BRP (TSX:DOO) Valuation Spotlight After Can-Am Wins Prestigious Motorcycle of the Year Award

Reviewed by Simply Wall St

BRP (TSX:DOO) just saw its Can-Am Canyon Redrock model named 2025 Motorcycle of the Year by Rider Magazine, a first for any 3-wheel vehicle. This recognition highlights the company's innovative approach and may draw fresh attention from both riders and investors.

See our latest analysis for BRP.

Over the past year, BRP’s total shareholder return reached 33.3 percent, with momentum building especially in recent months as the 90-day share price return climbed nearly 36 percent. While recognition like the Motorcycle of the Year award boosts confidence, it comes alongside an already impressive year-to-date performance and renewed interest from the market.

If BRP’s surge has you thinking about what else could be gaining traction in the sector, take a look at See the full list for free.

But with shares up over 33 percent in the past year and analyst targets still showing an 11 percent upside, investors have to wonder if there is more room to run or if BRP’s growth is already priced in.

Most Popular Narrative: 9.6% Undervalued

According to the most widely followed narrative, BRP’s fair value is several dollars higher than its last close, pointing to a meaningful valuation gap. This signals that the market may be underestimating the company’s prospects as projected by analyst consensus.

Ongoing international growth, with strong double-digit retail increases in Latin America and recovery in Asia-Pacific, underscores BRP's opportunity to leverage rising disposable income and shifting leisure preferences in global markets. This supports a multi-year runway for revenue growth and geographic diversification beyond North America. (Impacts: revenue diversification, revenue growth)

What is really driving this fair value estimate? There are some bold expectations below the surface. Big moves in margins, expansion into new markets, and a financial forecast that could redefine the outlook for BRP are at play. Eager to see the math and milestone events that might justify such a premium? The next section reveals the foundation behind the narrative’s bullish target.

Result: Fair Value of $102.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or unexpected regulatory setbacks could quickly challenge BRP’s outlook. This could cause investor sentiment to shift and test the current bullish narrative.

Find out about the key risks to this BRP narrative.

Another View: What Do Market Ratios Say?

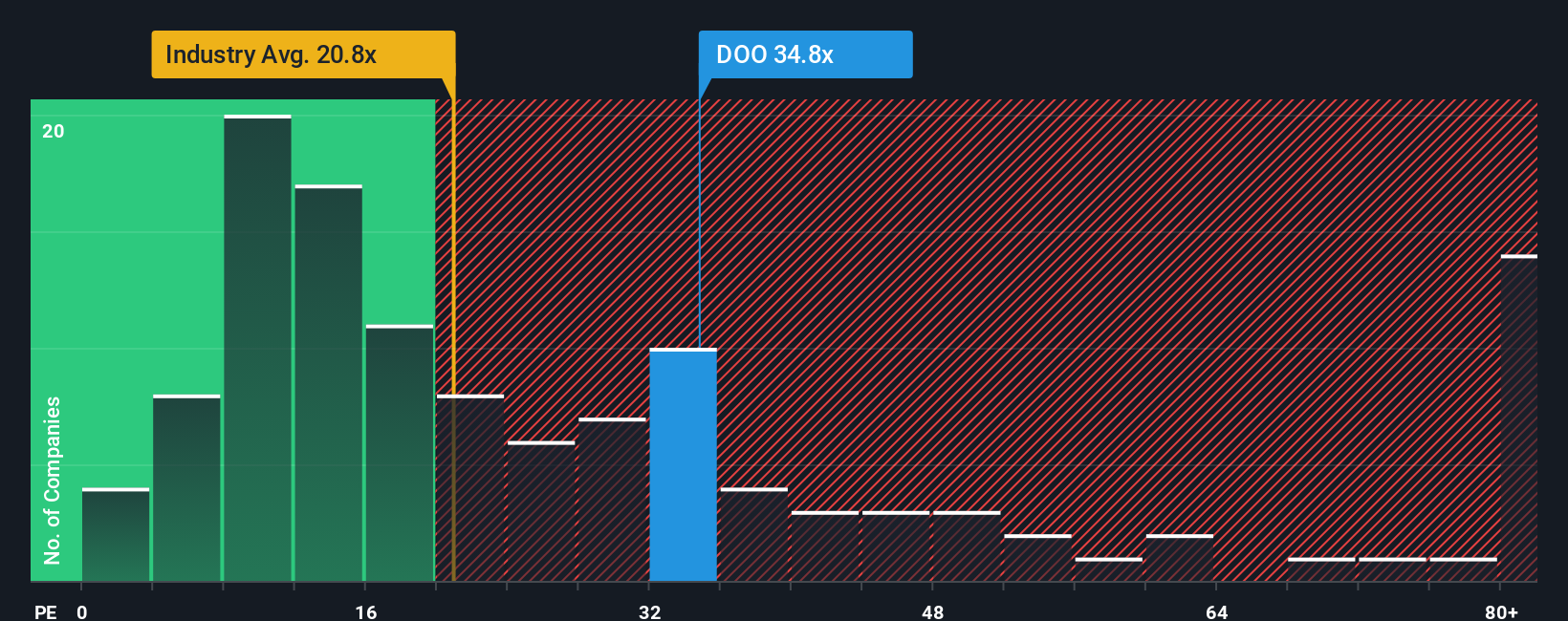

While the narrative points to BRP being undervalued, the current market multiple tells a more cautious story. The company is trading at 34.3 times earnings, which is significantly higher than the industry average of 20.7 times and even above its peers' average of 39.1 times. In comparison to a fair ratio of 29.9, this premium suggests that some of the future optimism may already be built into the price. Could this mean the runway is shorter than it first appears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BRP Narrative

If you have a different perspective or enjoy digging into the details yourself, you can craft a personal take on BRP’s story in just a few minutes, Do it your way

A great starting point for your BRP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready to Find Your Next Investment?

Smart investors know that big opportunities often fly under the radar. Simply Wall Street’s powerful Screener reveals fresh picks in fast-changing sectors you might regret missing.

- Spot emerging players aiming for exponential growth by checking out these 3570 penny stocks with strong financials and see which companies could be tomorrow's headline-makers.

- Uncover companies poised to benefit from advances in artificial intelligence when you browse these 27 AI penny stocks, putting you at the forefront of innovation.

- Secure higher income potential and stability by tapping into these 17 dividend stocks with yields > 3% that reward shareholders with attractive yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOO

BRP

Designs, develops, manufactures, and sells powersports vehicles and marine products in the Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives