- Canada

- /

- Capital Markets

- /

- CNSX:VST

Increases to Victory Square Technologies Inc.'s (CSE:VST) CEO Compensation Might Cool off for now

Key Insights

- Victory Square Technologies to hold its Annual General Meeting on 4th of October

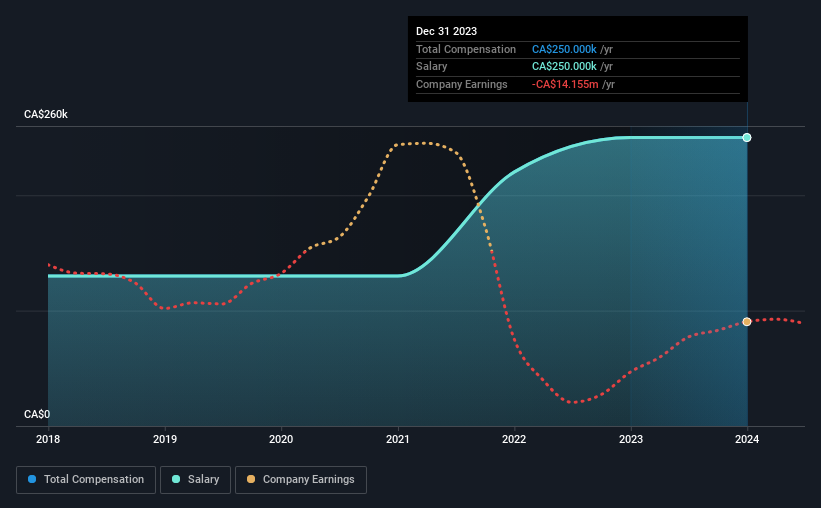

- CEO Shafin Tejani's total compensation includes salary of CA$250.0k

- The total compensation is 48% higher than the average for the industry

- Victory Square Technologies' EPS declined by 27% over the past three years while total shareholder loss over the past three years was 79%

Shareholders of Victory Square Technologies Inc. (CSE:VST) will have been dismayed by the negative share price return over the last three years. Per share earnings growth is also lacking, despite revenue growth. Shareholders will have a chance to take their concerns to the board at the next AGM on 4th of October and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

View our latest analysis for Victory Square Technologies

How Does Total Compensation For Shafin Tejani Compare With Other Companies In The Industry?

At the time of writing, our data shows that Victory Square Technologies Inc. has a market capitalization of CA$8.5m, and reported total annual CEO compensation of CA$250k for the year to December 2023. This was the same amount the CEO received in the prior year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$250k.

For comparison, other companies in the Canadian Capital Markets industry with market capitalizations below CA$269m, reported a median total CEO compensation of CA$169k. Accordingly, our analysis reveals that Victory Square Technologies Inc. pays Shafin Tejani north of the industry median. Moreover, Shafin Tejani also holds CA$99k worth of Victory Square Technologies stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$250k | CA$250k | 100% |

| Other | - | - | - |

| Total Compensation | CA$250k | CA$250k | 100% |

On an industry level, around 66% of total compensation represents salary and 34% is other remuneration. Speaking on a company level, Victory Square Technologies prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Victory Square Technologies Inc.'s Growth

Over the last three years, Victory Square Technologies Inc. has shrunk its earnings per share by 27% per year. Its revenue is up 58% over the last year.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Victory Square Technologies Inc. Been A Good Investment?

Few Victory Square Technologies Inc. shareholders would feel satisfied with the return of -79% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Victory Square Technologies pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 4 warning signs for Victory Square Technologies that you should be aware of before investing.

Important note: Victory Square Technologies is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:VST

Victory Square Technologies

A private equity and venture capital firm specializing in incubation, acquisition and invests in startups, Early stage and provides the senior leadership and resources needed to growth.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion