MCAN Mortgage Corporation's (TSE:MKP) investors are due to receive a payment of CA$0.36 per share on 30th of June. This makes the dividend yield 8.8%, which will augment investor returns quite nicely.

See our latest analysis for MCAN Mortgage

MCAN Mortgage's Payment Has Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, MCAN Mortgage's dividend was making up a very large proportion of earnings, and the company was also not generating any cash flow to offset this. We think that this practice can make the dividend quite risky in the future.

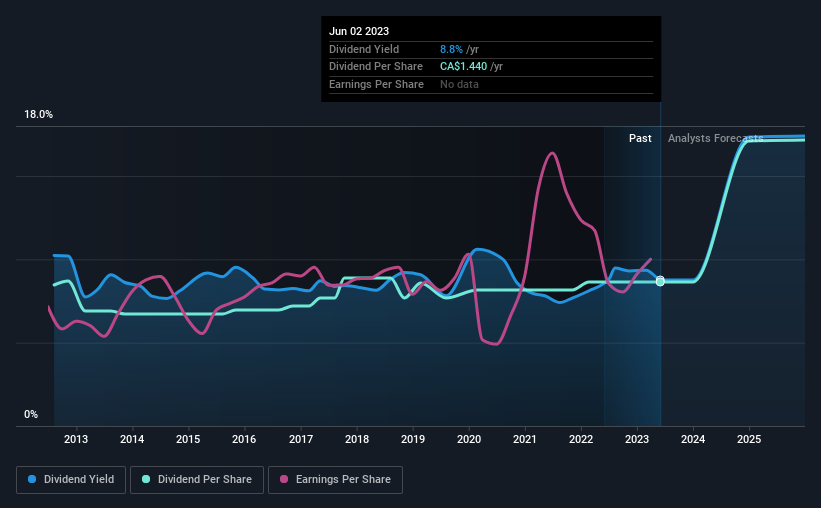

Looking forward, earnings per share is forecast to rise by 43.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 57%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of CA$1.41 in 2013 to the most recent total annual payment of CA$1.44. Its dividends have grown at less than 1% per annum over this time frame. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. MCAN Mortgage hasn't seen much change in its earnings per share over the last five years. Slow growth and a high payout ratio could mean that MCAN Mortgage has maxed out the amount that it has been able to pay to shareholders. When a company prefers to pay out cash to its shareholders instead of reinvesting it, this can often say a lot about that company's dividend prospects.

An additional note is that the company has been raising capital by issuing stock equal to 11% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 3 warning signs for MCAN Mortgage (1 is a bit unpleasant!) that you should be aware of before investing. Is MCAN Mortgage not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MKP

MCAN Mortgage

Operates as a loan and mortgage investment corporation in Canada.

Moderate growth potential second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion