- Canada

- /

- Diversified Financial

- /

- CNSX:XSF

Even With A 38% Surge, Cautious Investors Are Not Rewarding XS Financial Inc.'s (CSE:XSF) Performance Completely

XS Financial Inc. (CSE:XSF) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

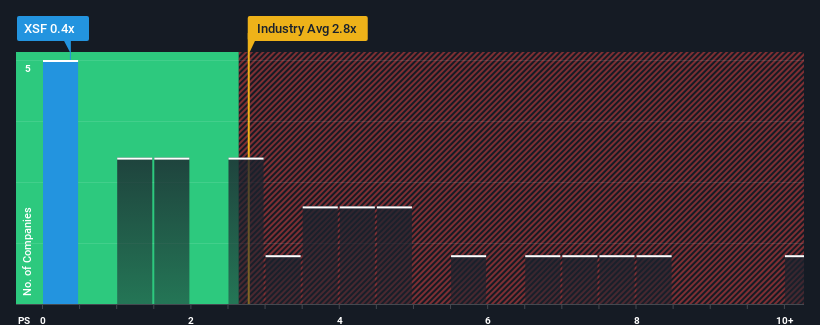

Even after such a large jump in price, given close to half the companies in Canada's Diversified Financial industry have price-to-sales ratios (or "P/S") above 3.6x, you may still consider XS Financial as a highly attractive investment with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for XS Financial

What Does XS Financial's Recent Performance Look Like?

Revenue has risen firmly for XS Financial recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on XS Financial will help you shine a light on its historical performance.How Is XS Financial's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like XS Financial's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 28% shows it's noticeably more attractive.

In light of this, it's peculiar that XS Financial's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Shares in XS Financial have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of XS Financial revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for XS Financial you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:XSF

XS Financial

A specialty finance company, provides equipment leasing solutions in the United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives