- Canada

- /

- Capital Markets

- /

- TSX:MKZ.UN

Improved Earnings Required Before Mackenzie Master Limited Partnership (TSE:MKZ.UN) Stock's 30% Jump Looks Justified

Despite an already strong run, Mackenzie Master Limited Partnership (TSE:MKZ.UN) shares have been powering on, with a gain of 30% in the last thirty days. The last 30 days bring the annual gain to a very sharp 44%.

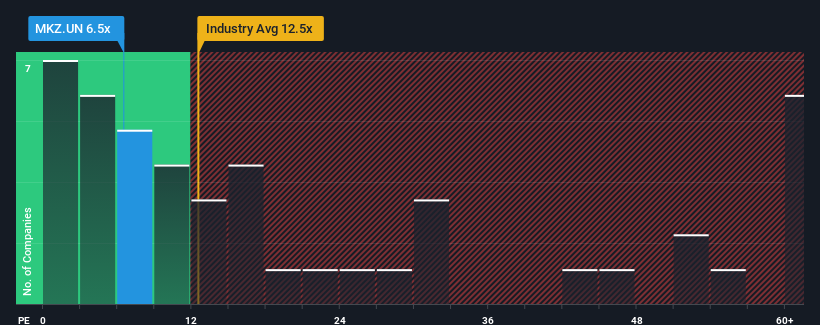

In spite of the firm bounce in price, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Mackenzie Master Limited Partnership as a highly attractive investment with its 6.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

It looks like earnings growth has deserted Mackenzie Master Limited Partnership recently, which is not something to boast about. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Mackenzie Master Limited Partnership

How Is Mackenzie Master Limited Partnership's Growth Trending?

In order to justify its P/E ratio, Mackenzie Master Limited Partnership would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 13% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's an unpleasant look.

With this information, we are not surprised that Mackenzie Master Limited Partnership is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Mackenzie Master Limited Partnership's P/E

Mackenzie Master Limited Partnership's recent share price jump still sees its P/E sitting firmly flat on the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Mackenzie Master Limited Partnership revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Mackenzie Master Limited Partnership (4 shouldn't be ignored!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MKZ.UN

Mackenzie Master Limited Partnership

Mackenzie Master Limited Partnership pays selling commissions to financial advisors who sell redemption charge securities of Mackenzie mutual funds for specific periods.

Flawless balance sheet and good value.

Market Insights

Community Narratives