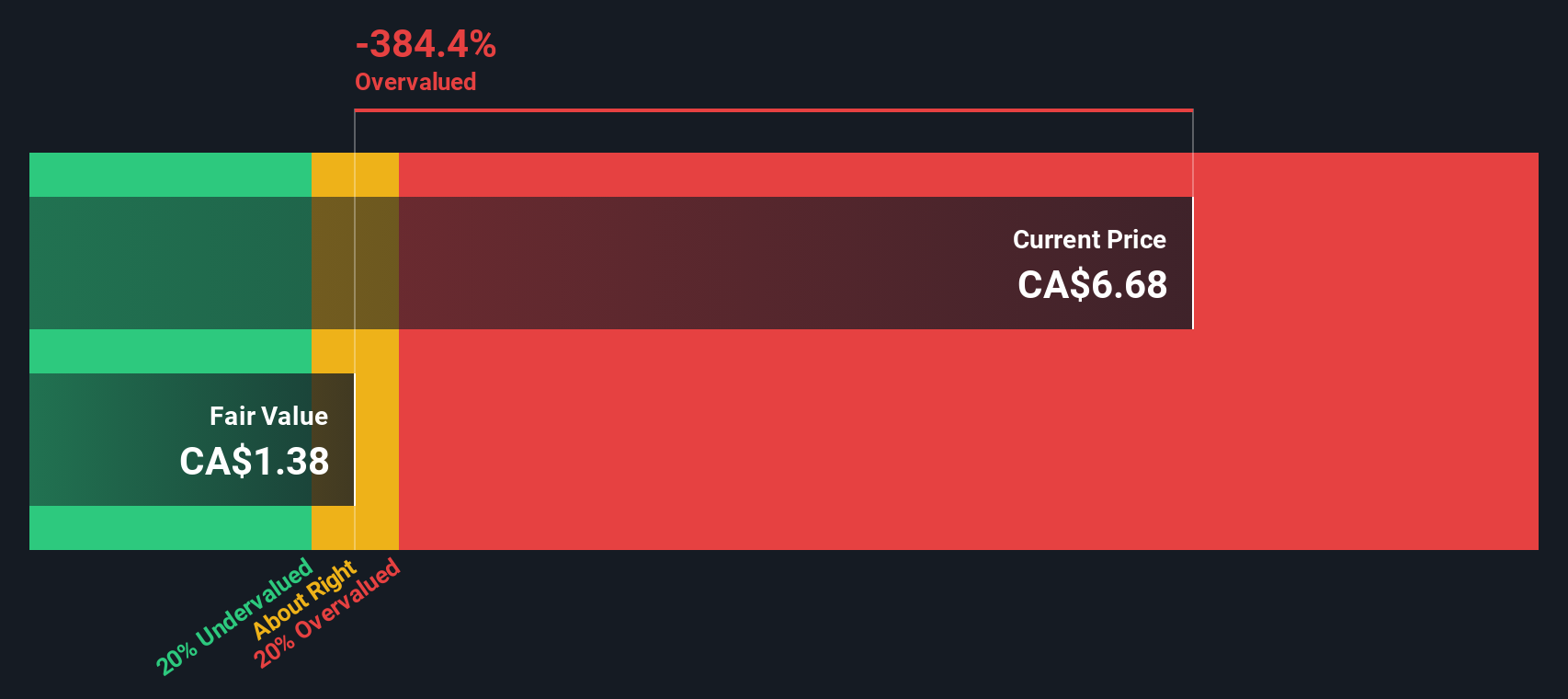

Taking a different approach, our DCF model calculates Birchcliff Energy’s fair value at just CA$1.38, which is well below the current share price of CA$6.81. This suggests the stock could be overvalued if cash flow forecasts are accurate. Could the market’s optimism be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Birchcliff Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 845 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Birchcliff Energy Narrative

If you see the numbers differently or want to dive deeper on your own, it takes just a few minutes to lay out your perspective and see how it compares. Do it your way

A great starting point for your Birchcliff Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Find Your Next Stock Winner?

There is no need to settle for ordinary when smarter investment ideas are only a click away. Start your next search and take your portfolio further with these targeted opportunities:

- Capture fresh income opportunities by tapping into the market’s top performers through these 20 dividend stocks with yields > 3%, offering attractive yields above 3%.

- Expand into tomorrow’s breakthroughs and accelerate your returns with these 26 AI penny stocks, leading artificial intelligence innovation across multiple sectors.

- Catch undervalued gems before the crowd by reviewing these 845 undervalued stocks based on cash flows, based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Birchcliff Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BIR

Birchcliff Energy

An intermediate oil and natural gas company, engages in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives