- Canada

- /

- Metals and Mining

- /

- TSX:DC.A

Canadian Hidden Treasures And 2 More Small Caps With Strong Potential

Reviewed by Simply Wall St

As the Canadian market navigates through a period of ambiguity with central banks offering limited forward guidance, investors are closely monitoring economic indicators for signs of potential interest rate cuts. In this environment, small-cap stocks can present unique opportunities for growth, especially those that demonstrate resilience and adaptability amid market volatility. Identifying these hidden treasures requires a keen eye for companies with strong fundamentals and the ability to thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| GR Silver Mining | NA | nan | 23.15% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Andean Precious Metals (TSX:APM)

Simply Wall St Value Rating: ★★★★★★

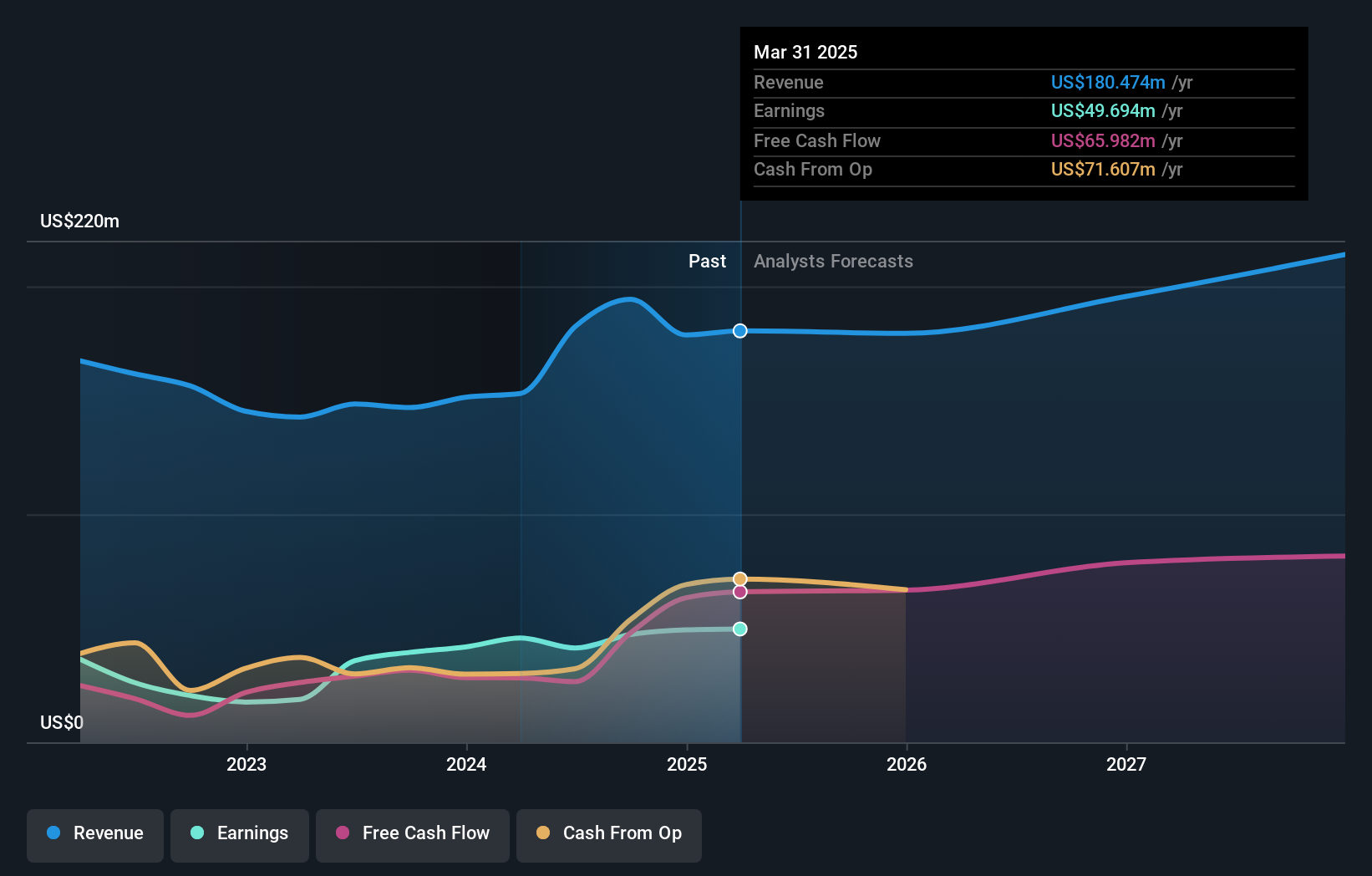

Overview: Andean Precious Metals Corp. is involved in the acquisition, exploration, development, and processing of mineral resource properties in the United States, with a market cap of CA$1.09 billion.

Operations: Andean Precious Metals generates revenue from mineral resource properties, with $131.89 million coming from the USA and $144.98 million from Bolivia.

Andean Precious Metals, a notable player in the mining sector, is leveraging its operational efficiency and expanded ore supply to drive growth. The company reported net income of US$17 million for Q2 2025, up from US$9 million a year ago, with basic earnings per share doubling to US$0.12. Despite challenges like permitting issues and geopolitical risks in Bolivia, Andean's debt-to-equity ratio improved from 44.6% to 28.7% over five years, indicating financial prudence. With production guidance reaffirmed for gold and silver outputs this year and strategic buybacks totaling CAD3.2 million completed recently, the company seems poised for steady progress amidst market fluctuations.

Dundee (TSX:DC.A)

Simply Wall St Value Rating: ★★★★☆☆

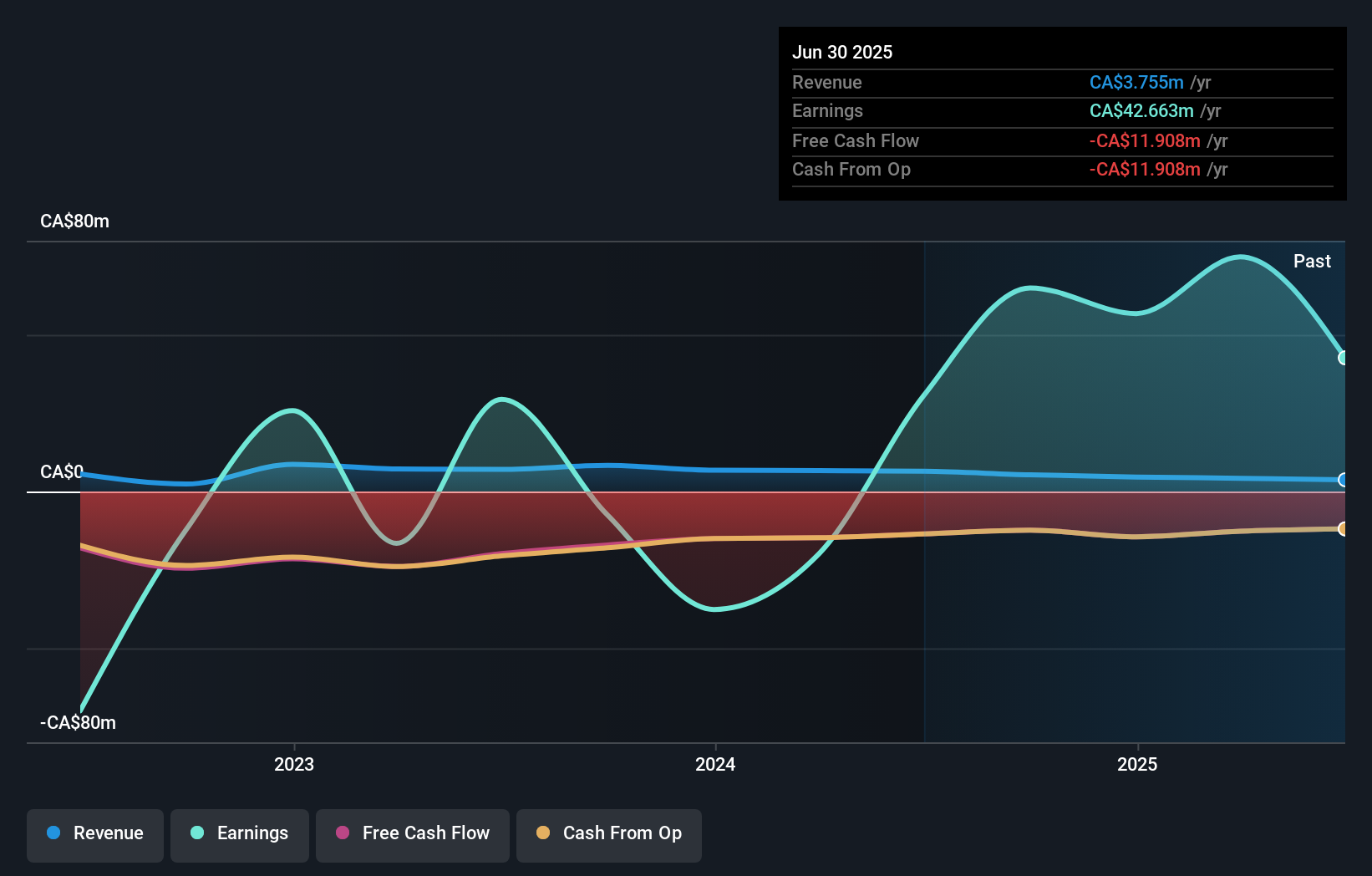

Overview: Dundee Corporation is a publicly owned investment manager with a market capitalization of CA$368.85 million.

Operations: Dundee's primary revenue stream is derived from mining services, generating CA$1.46 million. Corporate activities contribute an additional CA$2.98 million to its overall revenue mix.

Dundee Corporation, a small player in the Canadian market, showcases intriguing financial dynamics. Despite a sharp drop in net income to CA$19.92 million for Q2 2025 from CA$52.89 million the previous year, earnings growth of 38.8% outpaced the industry average of 27%. The company's debt-to-equity ratio has impressively reduced from 10% to just 1.9% over five years, indicating strengthened financial health. With its price-to-earnings ratio at an attractive 8.8x compared to the broader market's 16.4x, Dundee seems undervalued despite challenges like non-recurring gains affecting recent results and limited revenue streams at CA$4 million annually.

- Take a closer look at Dundee's potential here in our health report.

Understand Dundee's track record by examining our Past report.

Sprott (TSX:SII)

Simply Wall St Value Rating: ★★★★★★

Overview: Sprott Inc. is a publicly owned asset management holding company with a market capitalization of CA$2.67 billion, focusing on various investment strategies and products.

Operations: Sprott generates revenue primarily through its Exchange Listed Products, which contribute $117.90 million, and Managed Equities, adding $56.62 million. The Private Strategies segment also provides a notable revenue stream of $22.60 million.

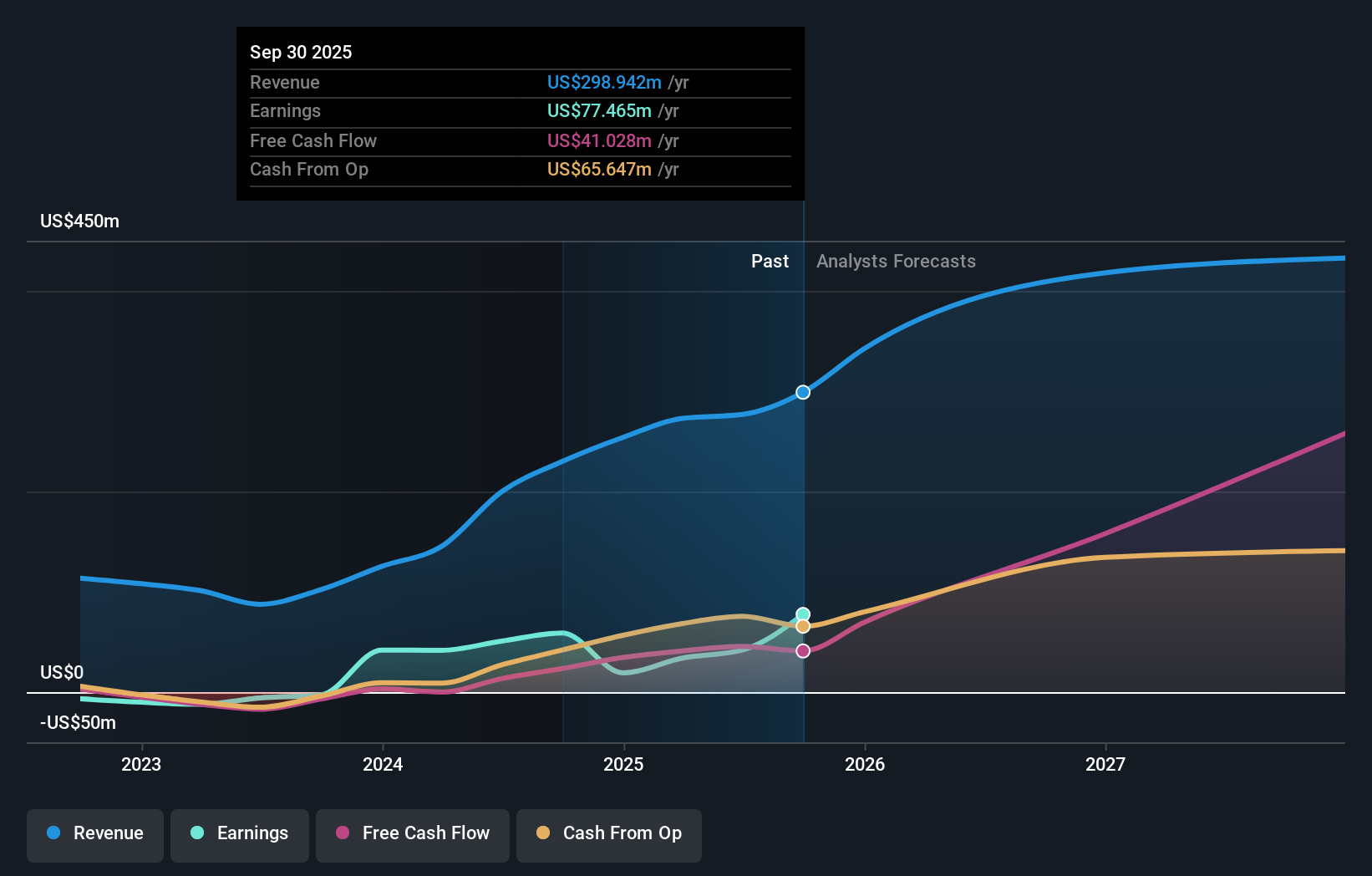

Sprott, a Canadian investment firm, is making waves with its launch of the Sprott Active Metals & Miners ETF, targeting strategic metals in high demand. The company reported impressive earnings growth of 20.5% over the past year, outpacing the Capital Markets industry average of 3.1%. With no debt on its balance sheet and a solid net income of US$25.46 million for the first half of 2025 compared to US$24.92 million last year, Sprott's financial health appears robust. Additionally, it declared a dividend of US$0.30 per share for Q2 2025, signaling confidence in its ongoing operations and shareholder returns.

- Dive into the specifics of Sprott here with our thorough health report.

Examine Sprott's past performance report to understand how it has performed in the past.

Where To Now?

- Click this link to deep-dive into the 47 companies within our TSX Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DC.A

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives