- Canada

- /

- Capital Markets

- /

- TSX:BN

Will Brookfield’s (TSX:BN) $11 Billion Bet on Indian AI Data Centers Redefine Its Growth Narrative?

Reviewed by Sasha Jovanovic

- Digital Realty announced that it, along with Brookfield Corporation, is part of Digital Connexions, a Reliance Industries joint venture investing US$11 billion to build a one-gigawatt AI-native data centre campus on 400 acres in Visakhapatnam, Andhra Pradesh, India, by 2030.

- This collaboration highlights Brookfield's ongoing move into technology-driven infrastructure and participation in the rapid digital transformation underway in India.

- We'll explore how Brookfield’s investment in Indian AI infrastructure could shape the company’s evolving asset management and growth narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Brookfield Investment Narrative Recap

Brookfield’s long-term investment thesis centers around its ability to capitalize on global infrastructure and alternative asset opportunities, backed by its proven asset management expertise. The Digital Connexions joint venture marks a significant step into India's AI infrastructure, but in the near term, the most important catalyst remains successful asset sales, while execution risks in new markets persist as a key risk; this new venture, while noteworthy, does not materially shift either outlook for now.

Among recent announcements, Brookfield issuing C$200 million in new Class A Preferred Shares stands out. This move is relevant given their ongoing participation in large-scale projects like Digital Connexions and underscores Brookfield’s efforts to maintain a balanced capital structure, an important consideration as access to favorable financing is a near-term catalyst for growth.

However, investors should also be aware that increased expansion into new or unfamiliar regions may expose the business to execution risks not previously encountered...

Read the full narrative on Brookfield (it's free!)

Brookfield's narrative projects $8.5 billion in revenue and $7.2 billion in earnings by 2028. This requires a 54.2% yearly revenue decline and an increase in earnings of approximately $6.7 billion from current earnings of $473 million.

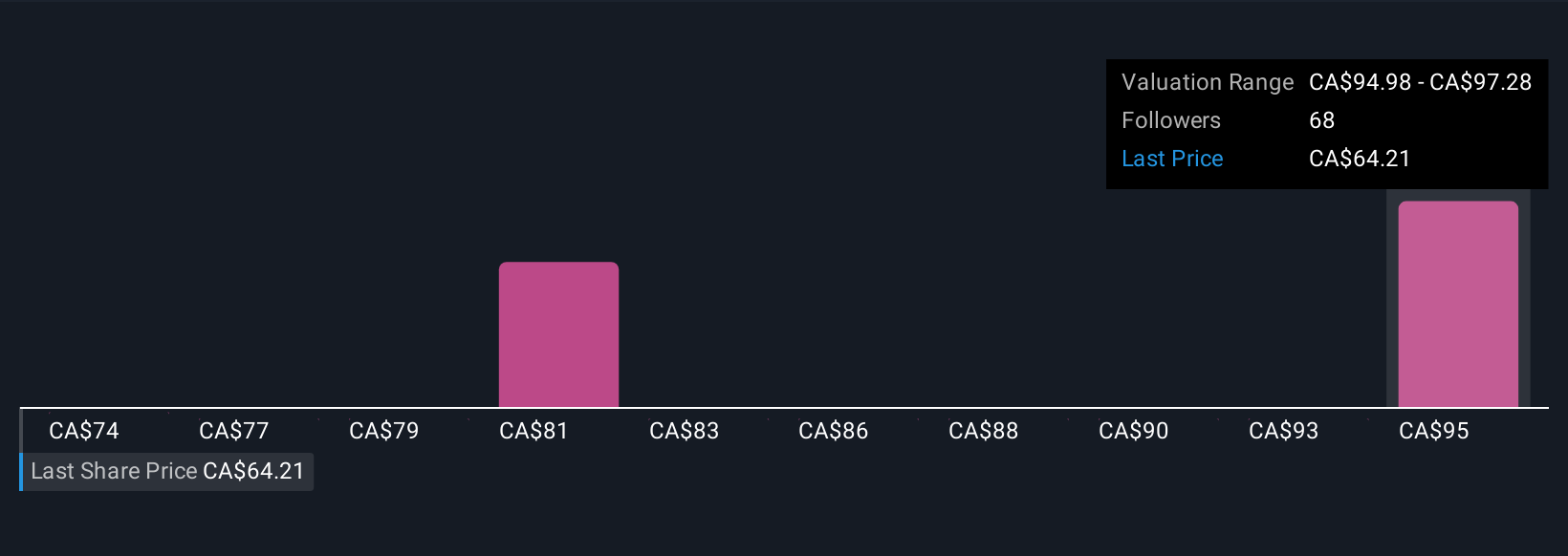

Uncover how Brookfield's forecasts yield a CA$97.28 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted fair value estimates for Brookfield from CA$74.25 to CA$97.28, based on four individual forecasts. In light of Brookfield’s recent move into India’s AI sector, market participants should weigh the potential execution risks in new markets when considering these varied viewpoints.

Explore 4 other fair value estimates on Brookfield - why the stock might be worth as much as 47% more than the current price!

Build Your Own Brookfield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Brookfield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BN

Brookfield

A multi-asset manager focused on real estate, credit, renewable power and transition, infrastructure, venture capital, and private equity including growth capital and emerging growth investments.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026