- Canada

- /

- Commercial Services

- /

- TSXV:BLM

TSX Penny Stocks Worth Watching In January 2025

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a complex landscape marked by rising government bond yields and political shifts, with the resignation of Prime Minister Trudeau adding to the uncertainty. Amid these conditions, investors are reminded that financial markets are ultimately driven by fundamentals rather than political headlines. Although "penny stocks" might seem like a dated term, they remain an intriguing investment area for those seeking growth opportunities in smaller or newer companies with solid financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.47 | CA$122.52M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.58 | CA$989.91M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.72 | CA$647.54M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.27 | CA$226.4M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Copper Road Resources (TSXV:CRD) | CA$0.02 | CA$975.24k | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.82 | CA$178.64M | ★★★★★☆ |

Click here to see the full list of 928 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Trilogy Metals (TSX:TMQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trilogy Metals Inc. is a base metals exploration company focused on the exploration and development of mineral properties in the United States, with a market cap of CA$252.68 million.

Operations: Trilogy Metals Inc. does not report any revenue segments as it is focused on the exploration and development of mineral properties in the United States.

Market Cap: CA$252.68M

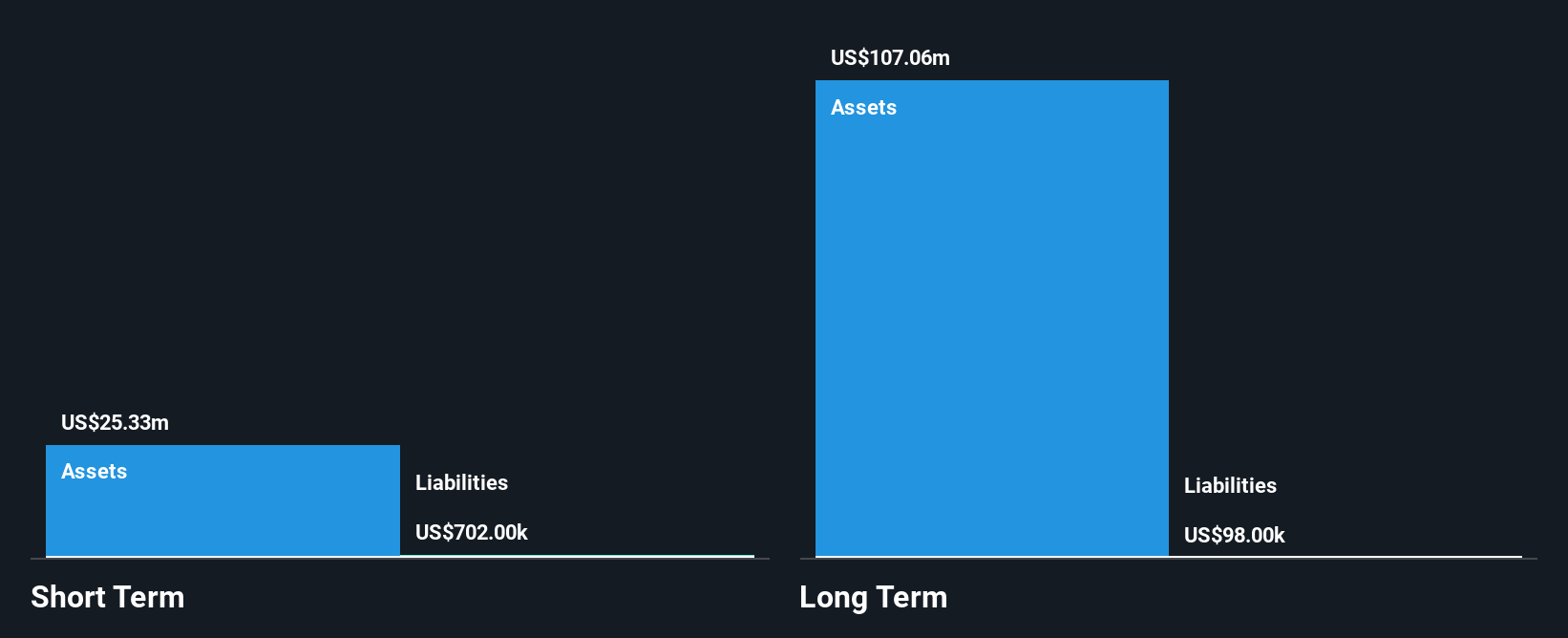

Trilogy Metals Inc., a pre-revenue base metals exploration company, maintains a debt-free status with short-term assets of US$26.1 million exceeding both its short and long-term liabilities. Despite its unprofitability and negative return on equity, the company benefits from an experienced board and management team. Trilogy's cash runway is sufficient for over three years, assuming historical free cash flow growth continues. The company's stock has shown high volatility recently, increasing from 21% to 34% weekly volatility over the past year. Recent developments include discussions on Bornite PEA results and a shelf registration filing for approximately US$6.98 million in common shares.

- Get an in-depth perspective on Trilogy Metals' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Trilogy Metals' track record.

BluMetric Environmental (TSXV:BLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BluMetric Environmental Inc. offers solutions for environmental issues globally and has a market cap of CA$31.95 million.

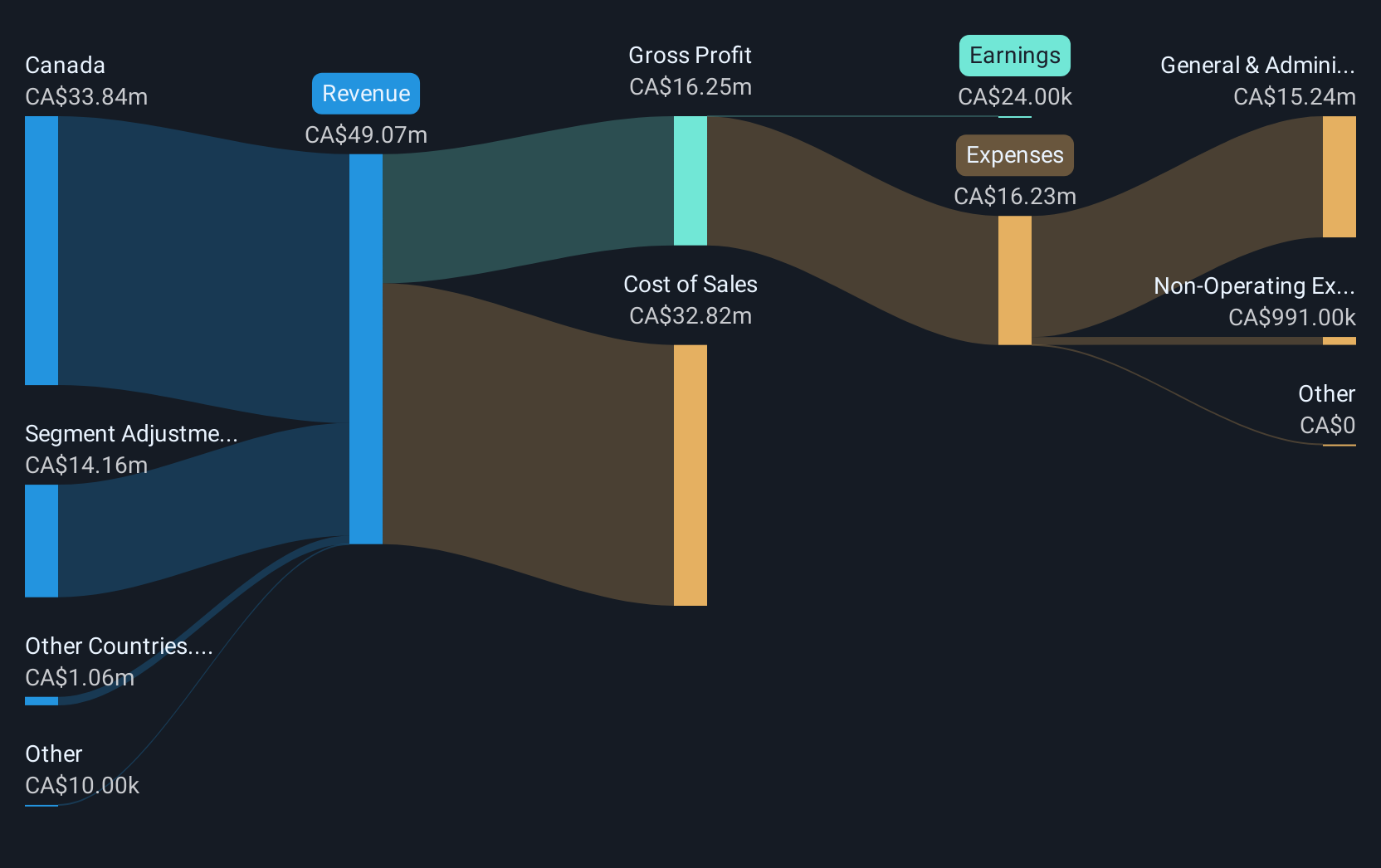

Operations: The company generates revenue from its Waste Management segment, amounting to CA$34.02 million.

Market Cap: CA$31.95M

BluMetric Environmental Inc., with a market cap of CA$31.95 million, has seen significant activity in private placements, raising CA$3.5 million through Clarus Securities and an additional CA$500,000 from accredited investors. The company recently secured a contract worth approximately CAD 1.1 million for a Sea Water Reverse Osmosis system in the Bahamas, indicating potential growth in its cleantech water systems segment. Despite past shareholder dilution and declining earnings over five years, BluMetric became profitable last year and maintains more cash than debt, although its operating cash flow remains negative. Its management team is experienced with an average tenure of 5.3 years.

- Take a closer look at BluMetric Environmental's potential here in our financial health report.

- Examine BluMetric Environmental's past performance report to understand how it has performed in prior years.

Metalla Royalty & Streaming (TSXV:MTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metalla Royalty & Streaming Ltd. is a precious metals royalty and streaming company focused on acquiring and managing gold, silver, and copper royalties and streams in Canada, with a market cap of CA$348.14 million.

Operations: The company's revenue is derived entirely from the acquisition and management of precious metal royalties, streams, and similar production-based interests, totaling $5.05 million.

Market Cap: CA$348.14M

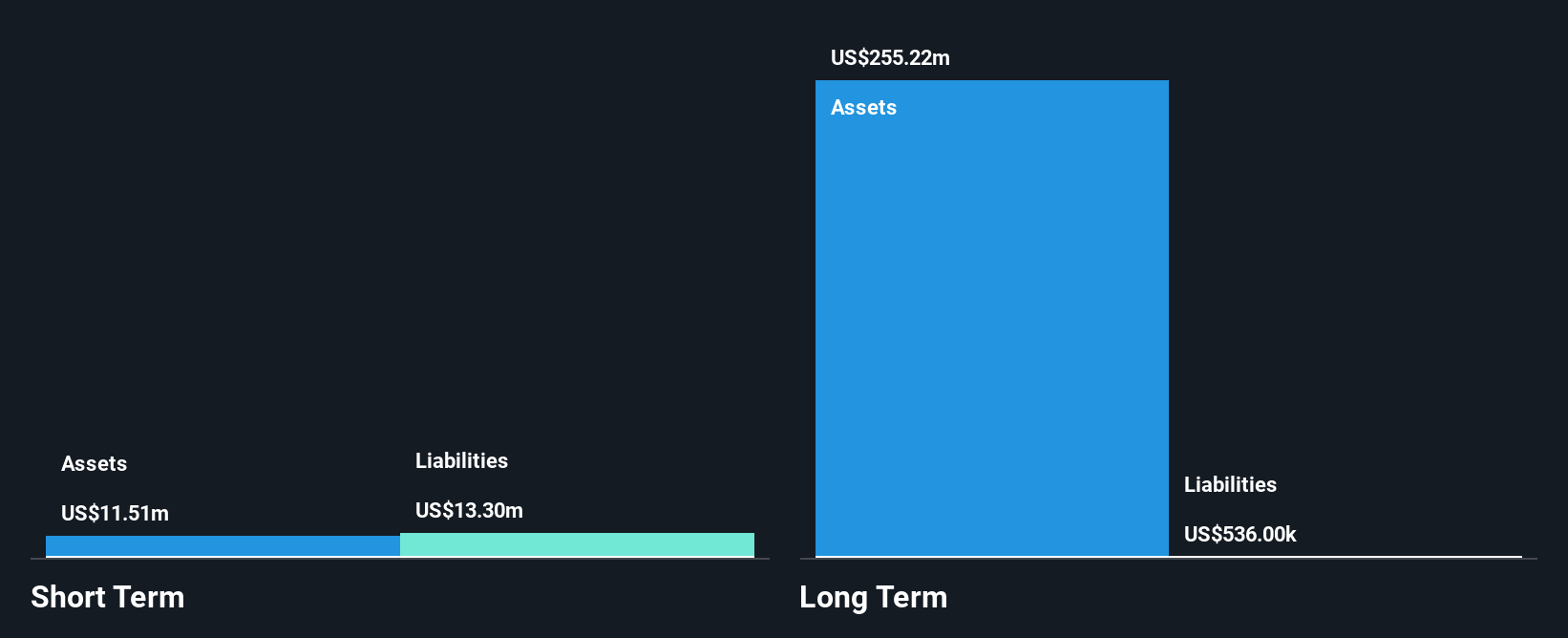

Metalla Royalty & Streaming Ltd., with a market cap of CA$348.14 million, remains unprofitable but shows potential in the penny stock landscape due to its strategic focus on precious metal royalties and streams. The company reported a reduced net loss for Q3 2024 compared to the previous year, indicating some financial improvement. Despite short-term liabilities exceeding assets, Metalla's debt levels are satisfactory with a net debt to equity ratio of 1.2%. Analysts suggest significant upside potential in stock price, and recent board enhancements bring valuable mining finance expertise that could support future growth initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of Metalla Royalty & Streaming.

- Learn about Metalla Royalty & Streaming's future growth trajectory here.

Next Steps

- Click this link to deep-dive into the 928 companies within our TSX Penny Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BluMetric Environmental might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BLM

BluMetric Environmental

Provides sustainable solutions for environmental issues in Canada and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion