- Canada

- /

- Capital Markets

- /

- TSX:AD.UN

Discovering Canada's Hidden Stock Gems In March 2025

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by tariff uncertainties and political shifts, investors are adopting a more cautious stance, with defensive sectors gaining traction. In this environment, identifying hidden stock gems requires a focus on companies that demonstrate resilience and potential for growth amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.38% | 13.35% | 20.20% | ★★★★★★ |

| Genesis Land Development | 46.48% | 30.46% | 55.37% | ★★★★★☆ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Senvest Capital | 78.27% | -8.22% | -9.65% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Alaris Equity Partners Income Trust (TSX:AD.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alaris Equity Partners Income Trust is a private equity firm focusing on management buyouts, growth capital, and mature investments in the lower and middle market sectors, with a market cap of CA$846.72 million.

Operations: The firm generates revenue primarily through equity investments in lower and middle-market companies, focusing on management buyouts and growth capital. With a market cap of CA$846.72 million, its financial performance is influenced by the success of these investments.

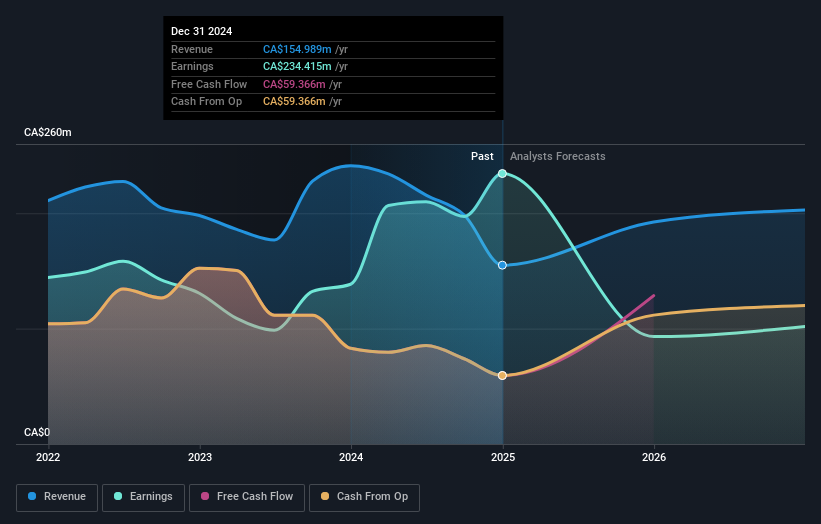

Alaris Equity Partners Income Trust has demonstrated robust financial health, with a net debt to equity ratio of 5.4%, indicating prudent management of liabilities. Over the past year, earnings have surged by 69.3%, outpacing the Capital Markets industry average of 11.3%. This growth is supported by a reduction in its debt to equity ratio from 62.2% five years ago to 5.8% today, showcasing effective debt management strategies. Despite these strengths, revenue for the last fiscal year was CAD 154.99 million compared to CAD 241.25 million previously, highlighting potential challenges ahead amidst forecasted declines in earnings over the next three years.

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Freehold Royalties Ltd. focuses on acquiring and managing royalty interests in crude oil, natural gas, natural gas liquids, and potash properties across Western Canada and the United States, with a market cap of approximately CA$1.98 billion.

Operations: Revenue primarily stems from royalty interests in oil and gas exploration and production, totaling CA$312.68 million.

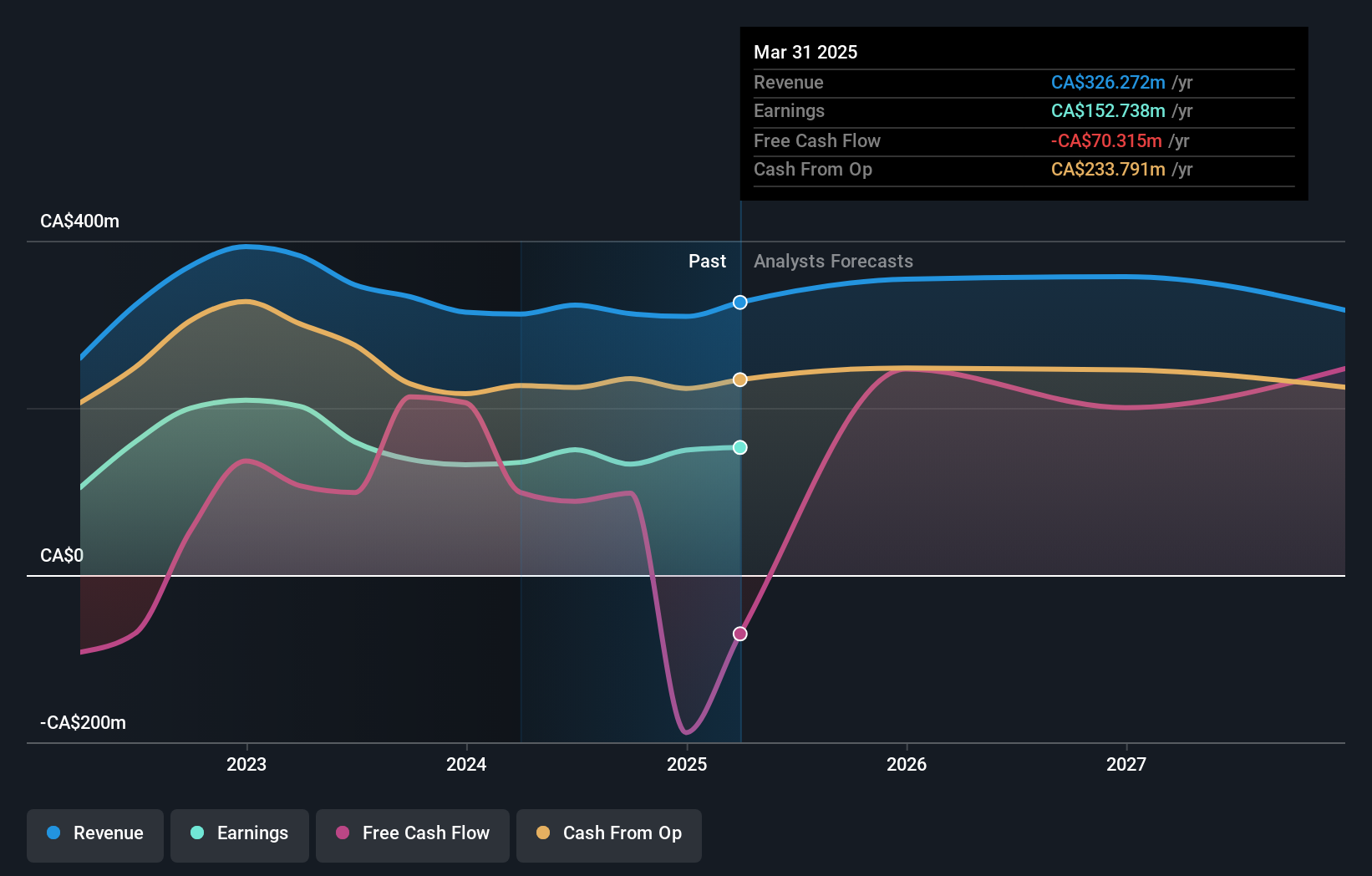

Freehold Royalties, a smaller player in the oil and gas sector, has shown resilience with its earnings growth at -4.1%, outperforming the industry average of -25.8%. The company's debt to equity ratio has risen from 16.1% to 22.7% over five years but remains satisfactory under 40%. Trading at a significant discount of 65.9% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. With robust EBIT coverage of interest payments at 13.7 times, Freehold's financial health appears solid despite recent challenges in earnings growth and increased leverage from expanded credit facilities by $50 million to $450 million.

- Get an in-depth perspective on Freehold Royalties' performance by reading our health report here.

Examine Freehold Royalties' past performance report to understand how it has performed in the past.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services in rural communities and urban neighborhood markets across northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.23 billion.

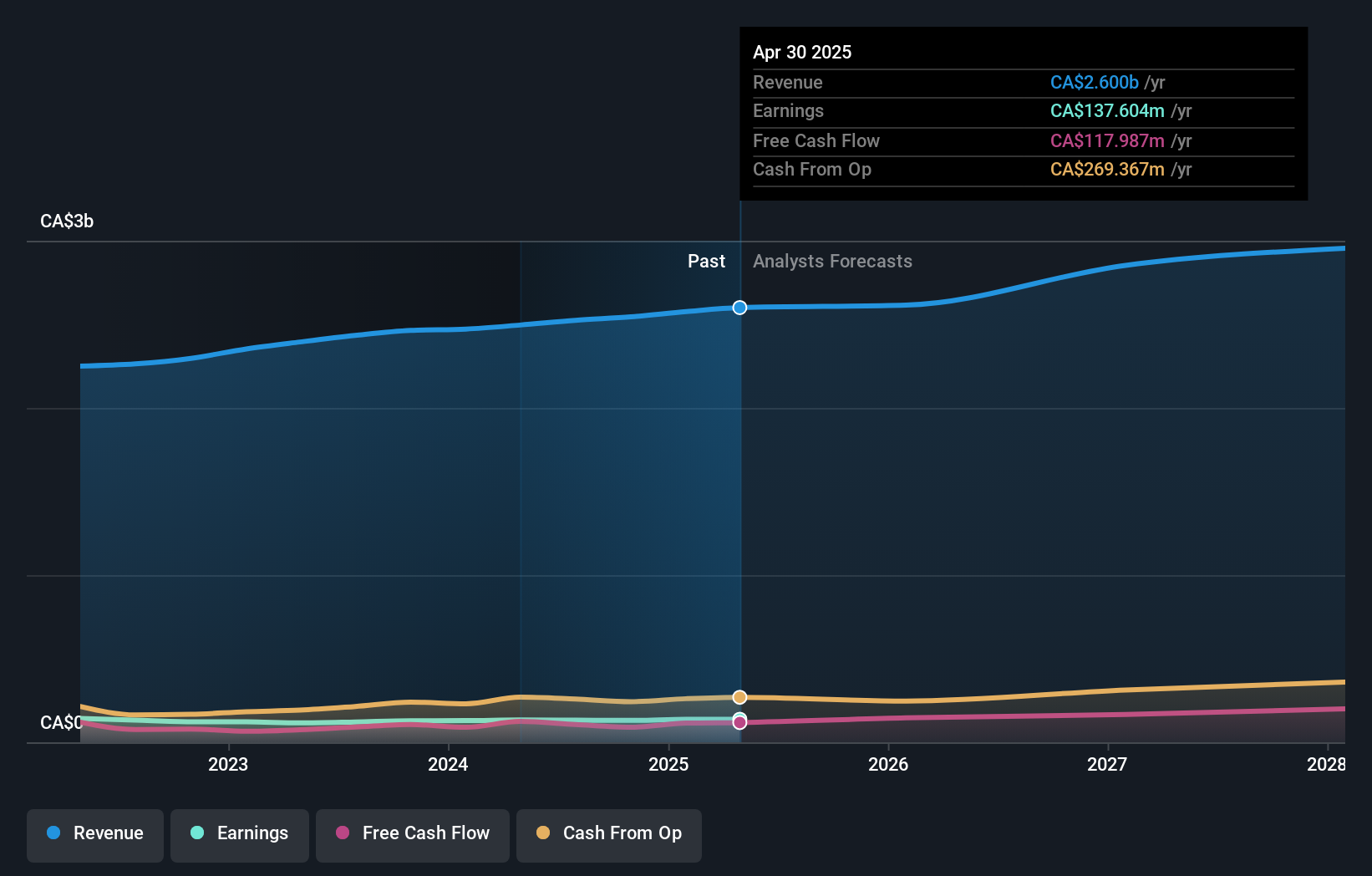

Operations: North West generates revenue primarily from its retail segment, with CA$2.54 billion in sales from food and everyday products and services. The company operates with a market cap of approximately CA$2.23 billion.

With a debt to equity ratio now at 42.3%, North West has significantly improved its financial stability over the past five years from 100.8%. Its earnings growth of 1.4% last year outpaced the Consumer Retailing industry's -12%, showcasing resilience in a challenging market. Trading at 55.9% below estimated fair value, it seems undervalued with potential for appreciation. The company's interest payments are well covered by EBIT, indicating strong operational efficiency with a coverage of 10.8 times, and its net debt to equity ratio stands satisfactorily at 33.5%. Future revenue is expected to grow annually by about 6.25%.

- Unlock comprehensive insights into our analysis of North West stock in this health report.

Gain insights into North West's historical performance by reviewing our past performance report.

Make It Happen

- Gain an insight into the universe of 40 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AD.UN

Alaris Equity Partners Income Trust

A private equity firm specializing in management buyouts, growth capital, lower & middle market, later stage, industry consolidation, growth capital, and mature investments.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)