- Canada

- /

- Capital Markets

- /

- NEOE:DEFI

DeFi Technologies (NEOE:DEFI): Revisiting Valuation After a Sharp 90-Day Share Price Pullback

Reviewed by Simply Wall St

DeFi Technologies (NEOE:DEFI) has been drifting after a tough past 3 months, and that recent pullback is exactly why investors are revisiting the stock’s mix of fast-growing revenue and volatile crypto-linked exposure.

See our latest analysis for DeFi Technologies.

That said, the current share price of $1.36 sits against a harsh 90 day share price return of about negative 60 percent and a steep year to date share price decline, even after a powerful three year total shareholder return above 900 percent. This suggests momentum has cooled as the market reassesses crypto risk and the sustainability of recent growth.

If you are weighing how speculative stories like DeFi fit into a broader strategy, it might be worth scanning fast growing stocks with high insider ownership for other fast moving names with more aligned insiders.

With revenue and net income still growing briskly, but the share price languishing far below past highs, investors now face a key question: Is DeFi Technologies trading at a genuine discount, or already reflecting all future upside?

Most Popular Narrative Narrative: 75.7% Undervalued

With DeFi Technologies last closing at CA$1.36 versus a narrative fair value of CA$5.60, the gap in expectations is striking and needs context.

The analysts have a consensus price target of CA$7.8 for DeFi Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$9.0, and the most bearish reporting a price target of just CA$7.0.

Want to see how this bold upside case is built? The narrative leans on aggressive revenue acceleration, surging margins, and a future earnings multiple that defies today’s mood. Curious which assumptions really move the dial?

Result: Fair Value of $5.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on resilient crypto markets and timely DeFi Alpha execution. Regulatory setbacks or prolonged delays could quickly undermine the bullish narrative.

Find out about the key risks to this DeFi Technologies narrative.

Another Lens on Valuation

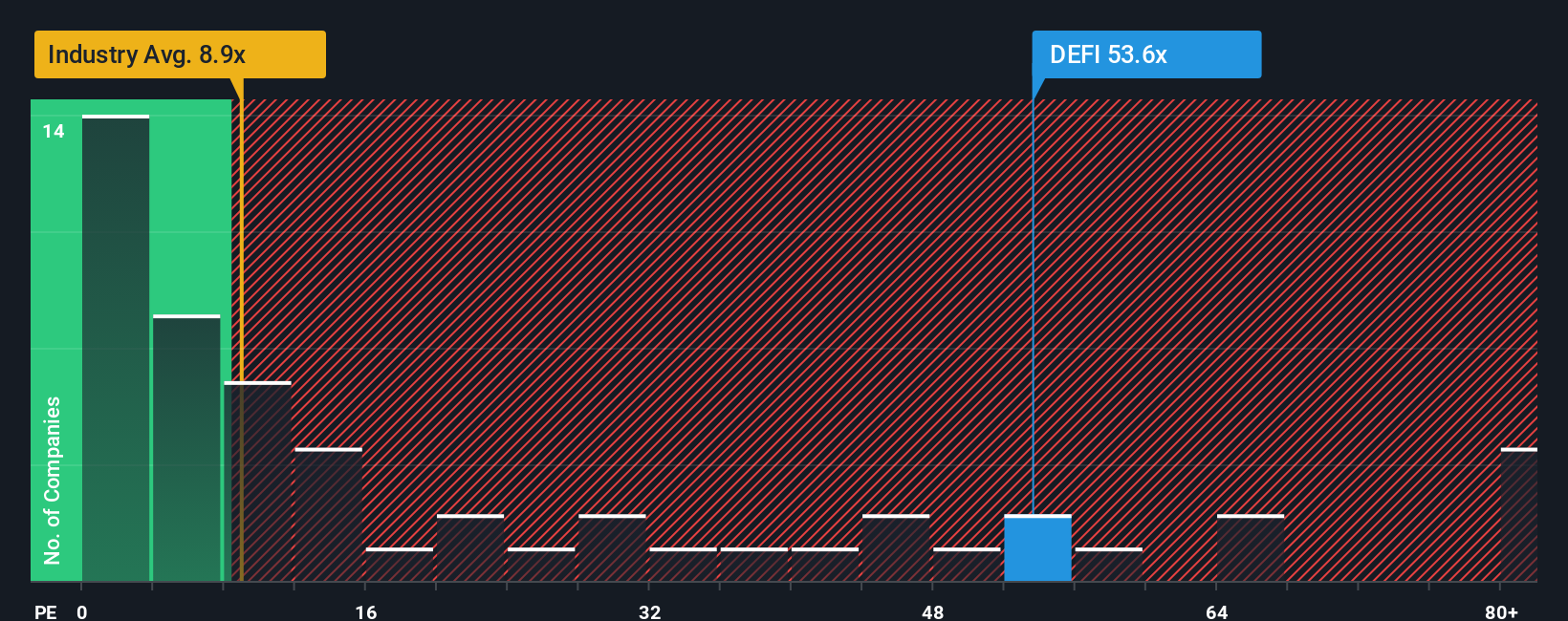

While the narrative fair value points to a big upside, the earnings multiple tells a more cautious story. DeFi Technologies trades on a 44.3x P E ratio, far richer than both the Canadian Capital Markets industry at 8.6x and its 59.1x fair ratio the market could drift toward. Does that premium reflect future growth or add downside risk if momentum fades?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DeFi Technologies Narrative

If this view does not fully align with your own, or you would rather dig into the numbers yourself, you can craft a personalized DeFi thesis in just a few minutes, Do it your way.

A great starting point for your DeFi Technologies research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single thesis. Use the Simply Wall St Screener to uncover fresh, data backed opportunities before other investors catch on.

- Capture under the radar value by scanning these 898 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride the next wave of innovation by targeting these 24 AI penny stocks positioned to benefit from rapid AI adoption.

- Boost your income potential by focusing on these 10 dividend stocks with yields > 3% that combine yield with solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:DEFI

DeFi Technologies

A technology company, develops exchange traded products that synthetically track the value of a single DeFi protocol or a basket of protocols in Canada.

High growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion