- Canada

- /

- Commercial Services

- /

- TSXV:GIP

Green Impact Partners Inc. (CVE:GIP) Stock's 39% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Green Impact Partners Inc. (CVE:GIP) shares have had a horrible month, losing 39% after a relatively good period beforehand. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 22%.

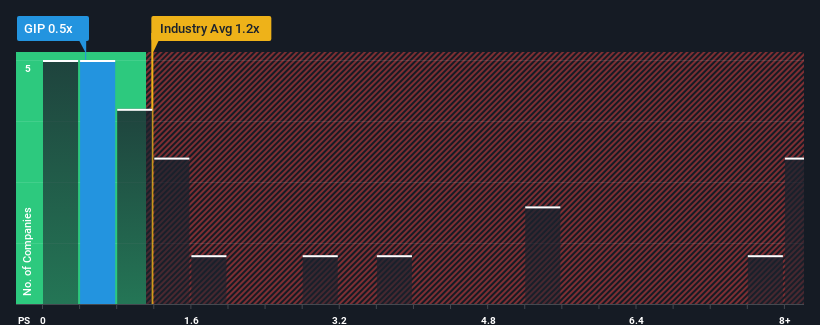

Since its price has dipped substantially, given about half the companies operating in Canada's Commercial Services industry have price-to-sales ratios (or "P/S") above 1x, you may consider Green Impact Partners as an attractive investment with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

We've discovered 4 warning signs about Green Impact Partners. View them for free.Check out our latest analysis for Green Impact Partners

How Green Impact Partners Has Been Performing

Green Impact Partners could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Green Impact Partners will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Green Impact Partners' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. Regardless, revenue has managed to lift by a handy 5.2% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 4.9% per annum as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.0% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Green Impact Partners' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Green Impact Partners' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Green Impact Partners' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Green Impact Partners (2 shouldn't be ignored!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:GIP

Green Impact Partners

Provides water, waste, and solids treatment and recycling services in Canada and North America.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives