- Canada

- /

- Capital Markets

- /

- TSX:BAM

Is Brookfield’s Stock Split (TSX:BAM) Changing Its Appeal to a New Generation of Investors?

Reviewed by Sasha Jovanovic

- Brookfield Corporation recently completed a three-for-two stock split, distributing one-half of a Class A Limited Voting Share for each Class A and Class B share held, with post-split trading beginning on October 10, 2025.

- This move is designed to make shares more accessible to a wider range of investors and potentially improve market liquidity, further highlighted by Brookfield's ambitions in energy transition and UK pension markets.

- We'll assess how the recent stock split, aimed at boosting investor accessibility, influences Brookfield's broader investment case and growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Brookfield Asset Management's Investment Narrative?

For anyone considering Brookfield Asset Management, the big picture rests on the firm's role as a diversified global manager with strengths across infrastructure, real assets, and the accelerating energy transition. The recently completed three-for-two stock split makes the shares easier for individual investors to access, though the impact on the company’s underlying value and near-term catalysts is likely minimal given recent price movements and steady growth trends. The bigger levers remain Brookfield's ongoing M&A activities, including sizable acquisition talks and ambitions in energy and UK pensions, which position the company for expansion but also introduce integration and valuation risks amid already elevated P/E ratios. For now, any shift in short-term risk or reward from the split seems modest relative to these broader business drivers and sustained earnings momentum.

However, sharp price swings could still reveal underlying disconnects in valuation.

Exploring Other Perspectives

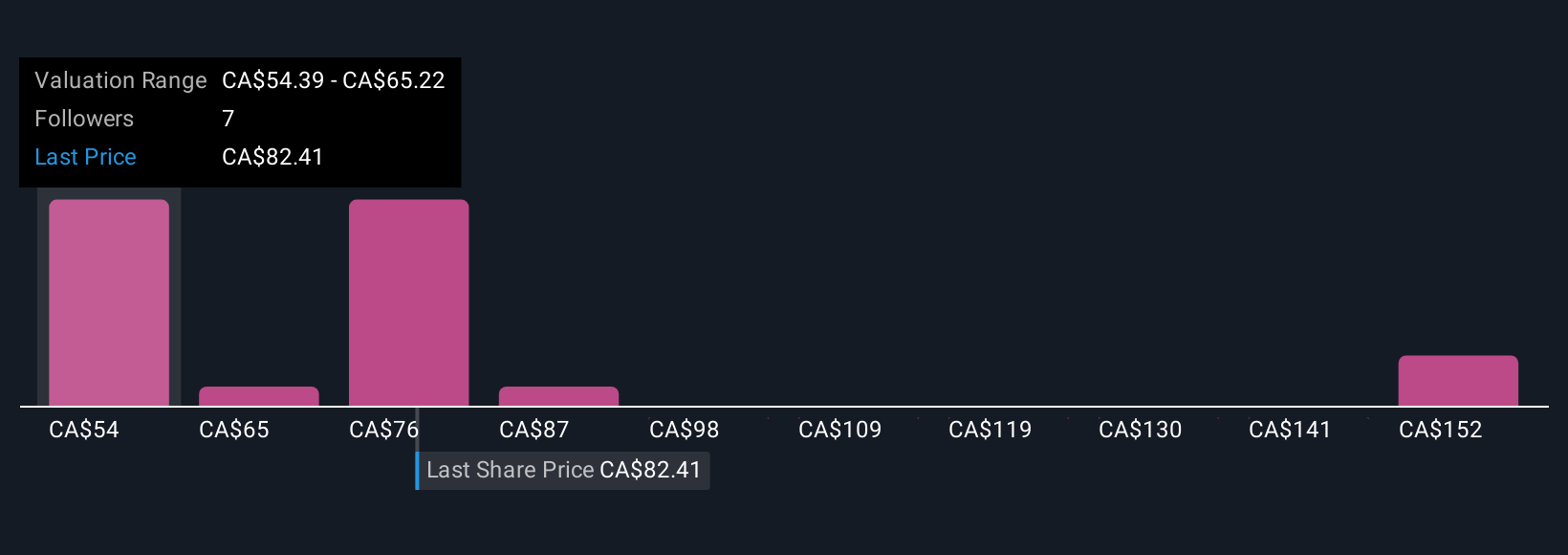

Explore 6 other fair value estimates on Brookfield Asset Management - why the stock might be worth 29% less than the current price!

Build Your Own Brookfield Asset Management Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Asset Management research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Asset Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Asset Management's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026