- Canada

- /

- Commercial Services

- /

- TSXV:BLM

What You Can Learn From BluMetric Environmental Inc.'s (CVE:BLM) P/S

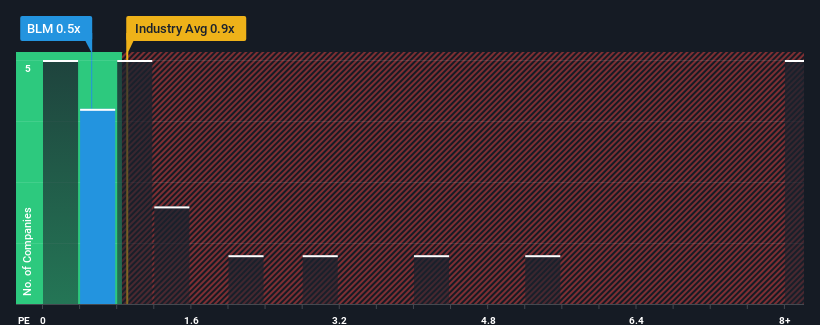

It's not a stretch to say that BluMetric Environmental Inc.'s (CVE:BLM) price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" for companies in the Commercial Services industry in Canada, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for BluMetric Environmental

How Has BluMetric Environmental Performed Recently?

As an illustration, revenue has deteriorated at BluMetric Environmental over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on BluMetric Environmental's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

BluMetric Environmental's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 2.1% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 6.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to decline by 1.9% over the next year, which is just as bad as the company's recent medium-term revenue decline.

In light of this, it's understandable that BluMetric Environmental's P/S sits in line with the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of BluMetric Environmental confirms that the company's contraction in revenue over the past three-year years is a major contributor to its industry-matching P/S, given the industry is set to decline in a similar fashion. Right now shareholders are comfortable with the P/S as they seem confident future revenue won't throw up any further unpleasant surprises. Although, we are concerned whether the company's performance will worsen relative to other industry players under these tough industry conditions. If the company's performance remains relatively stable, it's likely that the current share price will continue to find support.

You need to take note of risks, for example - BluMetric Environmental has 5 warning signs (and 2 which can't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BluMetric Environmental might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BLM

BluMetric Environmental

Provides sustainable solutions for environmental issues in Canada and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026