- Canada

- /

- Hospitality

- /

- TSX:TWC

TWC Enterprises (TSX:TWC) Profit Margin Declines as One-Off Gain Distorts Earnings Narrative

Reviewed by Simply Wall St

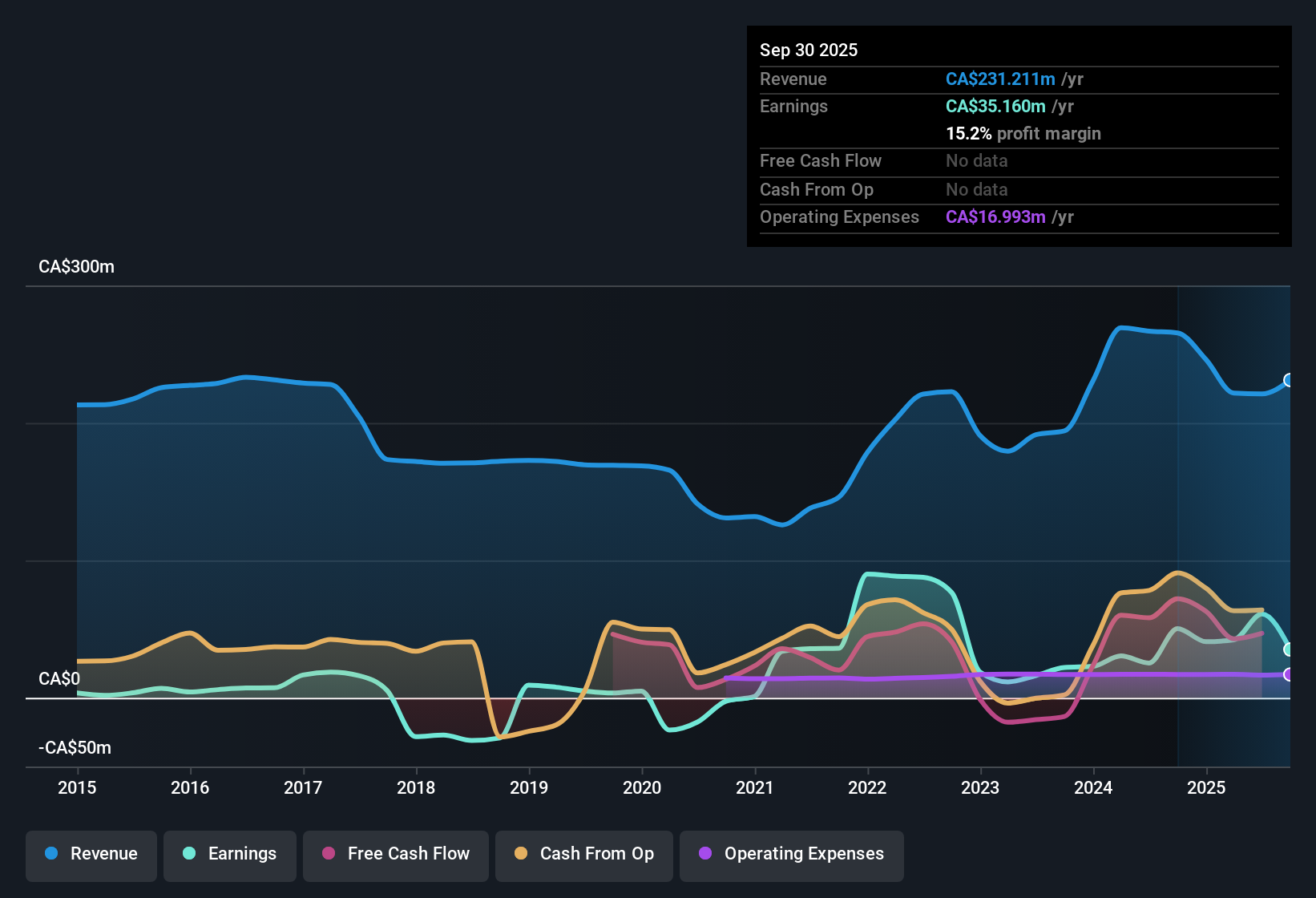

TWC Enterprises (TSX:TWC) posted a net profit margin of 15.2%, down from 19% last year, signaling lower profitability for the period. The company’s earnings growth rate over the past five years averaged 3.2% annually, showing steady progress toward profitability. However, recent results were heavily influenced by a one-off gain of CA$9.9 million, which investors should watch closely when interpreting the quality of reported earnings.

See our full analysis for TWC Enterprises.Now, it is time to see how the latest numbers compare to the prevailing narratives. Some long-held beliefs may get confirmed, while others could face a fresh challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Drives Recent Profits

- Recent financial results include a non-recurring gain of CA$9.9 million, significantly distorting the headline profitability figures and creating a challenge for investors who want to gauge the underlying performance trend.

- It is notable in the prevailing market view that while management achieved a 3.2% annual earnings growth over five years, short-term numbers are now heavily impacted by this substantial one-time gain.

- This complicates the task of measuring core profit progress from ongoing operations, since a large part of reported profit this year came from the exceptional CA$9.9 million item rather than recurring business activity.

- Investors need to be cautious about assuming this elevated margin will persist, as the next period is unlikely to repeat such a windfall.

Valuation Looks Compelling Versus Industry

- With a Price-to-Earnings ratio of 15.8x, TWC trades at a noticeable discount relative to the North American Hospitality industry average of 21.7x, yet still slightly above its direct peer average of 14.8x.

- The prevailing market view highlights strong interest in TWC's shares due to this valuation dynamic.

- While a discount to the industry may attract value-focused buyers, peers offer even cheaper exposure, creating an ongoing debate about the appropriate reference point for judging value.

- The current share price of CA$23 is well below the estimated DCF fair value of CA$46.56, suggesting material upside if fundamentals prove durable beyond the recent one-off gain.

Profit Margins Narrow but Remain Healthy

- Net profit margin slipped from 19% to 15.2% over the last year, reflecting a decline in underlying profitability even before factoring in exceptional items.

- Investors observing the prevailing market view are cautious, balancing the positive trend of steady five-year compound earnings growth at 3.2% with the reality that current margins are below last year's performance.

- This encourages a focus on sustainability, as future results may depend on regaining lost margin rather than relying on non-recurring income for profit support.

- Ongoing sector competition and cautious optimism about leisure travel indicate mixed momentum in the months ahead.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TWC Enterprises's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

TWC’s recent profitability relies heavily on a one-off gain. Core operating margins have slipped, and healthy, sustained earnings growth is now in question.

If you want steadier stories, use stable growth stocks screener (2093 results) to focus on companies demonstrating consistent earnings and revenue progress without depending on non-recurring windfalls.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TWC Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TWC

TWC Enterprises

Owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion