- Canada

- /

- Oil and Gas

- /

- TSX:BIR

Birchcliff Energy Ltd.'s (TSE:BIR) Business Is Trailing The Industry But Its Shares Aren't

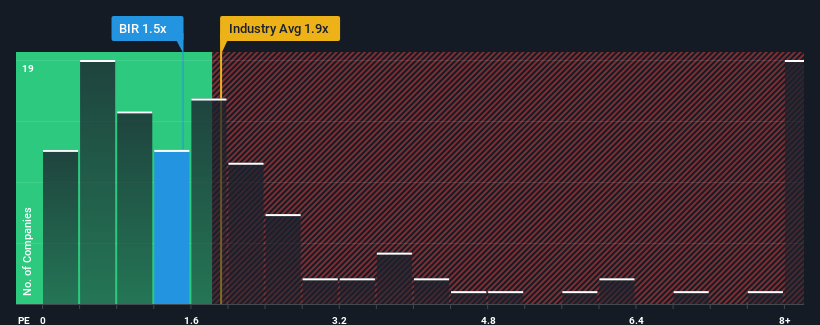

There wouldn't be many who think Birchcliff Energy Ltd.'s (TSE:BIR) price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S for the Oil and Gas industry in Canada is similar at about 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Birchcliff Energy

What Does Birchcliff Energy's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Birchcliff Energy's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Birchcliff Energy.How Is Birchcliff Energy's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Birchcliff Energy's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. Still, the latest three year period has seen an excellent 89% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 12% as estimated by the dual analysts watching the company. With the industry predicted to deliver 12% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Birchcliff Energy's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Birchcliff Energy's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

While Birchcliff Energy's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Birchcliff Energy (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Birchcliff Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BIR

Birchcliff Energy

An intermediate oil and natural gas company, engages in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives