- Canada

- /

- Hospitality

- /

- TSX:BRAG

Lacklustre Performance Is Driving Bragg Gaming Group Inc.'s (TSE:BRAG) 36% Price Drop

Bragg Gaming Group Inc. (TSE:BRAG) shareholders that were waiting for something to happen have been dealt a blow with a 36% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 33% in that time.

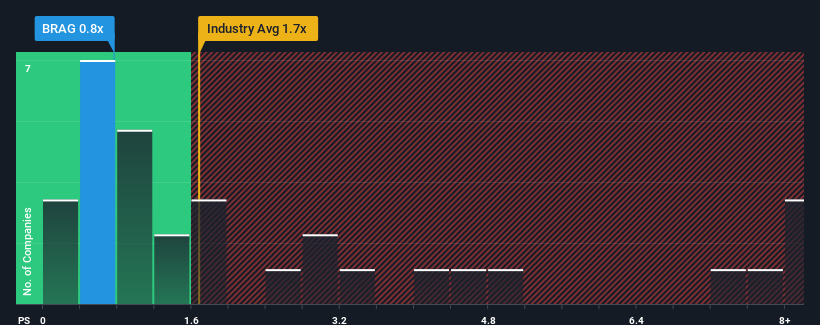

Following the heavy fall in price, Bragg Gaming Group's price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Hospitality industry in Canada, where around half of the companies have P/S ratios above 2.7x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Bragg Gaming Group

How Bragg Gaming Group Has Been Performing

With revenue growth that's inferior to most other companies of late, Bragg Gaming Group has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bragg Gaming Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Bragg Gaming Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 2.6% gain to the company's revenues. Pleasingly, revenue has also lifted 71% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the six analysts watching the company. With the industry predicted to deliver 219% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Bragg Gaming Group's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Bragg Gaming Group's P/S Mean For Investors?

The southerly movements of Bragg Gaming Group's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Bragg Gaming Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 1 warning sign for Bragg Gaming Group that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bragg Gaming Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BRAG

Bragg Gaming Group

Operates as an iGaming content and technology solutions provider serving online and land-based gaming operators with its proprietary and exclusive content.

Excellent balance sheet and fair value.

Market Insights

Community Narratives