- Canada

- /

- Construction

- /

- TSX:BDGI

3 Undervalued Small Caps On TSX With Insider Action In Canada

Reviewed by Simply Wall St

As the Canadian market demonstrates strong momentum heading into 2025, investors are keeping an eye on potential curveballs that might impact the trajectory of small-cap stocks. With valuations elevated in some sectors, but not universally so, there is a growing interest in identifying opportunities where stocks trade at or below their historical averages. In this context, small-cap companies on the TSX with insider activity can present compelling prospects for those looking to navigate these dynamic market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Sagicor Financial | 1.2x | 0.3x | 35.36% | ★★★★★★ |

| Calfrac Well Services | 12.2x | 0.2x | 33.62% | ★★★★★☆ |

| Nexus Industrial REIT | 13.0x | 3.3x | 25.73% | ★★★★★☆ |

| Trican Well Service | 8.6x | 1.0x | 12.00% | ★★★★☆☆ |

| Rogers Sugar | 15.7x | 0.6x | 47.26% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 44.79% | ★★★★☆☆ |

| Hemisphere Energy | 6.2x | 2.3x | -130.74% | ★★★☆☆☆ |

| First National Financial | 14.8x | 4.2x | 37.95% | ★★★☆☆☆ |

| Coveo Solutions | NA | 3.8x | 35.54% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.4x | -208.20% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

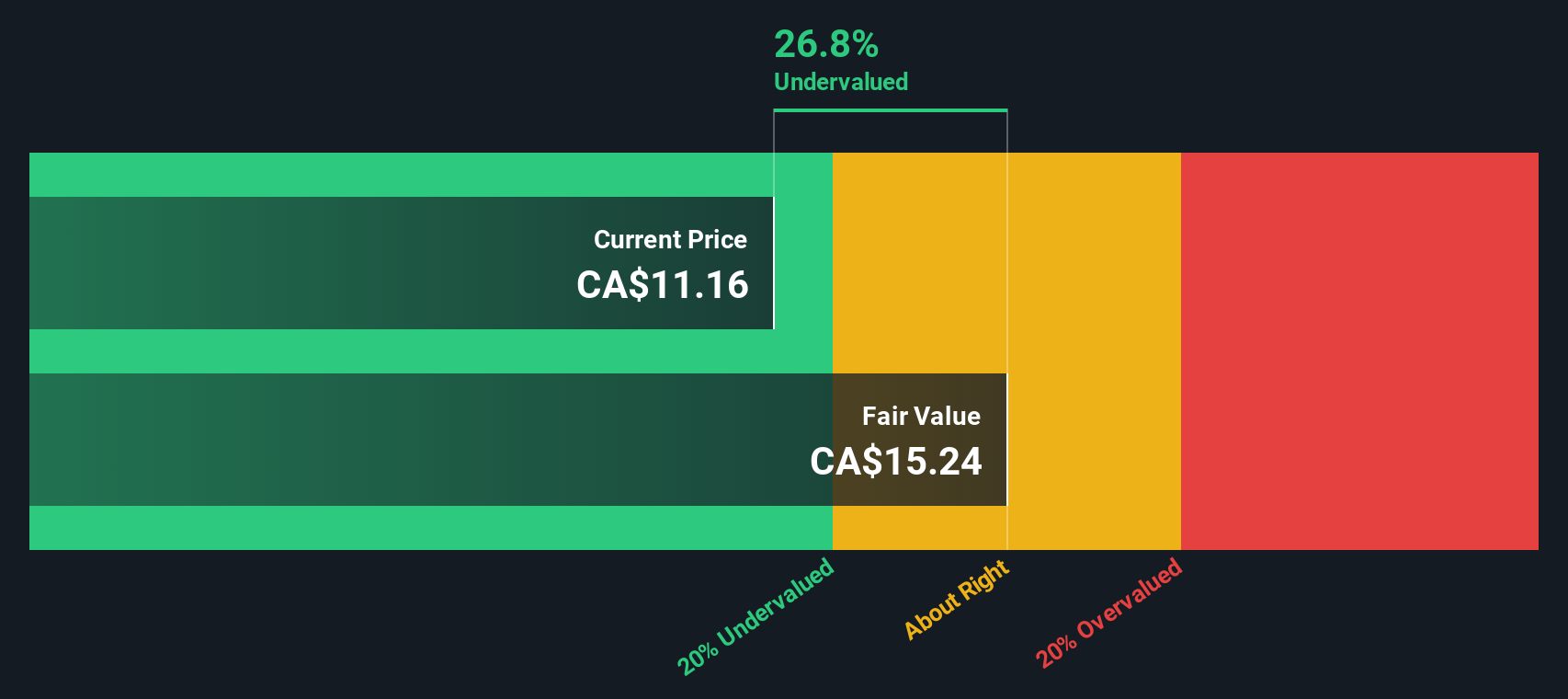

Atrium Mortgage Investment (TSX:AI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Atrium Mortgage Investment operates as a non-bank lender providing residential and commercial mortgages, with a market cap of CA$0.49 billion.

Operations: The company generates revenue primarily through its financial services in the mortgage sector, with recent figures showing CA$57.55 million. Its cost structure includes a cost of goods sold (COGS) of CA$8.62 million and operating expenses of CA$1.94 million, leading to a gross profit margin of 85.02%. The net income margin has shown variability, reaching 81.71% in the latest period analyzed.

PE: 11.3x

Atrium Mortgage Investment, a Canadian company with a focus on mortgage lending, is navigating its financial landscape with some challenges. Despite high debt levels and reliance on external borrowing, they maintain steady earnings growth projected at 7.12% annually. Recent earnings showed stable net income of CAD 11.61 million in Q3 2024, slightly up from last year. Insider confidence is evident through share purchases over recent months, indicating potential value recognition despite past shareholder dilution and fluctuating revenues.

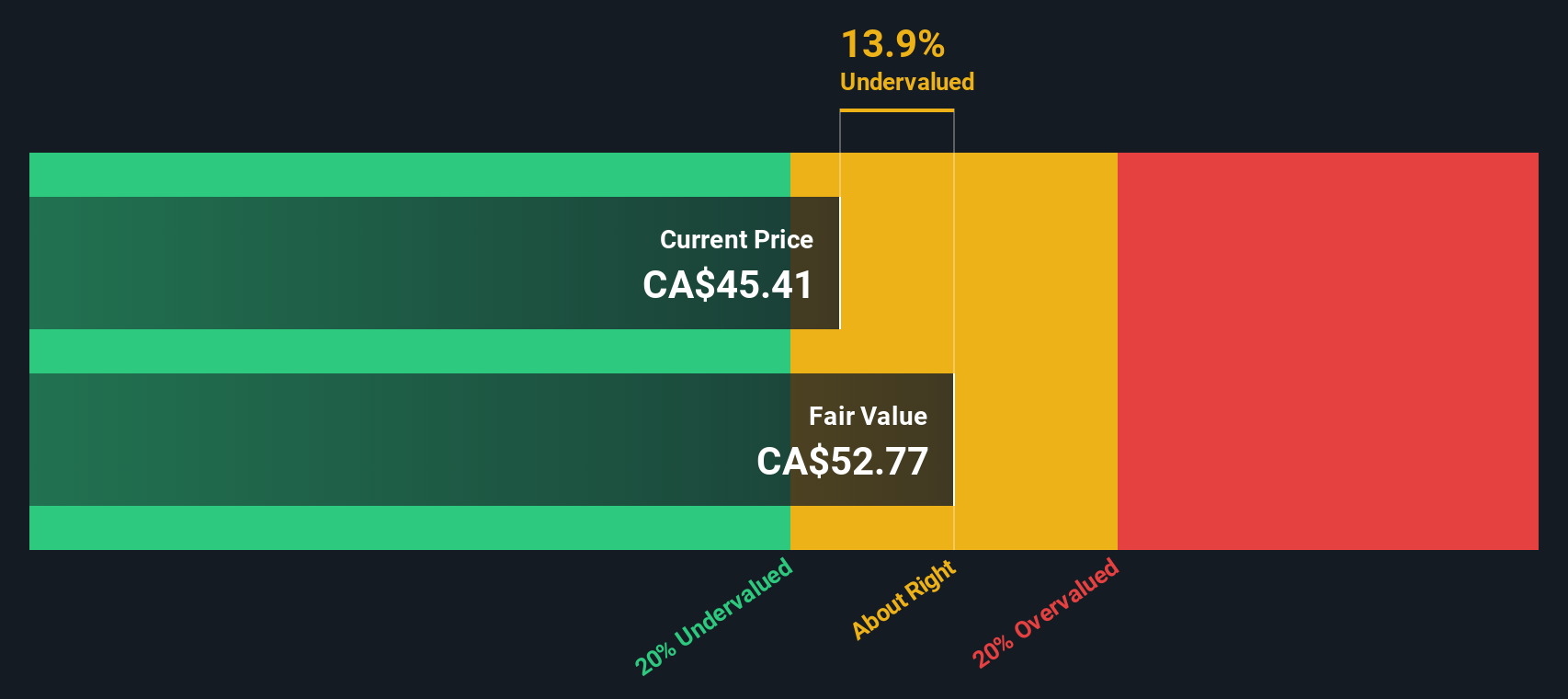

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★★★

Overview: Badger Infrastructure Solutions is a company that specializes in non-destructive excavating services, with a market capitalization of approximately $1.24 billion CAD.

Operations: The company's primary revenue stream is from non-destructive excavating services, with the latest reported revenue at $730.92 million. The cost of goods sold (COGS) for the same period was $522.81 million, resulting in a gross profit of $208.12 million and a gross profit margin of 28.47%. Operating expenses include general and administrative expenses, which were recorded at $57.28 million for the period ending September 30, 2024.

PE: 22.4x

Badger Infrastructure Solutions, a smaller player in Canada's market, has shown steady financial performance with Q3 2024 sales at US$209.38 million, up from US$195.55 million the previous year. Despite this growth, net income remained stable at approximately US$23 million. The company relies entirely on external borrowing for funding, which carries higher risk but no customer deposits are involved. Insider confidence is evident as they have been purchasing shares recently, suggesting potential optimism about future growth prospects amid forecasts of earnings increasing by 37% annually.

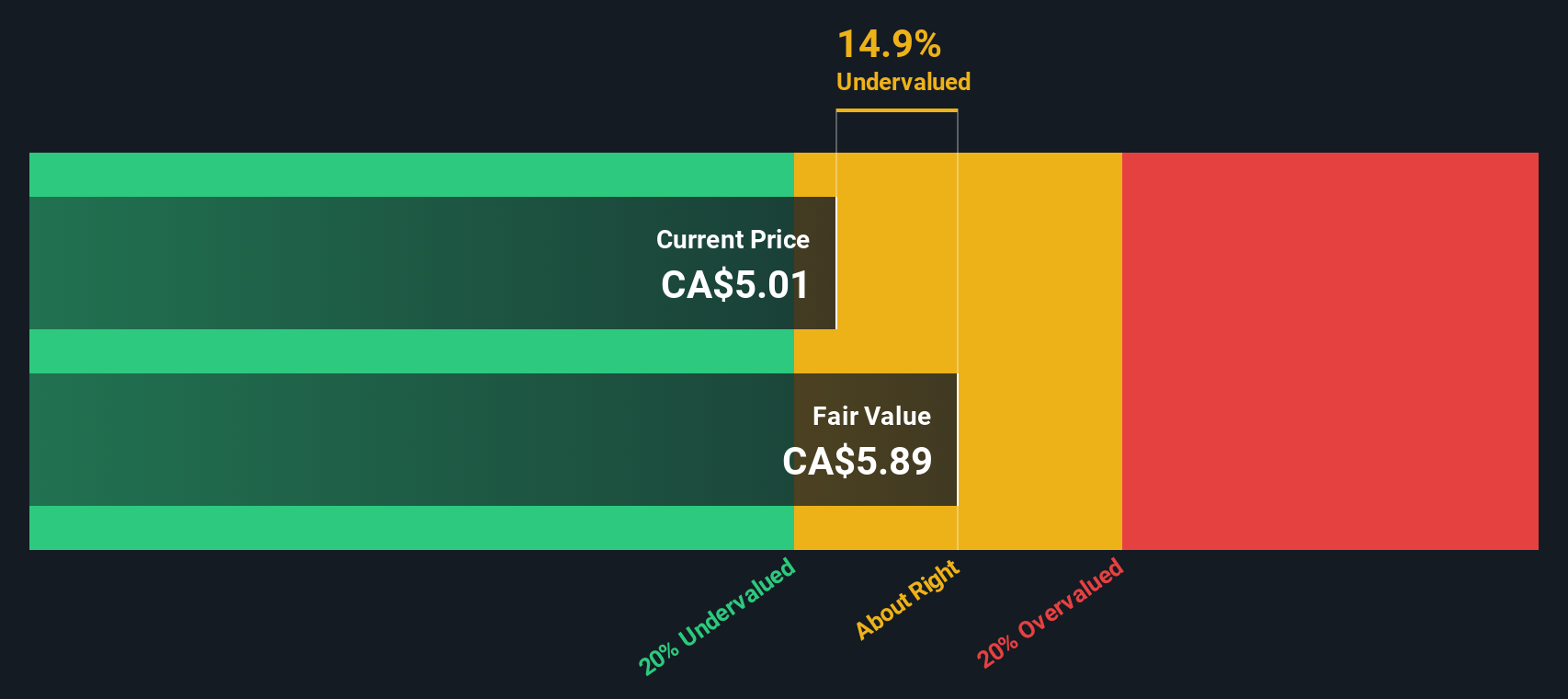

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates in the healthcare real estate industry, focusing on owning and managing a diversified portfolio of medical office buildings, clinics, and hospitals with a market cap of CA$2.55 billion.

Operations: The healthcare real estate segment generates revenue of CA$483.34 million, with a gross profit margin of 76.42%. Operating expenses and significant non-operating expenses contribute to a net income margin of -93.39%.

PE: -2.7x

NorthWest Healthcare Properties REIT, a smaller player in Canada's investment landscape, is navigating challenging waters with a reported net loss of C$138.25 million for Q3 2024. Despite this, insider confidence remains evident as insiders have been purchasing shares recently. The REIT's strategic lease renewals in Brazil, extending the WALE to 18.2 years, signal potential stability and long-term growth prospects. Additionally, consistent monthly distributions of C$0.03 per unit highlight ongoing shareholder returns amidst financial restructuring efforts and leadership transitions planned for mid-2025.

- Dive into the specifics of NorthWest Healthcare Properties Real Estate Investment Trust here with our thorough valuation report.

Learn about NorthWest Healthcare Properties Real Estate Investment Trust's historical performance.

Taking Advantage

- Click here to access our complete index of 22 Undervalued TSX Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Very undervalued with high growth potential and pays a dividend.