- Canada

- /

- Consumer Finance

- /

- TSX:PRL

Propel Holdings (TSX:PRL) Profit Margin Expansion Reinforces Bullish Narrative Ahead of Earnings Season

Reviewed by Simply Wall St

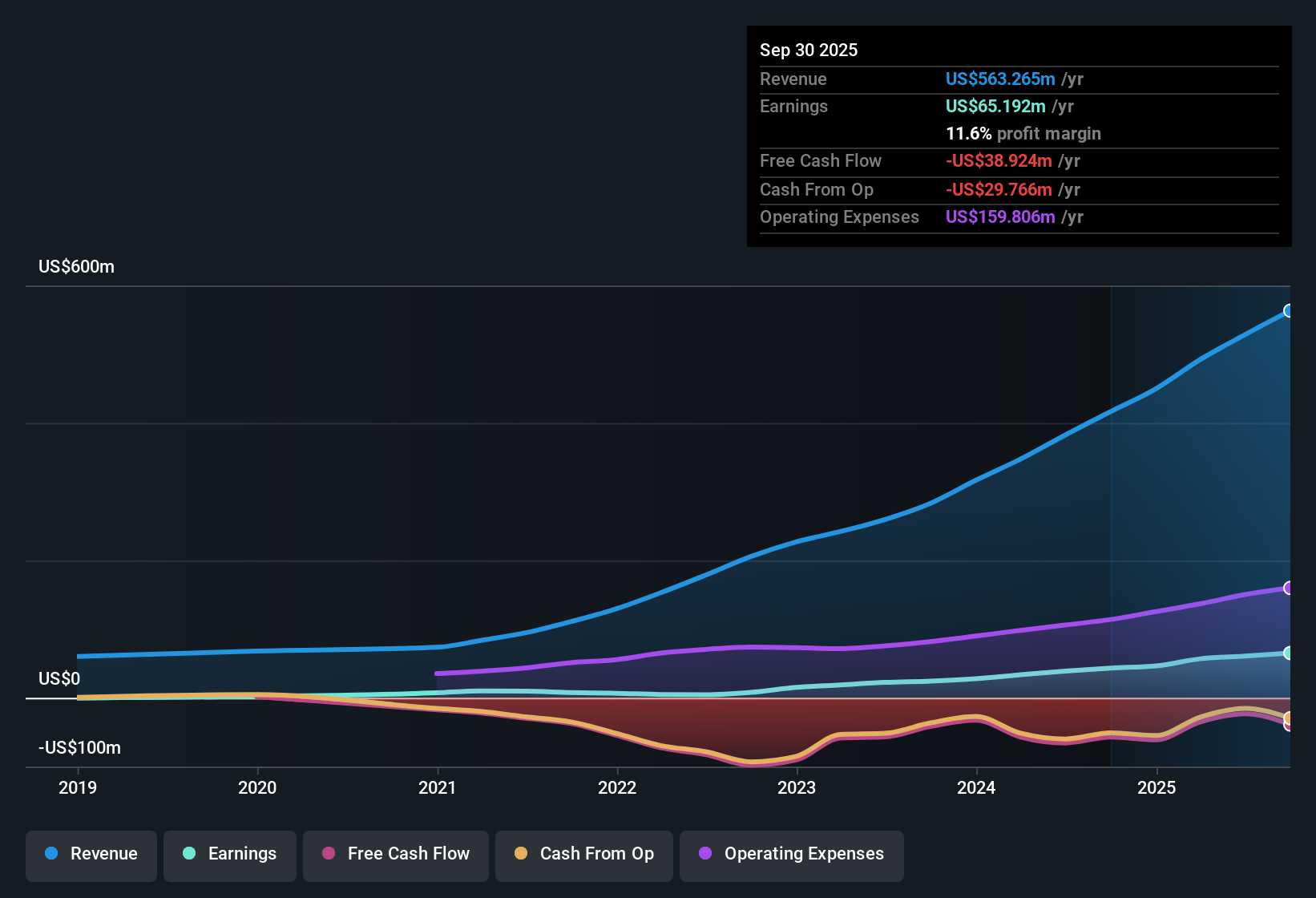

Propel Holdings (TSX:PRL) delivered 56.1% earnings growth over the past year, pushing net profit margins up to 11.5% from 10.2% a year earlier. With earnings rising at a compounded 51.2% annually over five years and revenues forecast to grow 23.4% per year, which is well ahead of the Canadian market’s 5.1% growth estimate, the momentum continues. A Price-To-Earnings ratio of 10x, sitting below peer and industry averages, adds to the case for a fundamentally strong, undervalued stock.

See our full analysis for Propel Holdings.The numbers are impressive, but the story depends on how they compare with the narratives shaping market sentiment. Next, we’ll see whether Propel Holdings’ results reinforce the prevailing view or offer new reasons for investors to reconsider.

See what the community is saying about Propel Holdings

AI Tools Power Operational Efficiencies

- Propel Holdings’ ongoing investment in AI-powered risk assessment and automation is credited with delivering improved credit performance and supporting the company’s margin expansion. Analysts expect profit margins to rise from 11.5% today to 14.8% by 2026.

- Analysts' consensus view points out that, as digital adoption increases and AI tools scale across operations, Propel stands to benefit from higher operating leverage and more stable net income.

- Consensus narrative notes that new product offerings and ongoing expansion into markets like the U.K. are driving steadier, more diversified earnings streams.

- Wider smartphone and app-based engagement, supported by digital innovations, should help sustain the high revenue growth trajectory projected at 28.1% annually for the next three years.

- Interest in how digital adoption and automation are moving the dial on Propel's growth and margin story deserves a closer look. 📊 Read the full Propel Holdings Consensus Narrative.

Competition and Regulation Challenge Expansion

- Despite the robust growth prospects, Propel faces significant risks from intensifying competition, regulatory headwinds, and potential margin pressure if customer acquisition costs continue to outpace revenue gains.

- Analysts' consensus view highlights several tensions, including:

- Bears argue that expansion into new geographies exposes Propel to a patchwork of lending regulations and possible rate caps, which could limit its revenue upside and weigh on compliance and operating costs as the business scales.

- Competitors with larger scale and advanced adoption of AI may undercut Propel on pricing or offer more attractive terms, threatening long-term growth and market share even as Propel continues to upgrade its own digital capabilities.

Trading at Steep Discount to Fair Value

- Propel Holdings trades at a Price-To-Earnings ratio of 10x, well below the peer group (19.8x) and industry average (10.9x), and remains meaningfully discounted both to its DCF fair value of CA$60.51 and the analyst price target of CA$39.29, versus a current share price of CA$21.75.

- Analysts' consensus view emphasizes that this sizable valuation gap rests on continued strong revenue growth, margin improvement, and the ability to successfully scale its Lending-as-a-Service business, which is expected to more than double by 2026.

- Bulls may find support in the persistent undervaluation, but consensus cautions that the discount only closes if Propel delivers on its growth and profitability promises.

- The company’s sector-leading fundamentals create a compelling story, but future gains will depend on converting high expectations into real and sustained growth across its evolving business lines.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Propel Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the numbers? Transform your viewpoint into a narrative in just minutes and share your side of the story. Do it your way

A great starting point for your Propel Holdings research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While Propel’s growth story is promising, its expansion efforts face real threats from regulatory hurdles, intense competition, and the risk of inconsistent performance if costs rise.

If you want to focus on companies delivering steady results regardless of market headwinds, check out stable growth stocks screener (2074 results) with proven consistent revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRL

Very undervalued with exceptional growth potential.

Market Insights

Community Narratives