- Canada

- /

- Hospitality

- /

- TSXV:BET

Investors Aren't Buying NorthStar Gaming Holdings Inc.'s (CVE:BET) Revenues

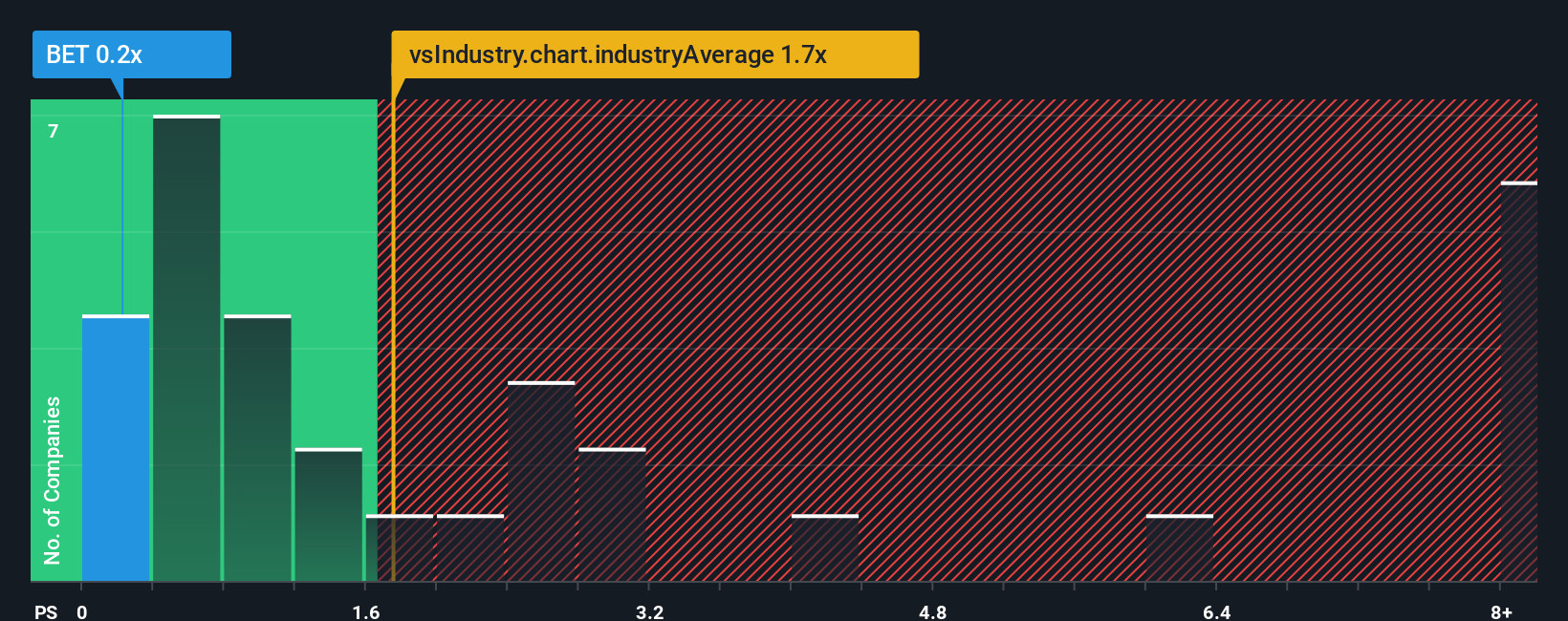

NorthStar Gaming Holdings Inc.'s (CVE:BET) price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the Hospitality industry in Canada, where around half of the companies have P/S ratios above 2.4x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for NorthStar Gaming Holdings

How Has NorthStar Gaming Holdings Performed Recently?

With revenue growth that's exceedingly strong of late, NorthStar Gaming Holdings has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on NorthStar Gaming Holdings will help you shine a light on its historical performance.How Is NorthStar Gaming Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like NorthStar Gaming Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 36% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 218% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why NorthStar Gaming Holdings' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, NorthStar Gaming Holdings maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 4 warning signs for NorthStar Gaming Holdings that you need to take into consideration.

If these risks are making you reconsider your opinion on NorthStar Gaming Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if NorthStar Gaming Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BET

NorthStar Gaming Holdings

Through its subsidiaries, engages in sports betting and online casino gaming business in Canada.

Slight risk and slightly overvalued.

Market Insights

Community Narratives