We can readily understand why investors are attracted to unprofitable companies. Indeed, Western Uranium & Vanadium (CSE:WUC) stock is up 341% in the last year, providing strong gains for shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So notwithstanding the buoyant share price, we think it's well worth asking whether Western Uranium & Vanadium's cash burn is too risky. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Western Uranium & Vanadium

How Long Is Western Uranium & Vanadium's Cash Runway?

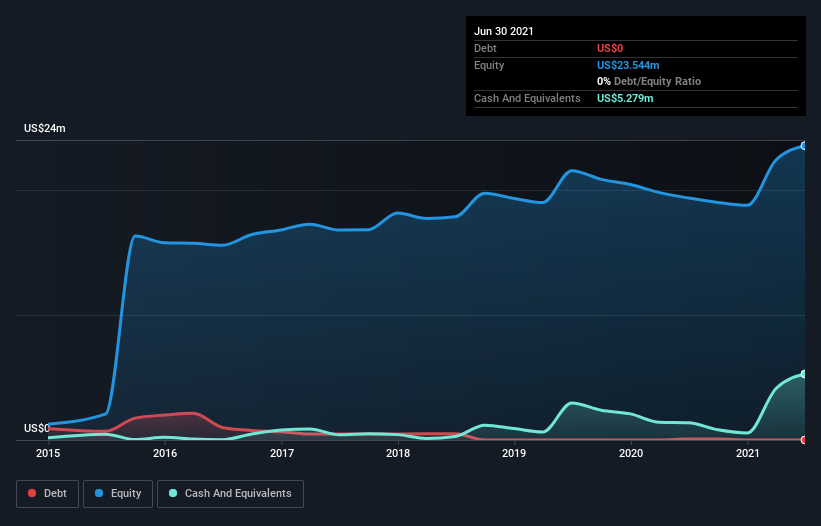

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2021, Western Uranium & Vanadium had US$5.3m in cash, and was debt-free. Importantly, its cash burn was US$1.7m over the trailing twelve months. Therefore, from June 2021 it had 3.1 years of cash runway. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

How Is Western Uranium & Vanadium's Cash Burn Changing Over Time?

In our view, Western Uranium & Vanadium doesn't yet produce significant amounts of operating revenue, since it reported just US$65k in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. With the cash burn rate up 5.7% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Western Uranium & Vanadium makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Western Uranium & Vanadium To Raise More Cash For Growth?

Since its cash burn is increasing (albeit only slightly), Western Uranium & Vanadium shareholders should still be mindful of the possibility it will require more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Western Uranium & Vanadium's cash burn of US$1.7m is about 2.0% of its US$85m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is Western Uranium & Vanadium's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Western Uranium & Vanadium is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Separately, we looked at different risks affecting the company and spotted 5 warning signs for Western Uranium & Vanadium (of which 2 are a bit unpleasant!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Western Uranium & Vanadium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:WUC

Western Uranium & Vanadium

Engages in exploring, developing, mining, and production of uranium and vanadium resource properties in the United States.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026