- Canada

- /

- Capital Markets

- /

- NEOE:DEFI

Will DeFi Technologies' (NEOE:DEFI) CEO Change and Lower Guidance Reshape Its Growth Story?

Reviewed by Sasha Jovanovic

- DeFi Technologies Inc. reported its Q3 2025 financial results, posting revenues of $22.5 million and operating income of $9 million, while also announcing a CEO transition with Co-Founder Johan Wattenström stepping in as CEO and Executive Chairman.

- The company revised its full-year 2025 revenue guidance downward due to delayed arbitrage opportunities but highlighted record assets under management and a $100 million equity financing, suggesting financial stability despite ongoing market challenges.

- We'll examine how the downward revenue guidance and CEO transition impact DeFi Technologies' evolving investment narrative and business outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

DeFi Technologies Investment Narrative Recap

Owning DeFi Technologies stock requires conviction in the company’s ability to scale new hybrid DeFi and TradFi products while maintaining profitability despite volatile digital asset markets. The recent CEO transition and lowered 2025 revenue guidance, driven by delayed arbitrage trades amid heightened competition and market consolidation, directly affect the short-term outlook but reinforce attention on revenue visibility, currently the most important catalyst as well as the largest risk. These events are material, sharpening focus on the company's execution and the sustainability of DeFi Alpha-driven revenue streams in the near future.

Among recent developments, the $100 million equity financing stands out given the revised guidance and operating environment. This announcement points to robust balance sheet strength and a commitment to funding growth, despite delays impacting core arbitrage activities and volatile cryptocurrency asset prices. Continued access to capital may support the company’s expansion and mitigate some market-driven uncertainties in the short term.

However, investors should be alert, especially as accelerating global regulatory scrutiny could...

Read the full narrative on DeFi Technologies (it's free!)

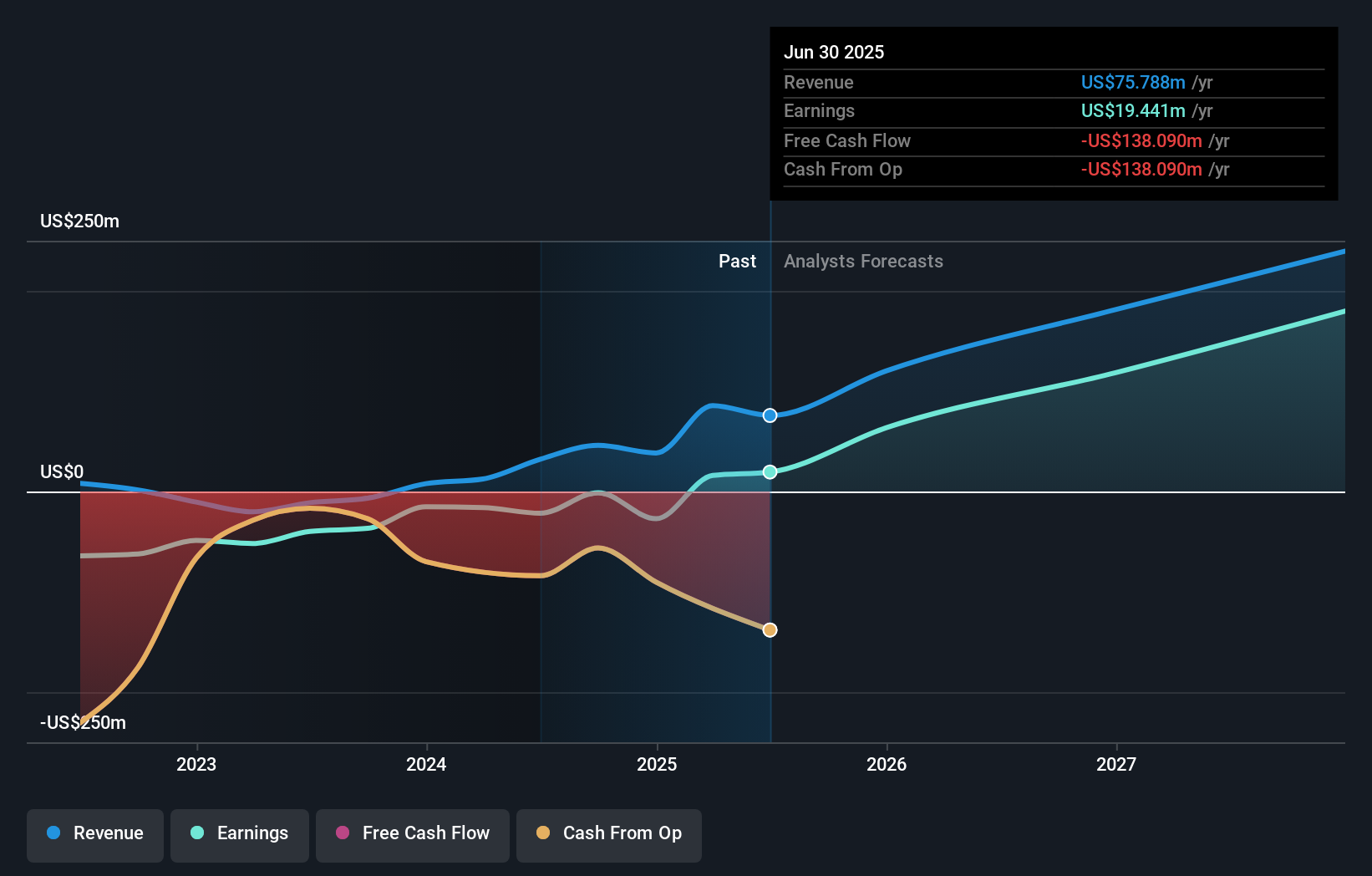

DeFi Technologies' narrative projects $324.7 million revenue and $269.6 million earnings by 2028. This requires 62.4% yearly revenue growth and a $250.2 million earnings increase from $19.4 million today.

Uncover how DeFi Technologies' forecasts yield a CA$6.40 fair value, a 270% upside to its current price.

Exploring Other Perspectives

Fair value estimates from eight Simply Wall St Community members range from US$1.24 to US$7.39 per share. With DeFi Technologies’ heavy reliance on arbitrage-driven revenue, consider how unpredictable execution timelines might shape future results, explore several viewpoints before making any decisions.

Explore 8 other fair value estimates on DeFi Technologies - why the stock might be worth over 4x more than the current price!

Build Your Own DeFi Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DeFi Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DeFi Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DeFi Technologies' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:DEFI

DeFi Technologies

A technology company, develops exchange traded products that synthetically track the value of a single DeFi protocol or a basket of protocols in Canada.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives