- Canada

- /

- Diversified Financial

- /

- TSX:ACD

Only 4 Days Left To Cash In On Accord Financial Corp.'s (TSE:ACD) Dividend

It looks like Accord Financial Corp. (TSE:ACD) is about to go ex-dividend in the next 4 days. You will need to purchase shares before the 14th of May to receive the dividend, which will be paid on the 1st of June.

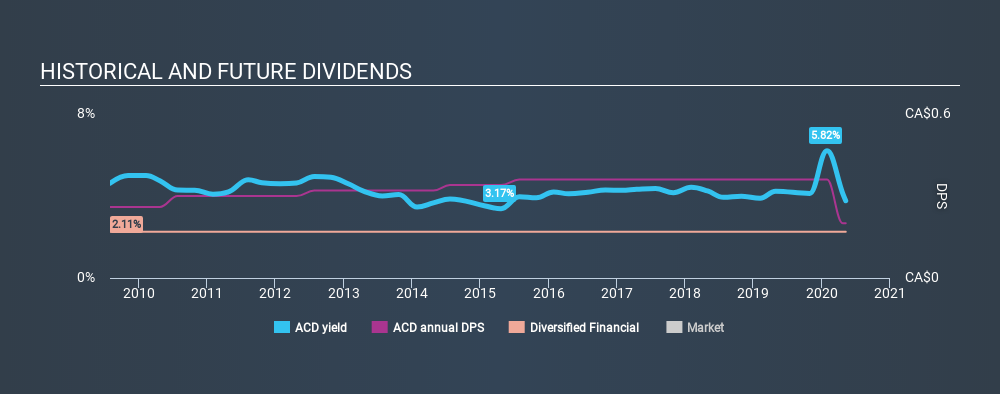

Accord Financial's next dividend payment will be CA$0.05 per share, and in the last 12 months, the company paid a total of CA$0.36 per share. Based on the last year's worth of payments, Accord Financial stock has a trailing yield of around 3.5% on the current share price of CA$5.66. If you buy this business for its dividend, you should have an idea of whether Accord Financial's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Accord Financial

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Accord Financial paid out a comfortable 47% of its profit last year. Accord Financial paid a dividend despite reporting negative free cash flow last year. That's typically a bad combination and - if this were more than a one-off - not sustainable.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit Accord Financial paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That explains why we're not overly excited about Accord Financial's flat earnings over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Accord Financial's dividend payments per share have declined at 2.6% per year on average over the past ten years, which is uninspiring.

To Sum It Up

Should investors buy Accord Financial for the upcoming dividend? Accord Financial's earnings per share are basically flat over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. We're unconvinced on the company's merits, and think there might be better opportunities out there.

If you're not too concerned about Accord Financial's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. For example, we've found 7 warning signs for Accord Financial (1 is a bit concerning!) that deserve your attention before investing in the shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:ACD

Accord Financial

Through its subsidiaries, provides asset-based financial services to industrial and commercial enterprises primarily in Canada and the United States.

Low risk and slightly overvalued.

Market Insights

Community Narratives