- Canada

- /

- Oil and Gas

- /

- TSX:ATH

Athabasca Oil (TSE:ATH) Ticks All The Boxes When It Comes To Earnings Growth

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Athabasca Oil (TSE:ATH). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Athabasca Oil with the means to add long-term value to shareholders.

View our latest analysis for Athabasca Oil

How Fast Is Athabasca Oil Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Athabasca Oil has grown EPS by 27% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

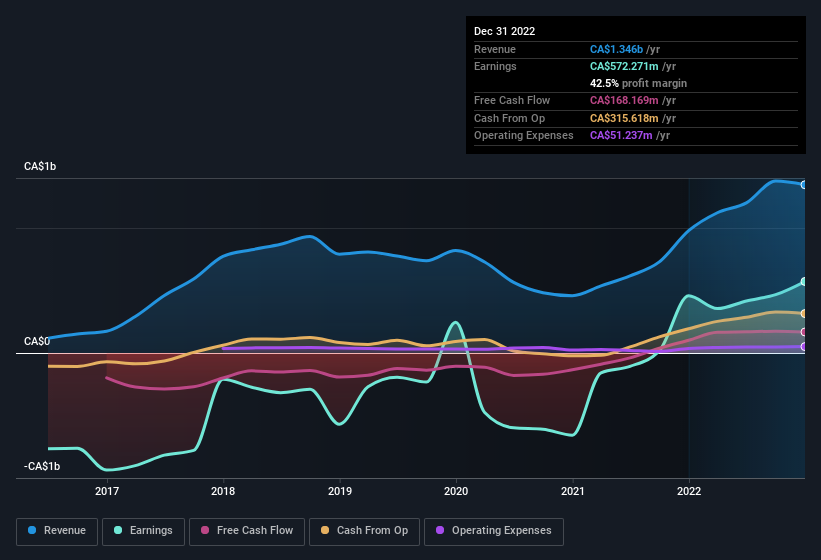

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Athabasca Oil has done well over the past year, growing revenue by 38% to CA$1.3b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Athabasca Oil?

Are Athabasca Oil Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Despite some Athabasca Oil insiders disposing of some shares, we note that there was CA$182k more in buying interest among those who know the company best On balance, that's a good sign. We also note that it was the Independent Director, Marty Proctor, who made the biggest single acquisition, paying CA$131k for shares at about CA$2.90 each.

On top of the insider buying, it's good to see that Athabasca Oil insiders have a valuable investment in the business. As a matter of fact, their holding is valued at CA$34m. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 1.6%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Should You Add Athabasca Oil To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Athabasca Oil's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 2 warning signs for Athabasca Oil (1 can't be ignored!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Athabasca Oil, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ATH

Athabasca Oil

Engages in the exploration, development, and production of thermal and light oil resource plays in the Western Canadian Sedimentary Basin in Alberta, Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success