- Canada

- /

- Food and Staples Retail

- /

- TSX:MRU

Metro (TSX:MRU): Assessing Valuation After New Buyback Plan and Strong Earnings Growth

Reviewed by Simply Wall St

Metro (TSX:MRU) just launched a fresh share repurchase program, aiming to buy back up to 4.68% of its outstanding shares over the next year. In addition to this announcement, the company posted stronger annual revenue and net income, drawing renewed interest from investors.

See our latest analysis for Metro.

Metro’s latest buyback news and solid earnings are coming on the back of momentum that is hard to ignore. The company posted a total shareholder return of 10.5% over the past year, with the stock up 11.2% year-to-date, highlighting consistent growth and renewed investor confidence.

If Metro’s capital return plans caught your attention, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with Metro’s shares trading near their recent highs and a slight discount to analyst price targets, the question is whether the market is overlooking further upside or if future growth is already fully accounted for in today’s price.

Most Popular Narrative: 5.3% Undervalued

The most widely followed narrative pegs Metro’s fair value modestly above its latest closing price. This suggests the market may not be fully pricing in future earnings momentum and operational advances. This gap, still within a close range, sets the stage for a deeper look at the fundamentals behind this call.

Robust growth in pharmacy same-store sales (5.5% in the quarter, with further tailwinds from increasing prescription and specialty medication demand) suggests Metro is well-placed to benefit from rising consumer focus on health and wellness. This supports both revenue and premium-margin opportunities.

Want to know why Metro is getting a valuation upgrade? The core of this narrative is a significant change in future profit quality and what analysts expect for margins. There is a noteworthy growth strategy in progress. See exactly what’s behind this number.

Result: Fair Value of $105.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, despite Metro's strong position, intensified discount grocer competition or higher supply costs could quickly pressure margins and challenge expectations for steady earnings growth.

Find out about the key risks to this Metro narrative.

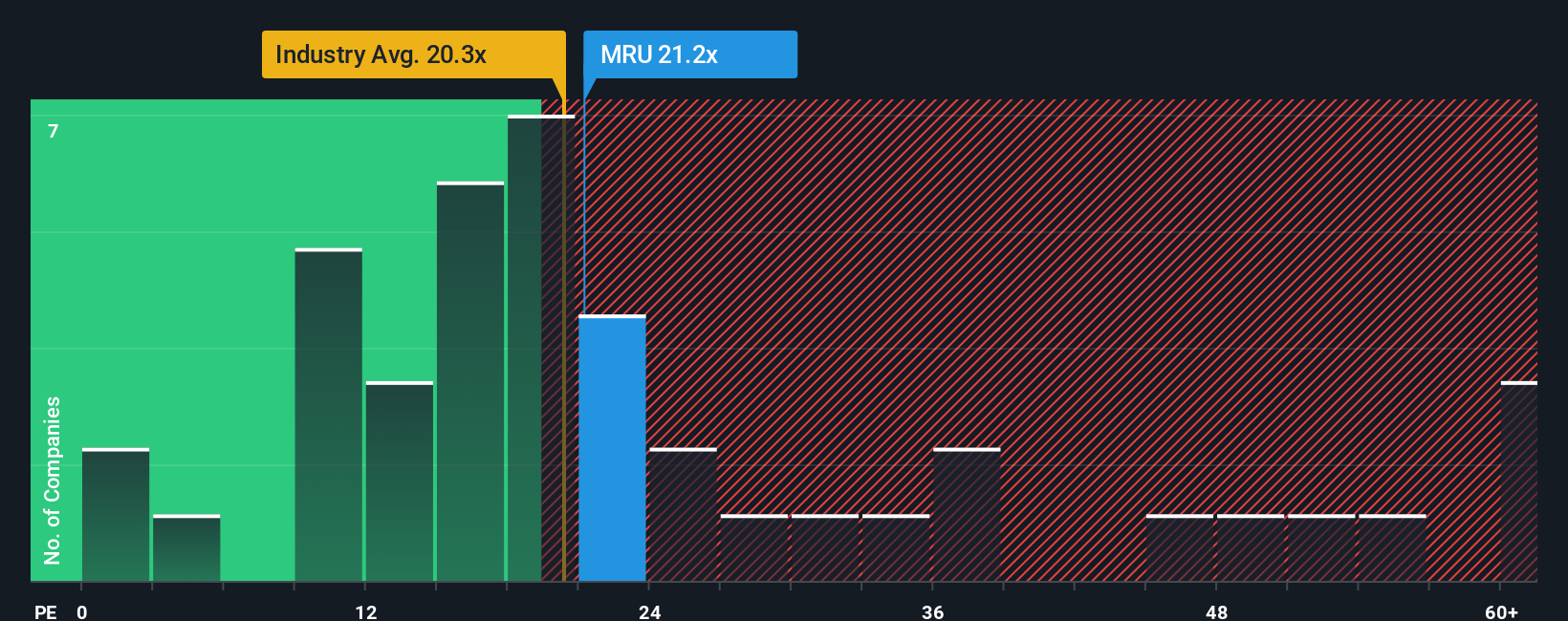

Another View: Market Ratios Paint a Different Picture

Looking at Metro's valuation through the lens of its price-to-earnings ratio presents a less optimistic outlook than the fair value estimate suggests. Metro trades at 21.2 times earnings, which is higher than both the Consumer Retailing industry average of 20.3x and its own estimated fair ratio of 20.2x. This above-average valuation means investors are paying a premium, which could leave less room for upside if expectations are not met. Is the market demanding too much for Metro’s track record, or could future results still surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Metro Narrative

If you'd rather chart your own course or dive deeper into the numbers, you can build a personalized narrative in only a few minutes. Do it your way

A great starting point for your Metro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge: skip the index and find tomorrow's winners before the crowd catches on. Try these proven screeners and seize new opportunities now.

- Tap into rapid innovation and uncover potential future market leaders by starting with these 25 AI penny stocks.

- Grow your passive income by targeting high-yield opportunities. Search through these 15 dividend stocks with yields > 3% that pay out over 3%.

- Position yourself early in breakthrough technologies by scanning these 28 quantum computing stocks for exciting advancement in computing power and applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MRU

Metro

Through its subsidiaries, operates as a retailer, franchisor, distributor, and manufacturer in the food and pharmaceutical sectors in Canada.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026