- Canada

- /

- Commercial Services

- /

- TSXV:BLM

Take Care Before Diving Into The Deep End On BluMetric Environmental Inc. (CVE:BLM)

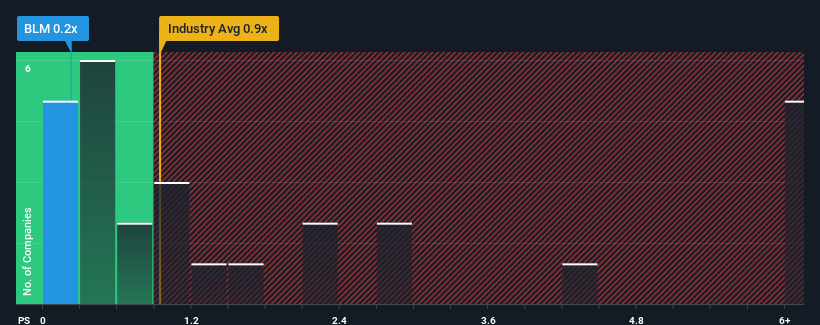

You may think that with a price-to-sales (or "P/S") ratio of 0.2x BluMetric Environmental Inc. (CVE:BLM) is a stock worth checking out, seeing as almost half of all the Commercial Services companies in Canada have P/S ratios greater than 0.9x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for BluMetric Environmental

How Has BluMetric Environmental Performed Recently?

We'd have to say that with no tangible growth over the last year, BluMetric Environmental's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on BluMetric Environmental will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For BluMetric Environmental?

BluMetric Environmental's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 40% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.7% shows it's a great look while it lasts.

In light of this, it's quite peculiar that BluMetric Environmental's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From BluMetric Environmental's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at the figures, it's surprising to see BluMetric Environmental currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Before you take the next step, you should know about the 2 warning signs for BluMetric Environmental (1 makes us a bit uncomfortable!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if BluMetric Environmental might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BLM

BluMetric Environmental

Provides sustainable solutions for environmental issues in Canada and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026