- Canada

- /

- Hospitality

- /

- TSXV:JJ

Jackpot Digital Inc.'s (CVE:JJ) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- Jackpot Digital's Annual General Meeting to take place on 5th of December

- Salary of CA$396.0k is part of CEO Jake Kalpakian's total remuneration

- The total compensation is similar to the average for the industry

- Jackpot Digital's total shareholder return over the past three years was 25% while its EPS grew by 61% over the past three years

CEO Jake Kalpakian has done a decent job of delivering relatively good performance at Jackpot Digital Inc. (CVE:JJ) recently. As shareholders go into the upcoming AGM on 5th of December, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

See our latest analysis for Jackpot Digital

How Does Total Compensation For Jake Kalpakian Compare With Other Companies In The Industry?

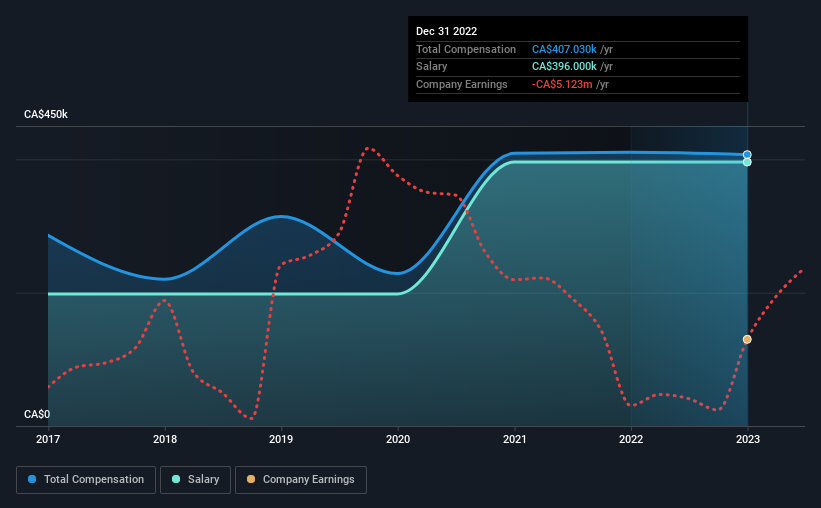

At the time of writing, our data shows that Jackpot Digital Inc. has a market capitalization of CA$14m, and reported total annual CEO compensation of CA$407k for the year to December 2022. That is, the compensation was roughly the same as last year. Notably, the salary which is CA$396.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the Canadian Hospitality industry with market capitalizations below CA$272m, we found that the median total CEO compensation was CA$506k. So it looks like Jackpot Digital compensates Jake Kalpakian in line with the median for the industry. Moreover, Jake Kalpakian also holds CA$95k worth of Jackpot Digital stock directly under their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CA$396k | CA$396k | 97% |

| Other | CA$11k | CA$15k | 3% |

| Total Compensation | CA$407k | CA$411k | 100% |

On an industry level, around 71% of total compensation represents salary and 29% is other remuneration. Jackpot Digital is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Jackpot Digital Inc.'s Growth Numbers

Jackpot Digital Inc.'s earnings per share (EPS) grew 61% per year over the last three years. In the last year, its revenue is up 107%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Jackpot Digital Inc. Been A Good Investment?

With a total shareholder return of 25% over three years, Jackpot Digital Inc. shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Jake receives almost all of their compensation through a salary. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 6 warning signs for Jackpot Digital (2 are a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:JJ

Jackpot Digital

Develops, markets, sells, and leases electronic table games to casino operators.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives