- Canada

- /

- Specialty Stores

- /

- TSX:GBT

Clairvest Group And 2 Other Undiscovered Gems In Canada

Reviewed by Simply Wall St

As the Canadian market navigates an environment of manageable inflation and potential rate cuts, small-cap stocks are gaining attention for their resilience and cyclical upside. In this context, identifying companies with strong fundamentals and growth potential becomes crucial, making Clairvest Group and two other undiscovered gems in Canada worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Clairvest Group (TSX:CVG)

Simply Wall St Value Rating: ★★★★★★

Overview: Clairvest Group Inc. is a private equity firm focused on mid-market growth equity investments, buyouts, industry consolidation, and acquisitions with a market cap of CA$1.05 billion.

Operations: Clairvest Group generates revenue primarily from its venture capital segment, amounting to CA$186.39 million.

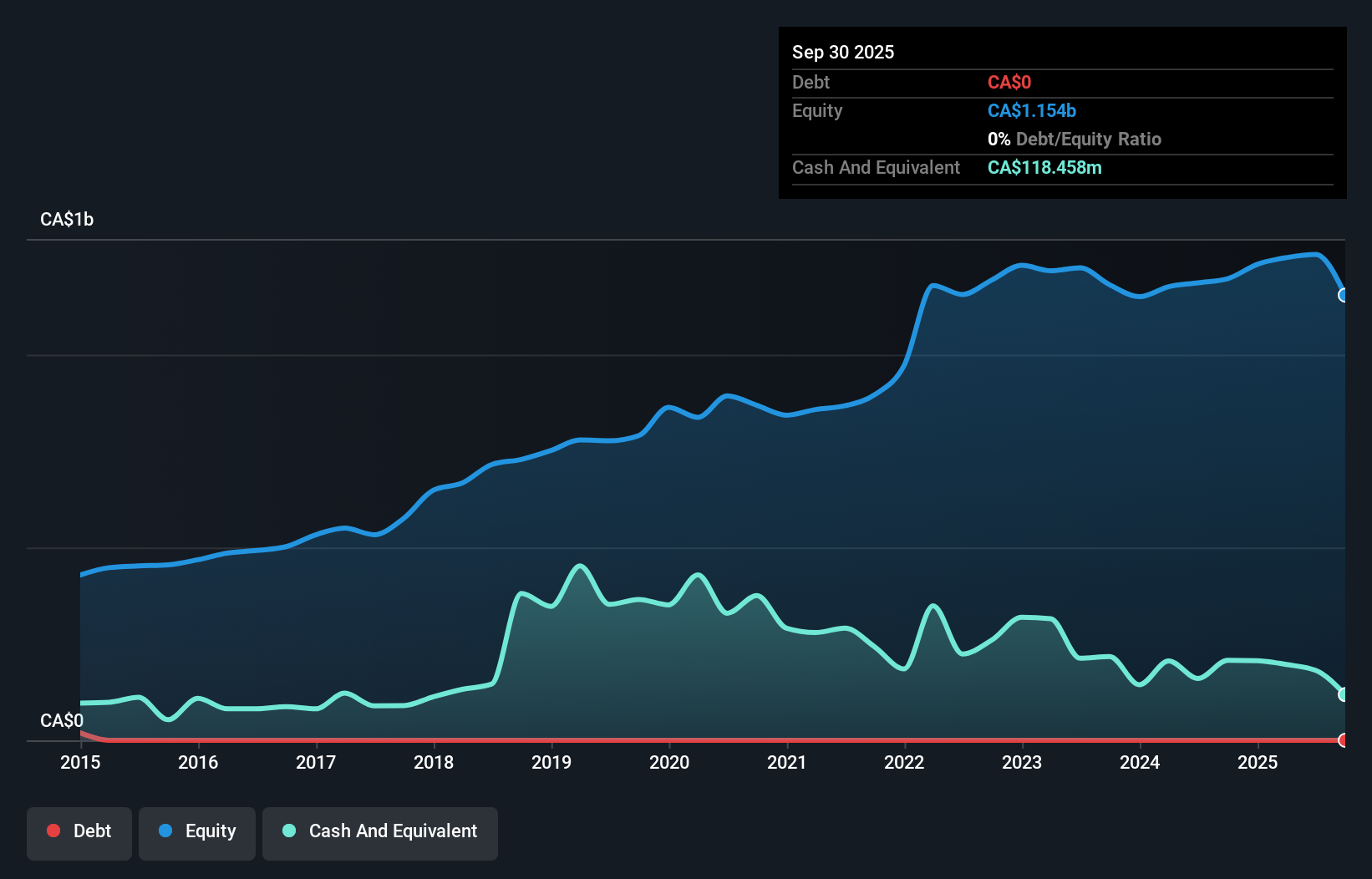

Clairvest Group, a nimble player in the Canadian market, showcases impressive financial health with no debt on its books. Its earnings skyrocketed by a staggering 10,701% last year, outpacing the Capital Markets industry's growth of 14%. Despite this surge, earnings have seen an average annual decline of 11.8% over five years. The company's P/E ratio at 8.8x remains attractively below the broader Canadian market's 15.8x. Recent results show revenue at C$48.85 million for Q1 2025 compared to C$38.94 million last year, though net income dipped slightly to C$21.34 million from C$23.92 million previously.

BMTC Group (TSX:GBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: BMTC Group Inc. operates a retail network specializing in furniture, household appliances, and electronic products across Canada with a market capitalization of CA$428.79 million.

Operations: The company generates revenue primarily from its retail network, with a notable segment adjustment of CA$612.43 million.

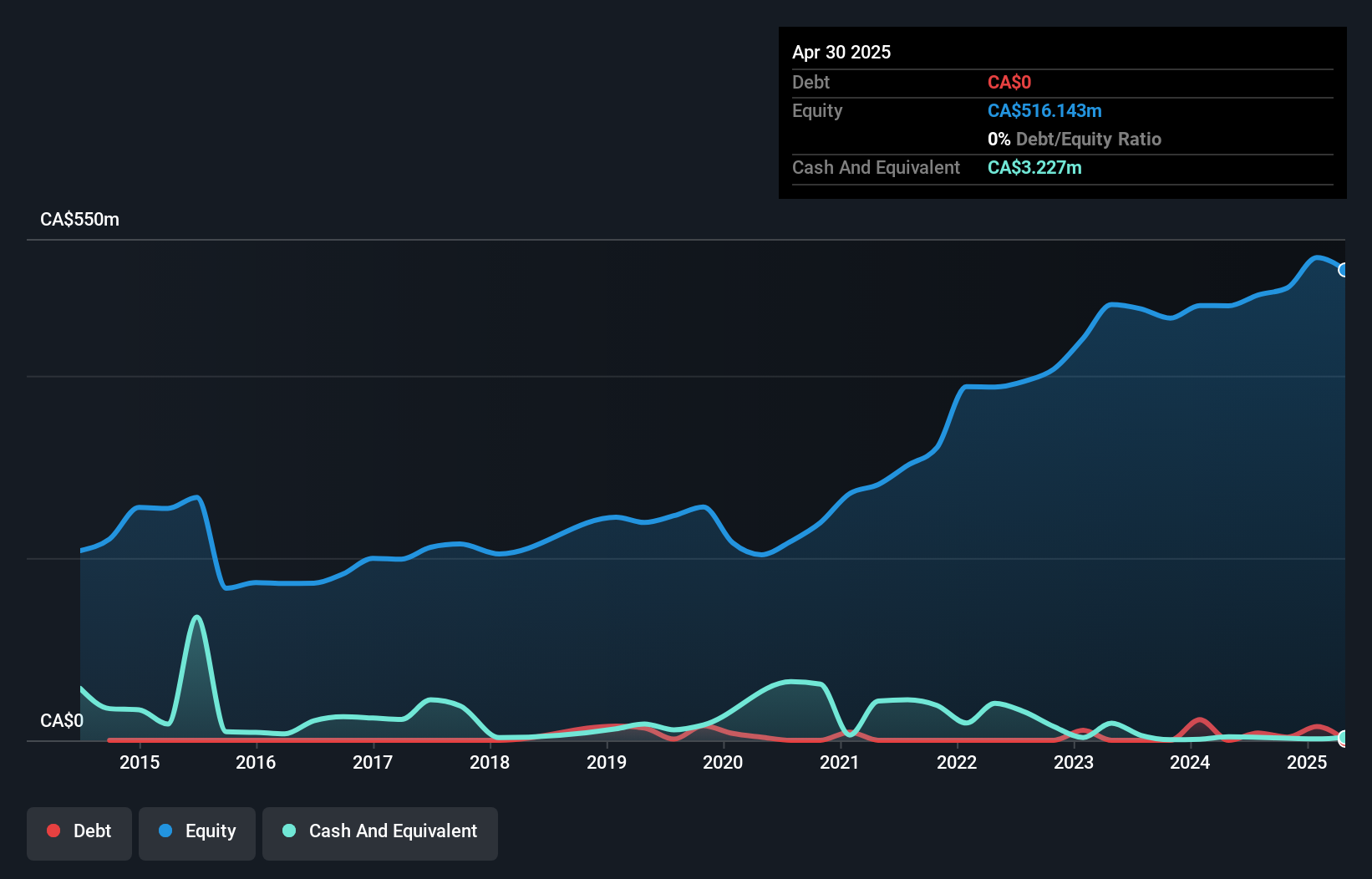

BMTC Group, a small cap player in the Canadian market, recently reported a sales increase to CA$150.12 million for the quarter ending April 2025, up from CA$137.14 million a year prior. Despite this growth, it posted a net loss of CA$12.93 million compared to last year's net income of CA$1.46 million, with basic and diluted losses per share both at CA$0.4 against previous earnings of CA$0.04 per share. The company executed share buybacks totaling 357,050 shares for approximately CA$4.72 million since April 2024, enhancing shareholder value amidst fluctuating earnings performance influenced by significant one-off gains of CA$24.8M in the past year.

- Dive into the specifics of BMTC Group here with our thorough health report.

Evaluate BMTC Group's historical performance by accessing our past performance report.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in acquiring, exploring, developing, producing, and operating mineral properties in Latin America with a market capitalization of CA$471.53 million.

Operations: Santacruz Silver Mining generates revenue primarily from its mineral properties, with significant contributions from the Zimapan ($90.38 million) and Bolivar ($85.81 million) segments. The company faces eliminations totaling $74.27 million due to inter-company and joint operation adjustments.

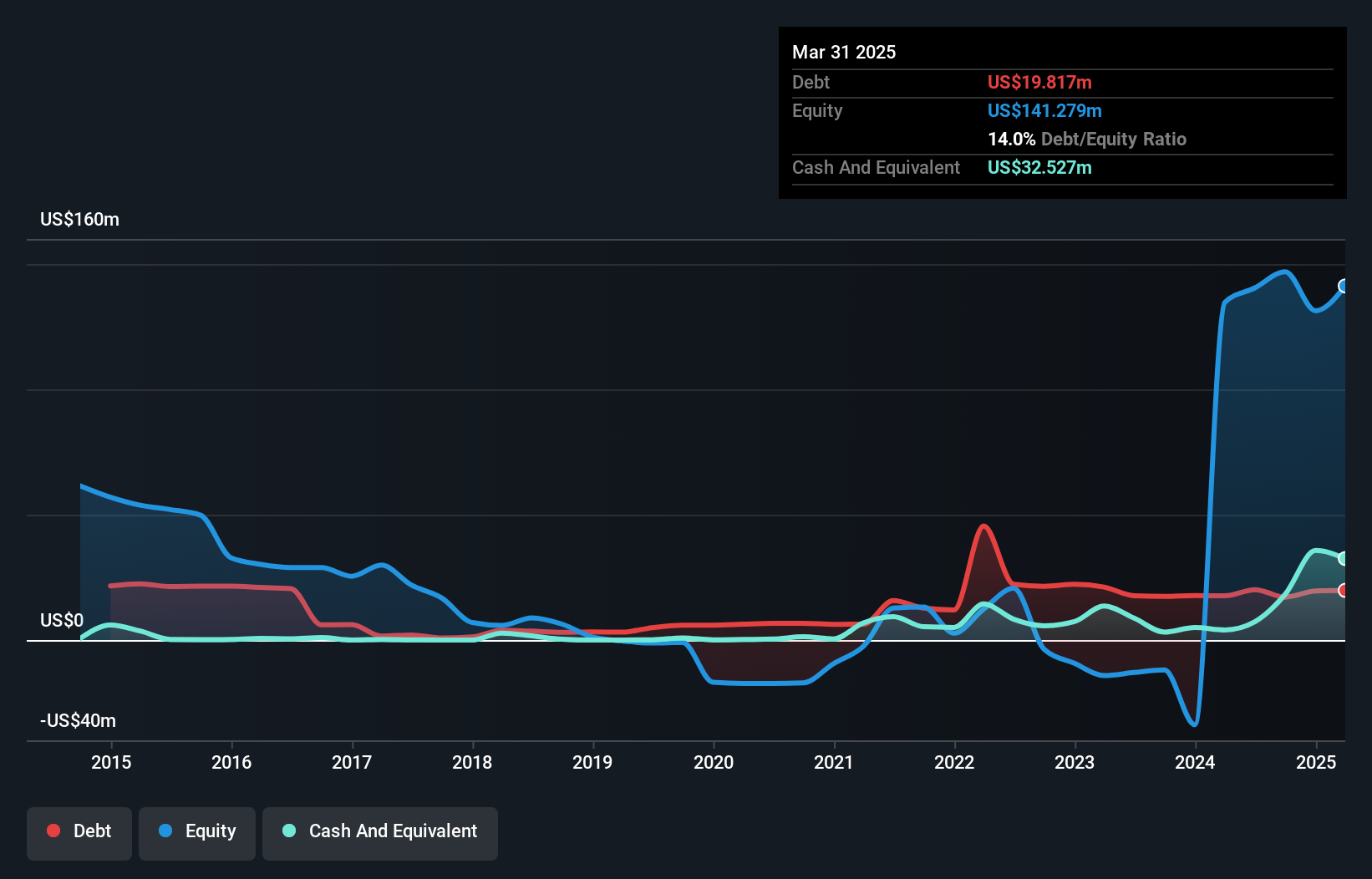

Santacruz Silver Mining, a dynamic player in the metals and mining sector, has shown resilience despite recent challenges. The company reported a net profit margin of 13.7%, down from 51.1% last year, yet its interest payments are well covered with EBIT at 42 times those costs. Santacruz's revenue is expected to grow by 8.41% annually while trading at nearly 90% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Despite significant insider selling recently, the company's financial discipline remains evident through structured payments for its Bolivian assets acquisition totaling US$40 million by October 2025.

Turning Ideas Into Actions

- Click this link to deep-dive into the 50 companies within our TSX Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BMTC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GBT

BMTC Group

Manages and operates a retail network of furniture, household appliances, and electronic products in Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives