iFabric Corp. (TSE:IFA) Might Not Be As Mispriced As It Looks After Plunging 29%

The iFabric Corp. (TSE:IFA) share price has fared very poorly over the last month, falling by a substantial 29%. Indeed, the recent drop has reduced its annual gain to a relatively sedate 4.8% over the last twelve months.

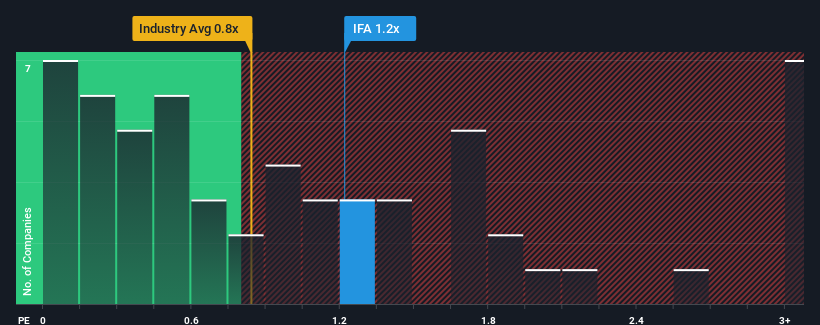

In spite of the heavy fall in price, it's still not a stretch to say that iFabric's price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Luxury industry in Canada, where the median P/S ratio is around 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for iFabric

What Does iFabric's Recent Performance Look Like?

Revenue has risen firmly for iFabric recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for iFabric, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For iFabric?

iFabric's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.6%. Pleasingly, revenue has also lifted 88% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 6.9% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that iFabric is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Following iFabric's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To our surprise, iFabric revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for iFabric you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if iFabric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IFA

iFabric

Engages in the design and distribute of women's intimate apparel and accessories in Canada, the United States, the United Kingdom, Southeast Asia, and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion