Valuing BRP (TSX:DOO) After Can-Am’s Exclusive Powersports Partnership With MeatEater

Reviewed by Simply Wall St

BRP (TSX:DOO) has announced an expanded partnership between its Can-Am brand and MeatEater, making Can-Am the exclusive powersports partner for the influential outdoor media company. This collaboration aims to boost Can-Am’s presence among hunters and adventurers.

See our latest analysis for BRP.

BRP’s latest move to deepen its ties with MeatEater comes at a time when investor optimism is climbing. The company’s share price is up 25.7% over the past 90 days and its 1-year total shareholder return is at an impressive 32%. While these gains hint at renewed growth potential, they also reflect a broader confidence in BRP’s strategy to drive engagement with outdoor enthusiasts and expand its reach through high-profile partnerships.

If news like BRP’s expanded partnership has you thinking about what else is making waves, this is a perfect opportunity to discover fast growing stocks with high insider ownership

But with BRP’s shares climbing and impressive returns already delivered, should investors view this as a buying opportunity? Or is the market already accounting for the company’s future growth potential?

Most Popular Narrative: 13.3% Undervalued

With BRP’s narrative fair value set at CA$103.47 compared to a recent closing price of CA$89.69, the crowd sees more upside ahead. This valuation hinges on BRP’s ability to accelerate innovation and execute international growth plans amid evolving market dynamics.

The rapid expansion of BRP's electric vehicle lineup (notably the Outlander electric ATV and electric motorcycle), combined with modular design efficiencies, positions the company to capture incremental revenue and margin improvement as consumer demand for sustainable, innovative recreational vehicles accelerates in response to global electrification and regulatory momentum. (Impacts: topline growth, margin expansion)

Want to see how aggressive electrification targets, tech upgrades, and a new margin roadmap influence BRP’s valuation? The real surprise might be which financial levers drive their narrative price target. Find out what could really propel these shares ahead.

Result: Fair Value of $103.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained macroeconomic uncertainty or stricter emissions regulations could quickly challenge BRP’s current growth trajectory and investor optimism.

Find out about the key risks to this BRP narrative.

Another View: What Do Market Ratios Say?

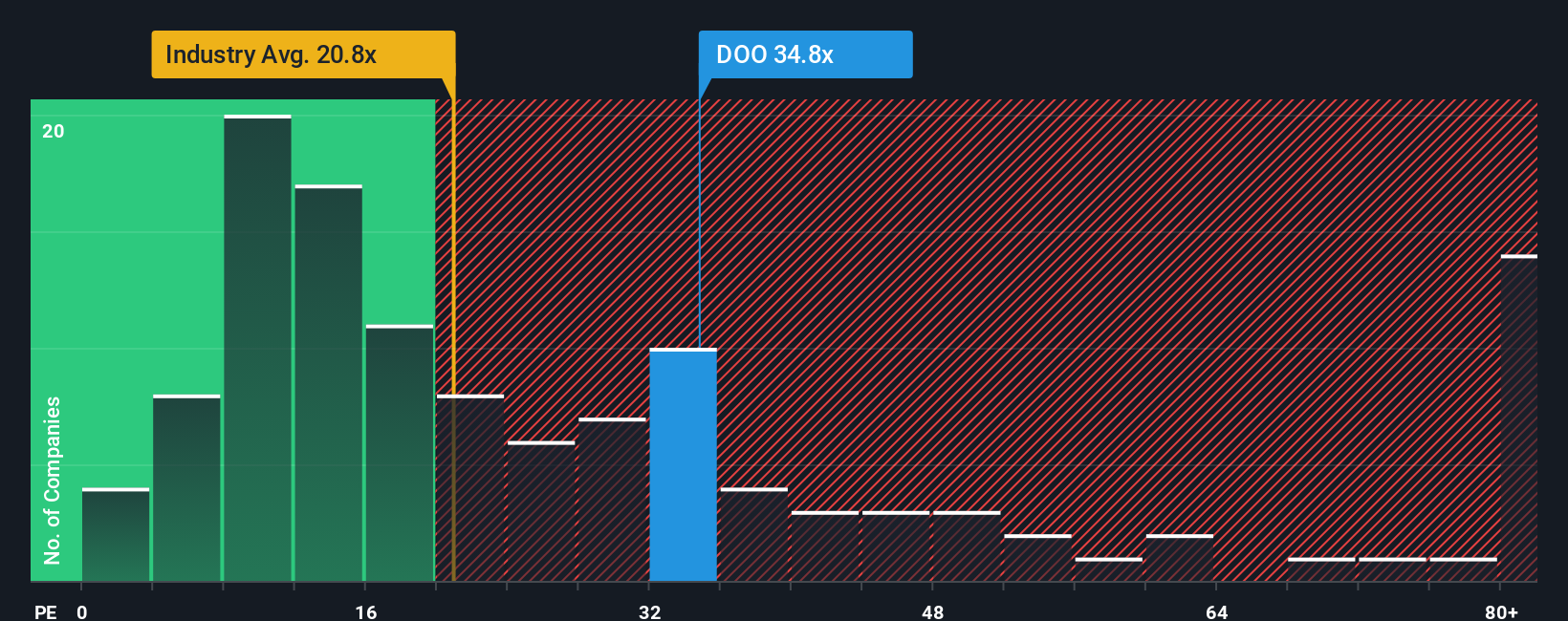

Looking at market ratios offers a less optimistic take on BRP’s valuation. Its price-to-earnings ratio sits at 33.1x, making it more expensive than both its peer average of 32.1x and the broader industry average of 20.9x. Meanwhile, the fair ratio is calculated at 31.2x, suggesting the stock carries a valuation premium that may increase downside risk if expectations are not met. Does the market already price in too much growth, or is this premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BRP Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can easily build your own viewpoint in just a few minutes. Do it your way

A great starting point for your BRP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investing Moves?

Don’t let opportunity slip by and level up your portfolio with ideas waiting just beyond BRP. Tap into tailored lists targeting tomorrow’s leaders and untapped financial rewards.

- Uncover untapped innovation by checking out these 25 AI penny stocks accelerating growth in areas like artificial intelligence, automation, and data-driven solutions.

- Maximize your income potential by reviewing these 16 dividend stocks with yields > 3% to find companies offering reliable, high-yield dividends and a track record of rewarding shareholders.

- Catch early-stage momentum with these 3589 penny stocks with strong financials showcasing small-cap standouts poised for rapid growth and market-moving breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOO

BRP

Designs, develops, manufactures, and sells powersports vehicles and marine products in the Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives