- Canada

- /

- Capital Markets

- /

- TSX:BN

Does Brookfield’s AI and Infrastructure Fund Ambitions Reshape Its Long-Term Growth Strategy (TSX:BN)?

Reviewed by Sasha Jovanovic

- Brookfield recently reported solid quarterly results across its asset management, real estate, and insurance divisions, while unveiling plans at its annual investor day for new infrastructure and AI-focused investment funds in 2025.

- Management’s emphasis on sustained business growth and shareholder returns, combined with anticipated fund launches, provides insight into Brookfield’s continued expansion and evolving priorities for capital deployment.

- We’ll now examine how Brookfield’s push into AI infrastructure funds and multi-sector growth plans shapes its broader investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Brookfield Investment Narrative Recap

To be a Brookfield shareholder today, you have to believe in its ability to deliver returns despite changing market cycles and the challenges of executing ambitious expansion plans. The latest announcement regarding new infrastructure and AI-focused funds highlights Brookfield’s commitment to capital deployment and growth initiatives, but it does not materially change the central catalyst, monetizing assets in supportive markets, and the main risk remains the company’s reliance on favorable conditions for these transactions. In the near term, these news events reinforce management’s focus on raising and deploying capital efficiently while closely watching market volatility as a persistent challenge.

The upcoming launch of Brookfield's sixth infrastructure fund and its inaugural AI infrastructure strategy is especially relevant, signaling an intent to attract substantial new capital and broaden its offering. For investors, these planned fund launches could become important catalysts if market sentiment supports strong fundraising, but any shift in credit or equity market tone could quickly test management’s ability to maintain historically robust returns. On the other hand, investors should watch closely for...

Read the full narrative on Brookfield (it's free!)

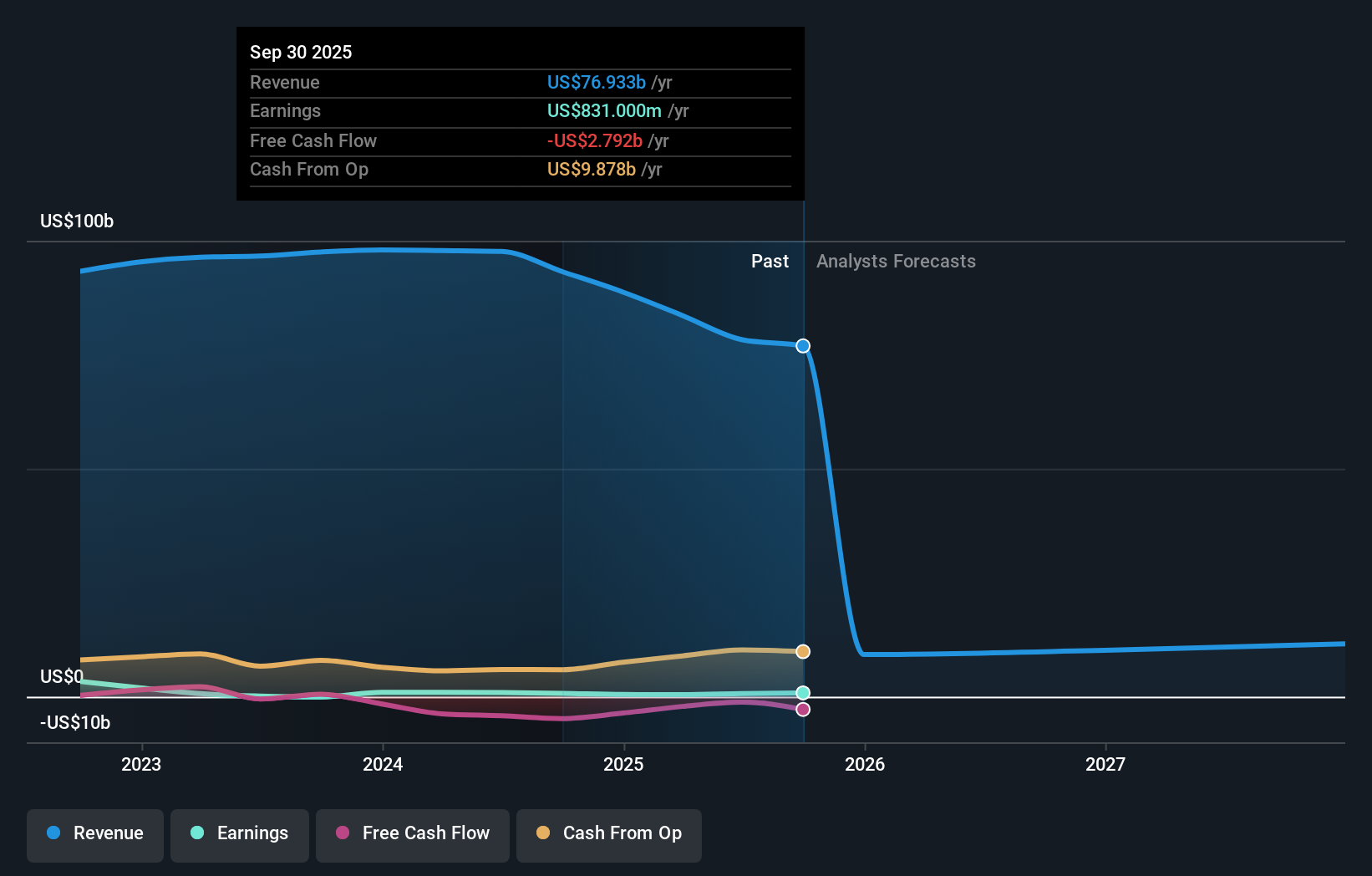

Brookfield's outlook anticipates $8.5 billion in revenue and $7.2 billion in earnings by 2028. This scenario implies a 54.2% annual revenue decline but a substantial earnings jump of about $6.73 billion from current earnings of $473 million.

Uncover how Brookfield's forecasts yield a CA$97.28 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members estimate Brookfield’s fair value between US$74.25 and US$97.28, reflecting varied future growth expectations. With Brookfield’s planned fund launches, your outlook may shift depending on how much weight you give to market conditions affecting asset monetization and earnings.

Explore 4 other fair value estimates on Brookfield - why the stock might be worth just CA$74.25!

Build Your Own Brookfield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Brookfield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BN

Brookfield

An alternative asset manager and real estate investment manager firm focuses on real estate, renewable power, infrastructure and venture capital and private equity assets.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives