- Canada

- /

- Consumer Finance

- /

- CNSX:INVR

If You Had Bought Marble Financial (CSE:MRBL) Stock A Year Ago, You'd Be Sitting On A 17% Loss, Today

Over the last month the Marble Financial Inc. (CSE:MRBL) has been much stronger than before, rebounding by 54%. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact, the price has declined 17% in a year, falling short of the returns you could get by investing in an index fund.

View our latest analysis for Marble Financial

With just CA$90,041 worth of revenue in twelve months, we don't think the market considers Marble Financial to have proven its business plan. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Marble Financial will significantly advance the business plan before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

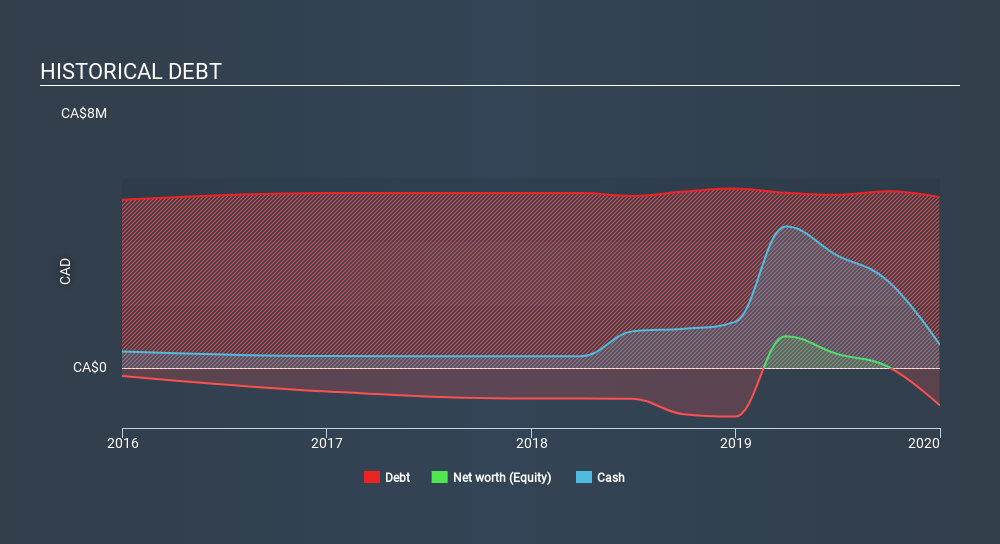

Our data indicates that Marble Financial had more in total liabilities than it had cash, when it last reported. That put it in the highest risk category, according to our analysis. But since the share price has dived -17% in the last year , it looks like some investors think it's time to abandon ship, so to speak, even though the cash reserves look a little better with the capital raising. You can click on the image below to see (in greater detail) how Marble Financial's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

Marble Financial shareholders are down 17% for the year, even worse than the market loss of 13%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 5.3%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Marble Financial (of which 3 are potentially serious!) you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CNSX:INVR

Inverite Insights

Provides AI-driven software focusing on real-time financial data that empowers business lenders and financial institutions to transact with consumers for data enrichment, identify-KYC, risk management, and compliance.

Slight risk with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)