- Canada

- /

- Capital Markets

- /

- TSXV:WP

Here's Why We Think Western Pacific Trust (CVE:WP) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Western Pacific Trust (CVE:WP). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Western Pacific Trust

How Fast Is Western Pacific Trust Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Western Pacific Trust's EPS went from CA$0.00045 to CA$0.031 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Western Pacific Trust's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that Western Pacific Trust is growing revenues, and EBIT margins improved by 2.5 percentage points to 11%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

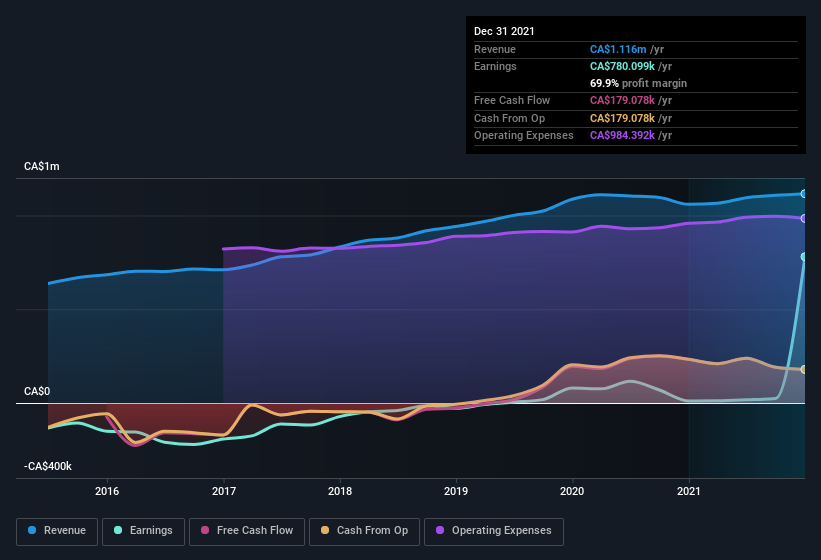

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Western Pacific Trust isn't a huge company, given its market capitalization of CA$6.3m. That makes it extra important to check on its balance sheet strength.

Are Western Pacific Trust Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Western Pacific Trust insiders own a significant number of shares certainly appeals to me. Actually, with 48% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only CA$6.3m Western Pacific Trust is really small for a listed company. So despite a large proportional holding, insiders only have CA$3.0m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Western Pacific Trust with market caps under CA$252m is about CA$201k.

Western Pacific Trust offered total compensation worth CA$136k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Western Pacific Trust Worth Keeping An Eye On?

Western Pacific Trust's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so I do think Western Pacific Trust is worth considering carefully. Still, you should learn about the 4 warning signs we've spotted with Western Pacific Trust .

Although Western Pacific Trust certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Western Pacific Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:WP

Western Pacific Trust

A non-deposit-taking independent trust company, provides various financial services in Canada.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives