- Canada

- /

- Commercial Services

- /

- TSXV:GIP

Market Might Still Lack Some Conviction On Green Impact Partners Inc. (CVE:GIP) Even After 27% Share Price Boost

Those holding Green Impact Partners Inc. (CVE:GIP) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

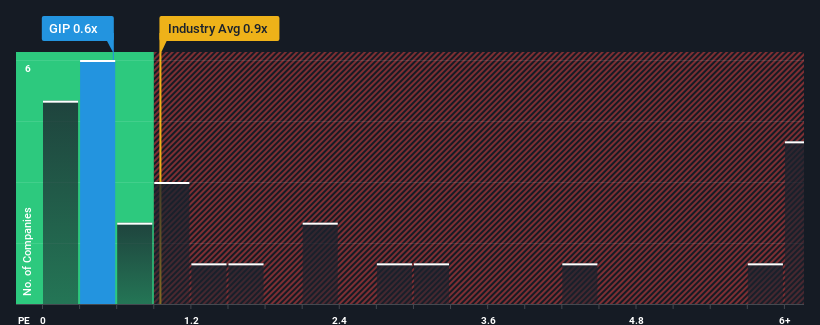

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Green Impact Partners' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Canada is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Green Impact Partners

What Does Green Impact Partners' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Green Impact Partners' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Green Impact Partners' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Green Impact Partners' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 14% during the coming year according to the four analysts following the company. With the rest of the industry predicted to shrink by 0.7%, that would be a fantastic result.

With this in mind, we find it intriguing that Green Impact Partners' P/S trades in-line with its industry peers. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Final Word

Green Impact Partners' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We note that even though Green Impact Partners trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Green Impact Partners (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If you're unsure about the strength of Green Impact Partners' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GIP

Green Impact Partners

Provides water, waste, and solids treatment and recycling services in Canada and North America.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives