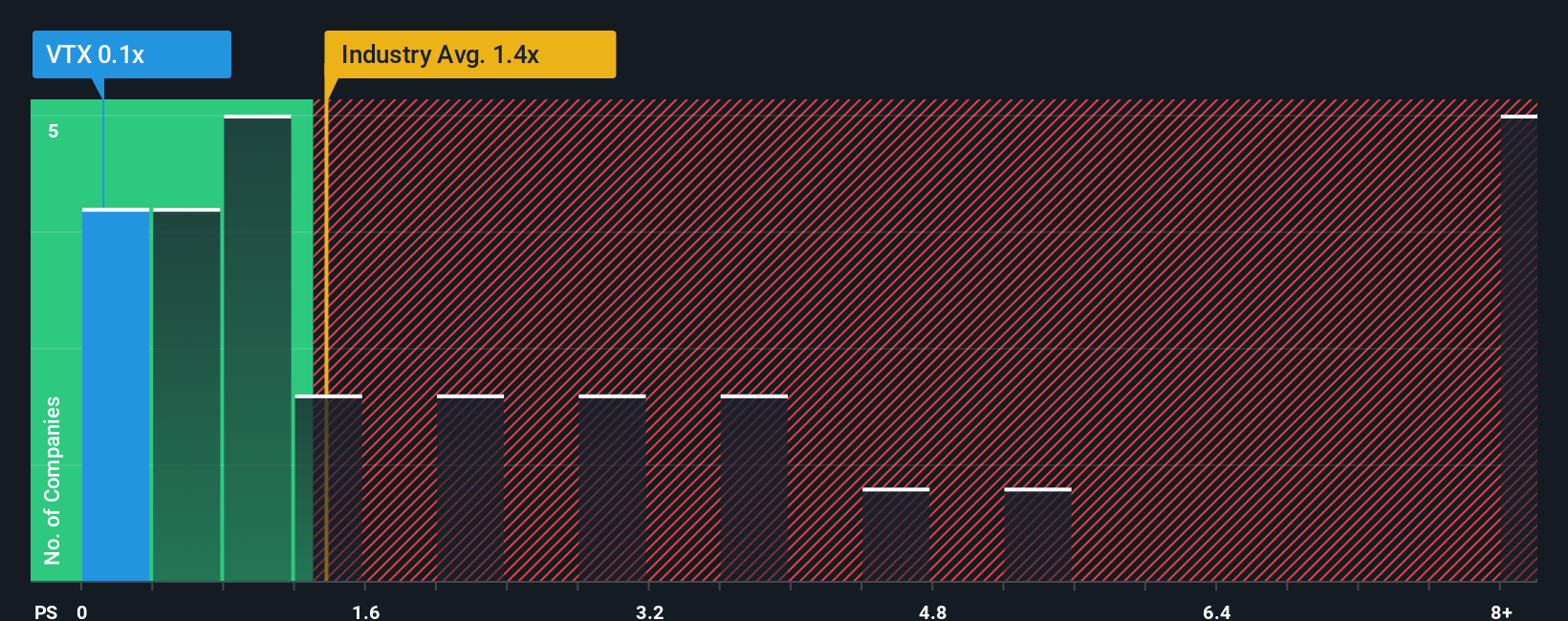

Vertex Resource Group Ltd.'s (CVE:VTX) price-to-sales (or "P/S") ratio of 0.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Commercial Services industry in Canada have P/S ratios greater than 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Vertex Resource Group

How Has Vertex Resource Group Performed Recently?

While the industry has experienced revenue growth lately, Vertex Resource Group's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Vertex Resource Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Vertex Resource Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Vertex Resource Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 15% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 2.2% during the coming year according to the lone analyst following the company. This is still shaping up to be materially better than the broader industry which is also set to decline 19%.

With this in mind, we find it curious but not unexplainable that Vertex Resource Group's P/S falls short of its industry peers. Even though the company may outperform the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares excessively.

The Bottom Line On Vertex Resource Group's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In our view, Vertex Resource Group's P/S ratio appears to be lower than anticipated, considering that its revenue projections are not as dismal as the rest of the struggling industry. When we see this a revenue outlook that is advantageous when compared to competitors, we assume potential risks are what might be placing significant pressure on the P/S ratio. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. So, given the low P/S, risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Vertex Resource Group that you should be aware of.

If these risks are making you reconsider your opinion on Vertex Resource Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:VTX

Vertex Resource Group

Provides environmental and industrial services in Canada and the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives