- Canada

- /

- Capital Markets

- /

- TSX:BAM

Brookfield Asset Management (TSX:BAM): Evaluating Valuation as Shares Drift Lower to Key Support Levels

Reviewed by Simply Wall St

Brookfield Asset Management (TSX:BAM) has seen its shares drift lower over the past month, continuing a trend that has lasted throughout the past 3 months. Investors are taking notice because the stock is approaching support levels last seen earlier this year.

See our latest analysis for Brookfield Asset Management.

After steadily drifting lower, Brookfield Asset Management’s 1-year total shareholder return stands at -5.0%. Its recent momentum has faded, with a 1-day share price return of -5.1% and a 30-day share price return of -8.4%. Investors seem cautious as valuation questions linger and the stock searches for firmer footing.

If you’re considering what else is moving in the market, now is a good time to broaden your investing perspective and discover fast growing stocks with high insider ownership

With steady declines but underlying business growth, investors are left to wonder if Brookfield Asset Management is now underrated in the market or if today’s valuation already reflects its prospects for future growth.

Price-to-Earnings of 32x: Is it justified?

Brookfield Asset Management is trading at a price-to-earnings (P/E) ratio of 32x, which signals a premium valuation relative to peers and the broader industry. At its last close of CA$72.74, the stock’s valuation is well above the Canadian Capital Markets industry average.

The P/E ratio measures how much investors are willing to pay for each dollar of the company’s earnings. For asset managers like Brookfield, it reflects both current profitability and expectations of future growth or stability in profits.

At 32x, the market’s willingness to ascribe such a multiple is notable, especially since it exceeds the industry’s average of 9.1x. This suggests investors see Brookfield as either less risky, more likely to grow, or deserving of a higher premium than most of its peers. However, the 32x multiple is also higher than the estimated fair price-to-earnings ratio of 28.5x, signaling a further stretch from levels that could be justified by fundamentals alone. The premium implies optimism for continued profit growth, but it is well above benchmarks the market might eventually move toward.

Explore the SWS fair ratio for Brookfield Asset Management

Result: Price-to-Earnings of 32x (OVERVALUED)

However, slowing net income growth and a persistent discount to analyst price targets could signal ongoing caution about Brookfield’s near-term outlook.

Find out about the key risks to this Brookfield Asset Management narrative.

Another View: What Does the SWS DCF Model Say?

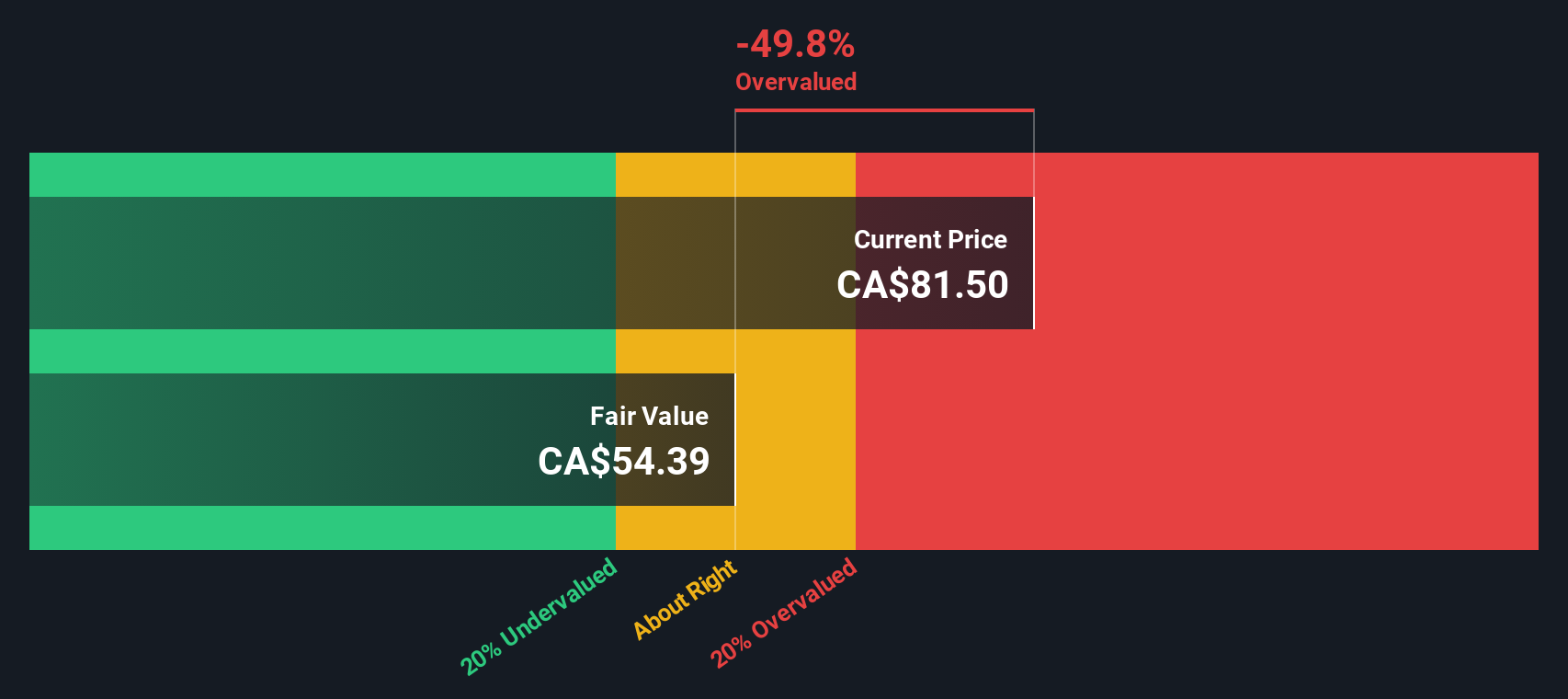

While the price-to-earnings ratio paints Brookfield Asset Management as expensive, our SWS DCF model offers a different perspective. According to this approach, BAM trades above its fair value estimate, suggesting the stock could be overvalued if future cash flows do not accelerate. The key question is whether the market's optimism is too bold.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Asset Management Narrative

If you want to dive into the numbers and form your own outlook, the tools are available. You can build your narrative in just minutes. Do it your way

A great starting point for your Brookfield Asset Management research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There are plenty of other promising stocks making waves right now. Don’t wait for the perfect moment; now is a great time to identify fresh investment themes that stand out from the crowd.

- Unlock passive income potential and generate consistent returns by checking out these 15 dividend stocks with yields > 3%, known for strong yields and resilient payouts.

- Catch the next surge in technology by backing these 27 AI penny stocks, gaining momentum from unstoppable AI trends and innovations.

- Stay ahead with these 870 undervalued stocks based on cash flows, offering hidden gems overlooked by the broader market and ripe for a re-rating as fundamentals come into focus.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives