It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Athabasca Oil (TSE:ATH). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Athabasca Oil with the means to add long-term value to shareholders.

See our latest analysis for Athabasca Oil

Athabasca Oil's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Athabasca Oil grew its EPS from CA$0.031 to CA$0.80, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

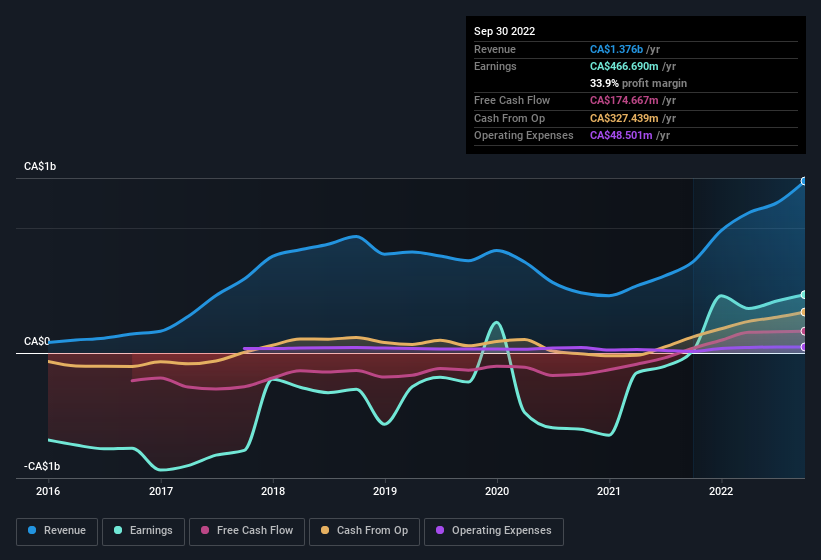

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Athabasca Oil shareholders can take confidence from the fact that EBIT margins are up from 7.9% to 15%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Athabasca Oil Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last year insider at Athabasca Oil were both selling and buying shares; but happily, as a group they spent CA$232k more on stock, than they netted from selling it. Shareholders who may have questioned insiders selling will find some reassurance in this fact. Zooming in, we can see that the biggest insider purchase was by Independent Director John Festival for CA$472k worth of shares, at about CA$1.18 per share.

Is Athabasca Oil Worth Keeping An Eye On?

Athabasca Oil's earnings have taken off in quite an impressive fashion. Growth investors should find it difficult to look past that strong EPS move. And may very well signal a significant inflection point for the business. If that's the case, you may regret neglecting to put Athabasca Oil on your watchlist. You still need to take note of risks, for example - Athabasca Oil has 3 warning signs (and 1 which can't be ignored) we think you should know about.

The good news is that Athabasca Oil is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ATH

Athabasca Oil

Engages in the exploration, development, and production of thermal and light oil resource plays in the Western Canadian Sedimentary Basin in Alberta, Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success