Assessing Canada Goose (TSX:GOOS) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Canada Goose Holdings.

Momentum has shifted for Canada Goose Holdings, with investors noticing a robust 23.4% share price return over the past three months. While the one-year total shareholder return stands at 40.1%, the longer-term track record is mixed. This hints that recent optimism could signal a turnaround after years of underperformance.

If this momentum has you thinking about where to look next, it’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing recently and a modest discount to analyst targets, investors now face a key question: Is Canada Goose Holdings an undervalued opportunity, or is all future growth already reflected in the price?

Most Popular Narrative: 8.8% Undervalued

Canada Goose Holdings recently closed at CA$19.19, with the most widely followed narrative assigning a fair value of CA$21.03. This suggests that, based on anticipated growth and profitability, analysts see more upside for the stock than the market price currently reflects.

Exceptional revenue growth in North America and Mainland China, especially driven by rising affluence and demand for premium/luxury goods in Asia, highlights Canada Goose's ability to tap expanding high-end consumer markets. This points to a longer-term expansion of the addressable customer base and continued international revenue growth.

Curious how Canada Goose’s targeted expansion and shifting consumer trends shape analyst confidence? One decisive prediction in this narrative hinges on a future profitability level rarely achieved outside the luxury elite. Find out the exact financial benchmarks analysts are betting on if you want to understand what’s really driving that fair value.

Result: Fair Value of $21.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in key regions and rising operating expenses could challenge Canada Goose’s growth story if sales momentum does not meet expectations.

Find out about the key risks to this Canada Goose Holdings narrative.

Another View: Market Ratios Raise Valuation Questions

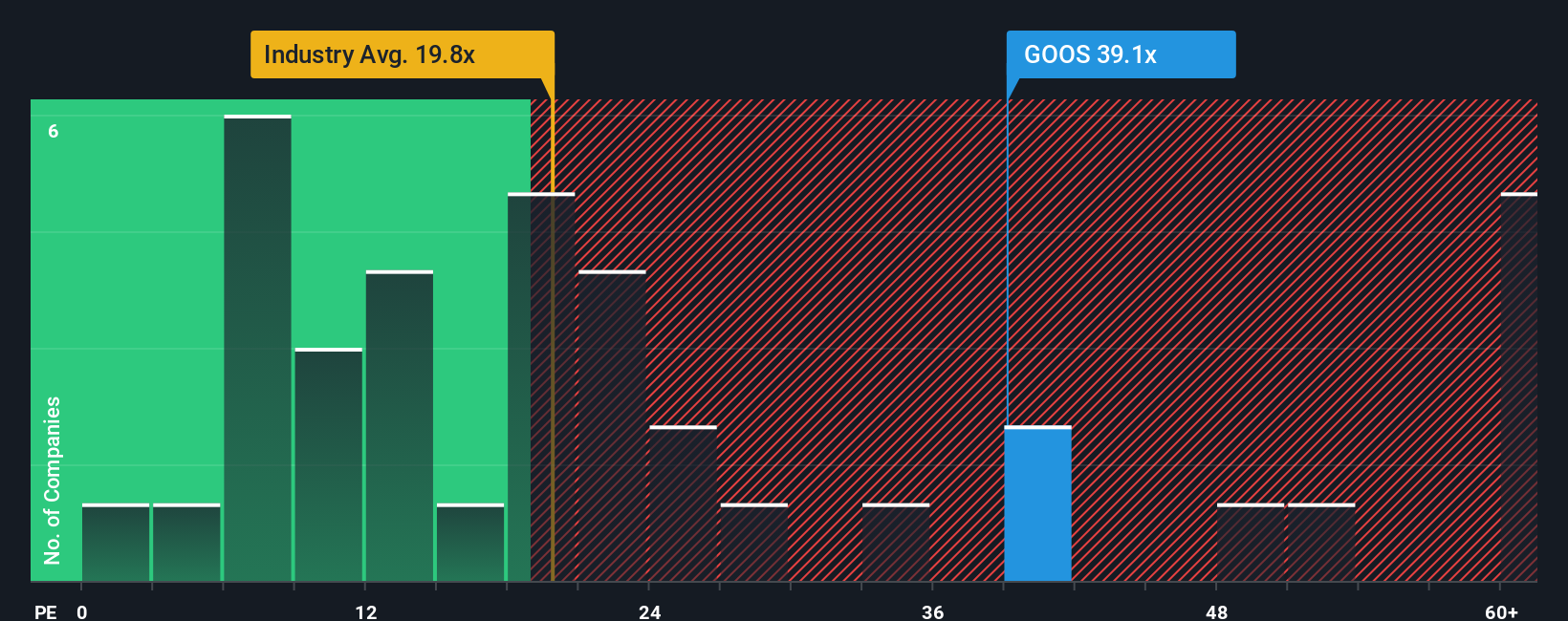

Looking at valuation from a different angle, Canada Goose Holdings trades at a price-to-earnings ratio of 39.6x. This figure is double the North American Luxury industry average of 19.5x and is well above its own fair ratio of 17.8x. Such a premium could expose investors to downside risk if sentiment shifts or earnings growth disappoints. Should investors be concerned that the optimism in the share price has run too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canada Goose Holdings Narrative

If you’d rather take a hands-on approach or see things differently, you can easily build your own perspective on Canada Goose Holdings in just a few minutes. Do it your way

A great starting point for your Canada Goose Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't miss out on standout opportunities beyond a single stock. Use Simply Wall Street's Screener to spot dynamic investing angles few investors are watching.

- Capture growth with these 26 AI penny stocks that are shaping tomorrow’s AI-driven markets before the crowd even catches on.

- Boost your portfolio’s earning power by targeting these 24 dividend stocks with yields > 3% that offer reliable yields over 3% to help smooth out market ups and downs.

- Capitalize on hidden gems by filtering for these 3576 penny stocks with strong financials with strong financials and the potential for big gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOOS

Canada Goose Holdings

Designs, manufactures, and sells performance luxury outerwear, apparel, footwear, and accessories for men, women, youth, children, and babies.

Mediocre balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives