- Canada

- /

- Professional Services

- /

- TSX:TRI

Will Segment Divergence in Thomson Reuters (TSX:TRI) Earnings Shape Its Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- Thomson Reuters recently drew analyst attention ahead of its Q3 earnings announcement, with forecasts pointing to year-over-year increases in both earnings per share and revenue, particularly in the Tax & Accounting Professionals and Corporates segments, while Legal Professionals and Global Print are expected to see declines.

- Analyst sentiment remains generally optimistic as the consensus outlook holds steady, suggesting investors are watching closely for confirmation of ongoing growth trends and the company's ability to deliver across its diverse business lines.

- With stable analyst sentiment ahead of earnings, we'll examine how these expectations could influence Thomson Reuters' investment narrative and future outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Thomson Reuters Investment Narrative Recap

Being a Thomson Reuters shareholder means believing in the company's ability to leverage its premium content, workflow platforms, and AI-driven innovation for consistent subscription and service revenue, even as legacy segments like Legal Professionals and Global Print face challenges. The recent analyst outlook and stable consensus projections reinforce expectations for continued growth in core franchises but do not materially alter the fact that competitive pressures from legal-tech rivals and evolving AI adoption trends remain the biggest short-term risks to watch.

Among recent announcements, Thomson Reuters' August share buyback plan stands out, authorizing up to US$1 billion for repurchases. This move is particularly relevant, as it underscores management’s commitment to capital return, potentially helping offset near-term volatility from segment softness and providing additional confidence for investors focused on the upcoming Q3 earnings as a key catalyst.

By contrast, investors should also keep in mind the risk that rapid innovation by new AI start-ups and established legal tech firms could...

Read the full narrative on Thomson Reuters (it's free!)

Thomson Reuters' narrative projects $9.2 billion revenue and $2.1 billion earnings by 2028. This requires 7.8% yearly revenue growth and a $0.5 billion earnings increase from $1.6 billion currently.

Uncover how Thomson Reuters' forecasts yield a CA$276.64 fair value, a 28% upside to its current price.

Exploring Other Perspectives

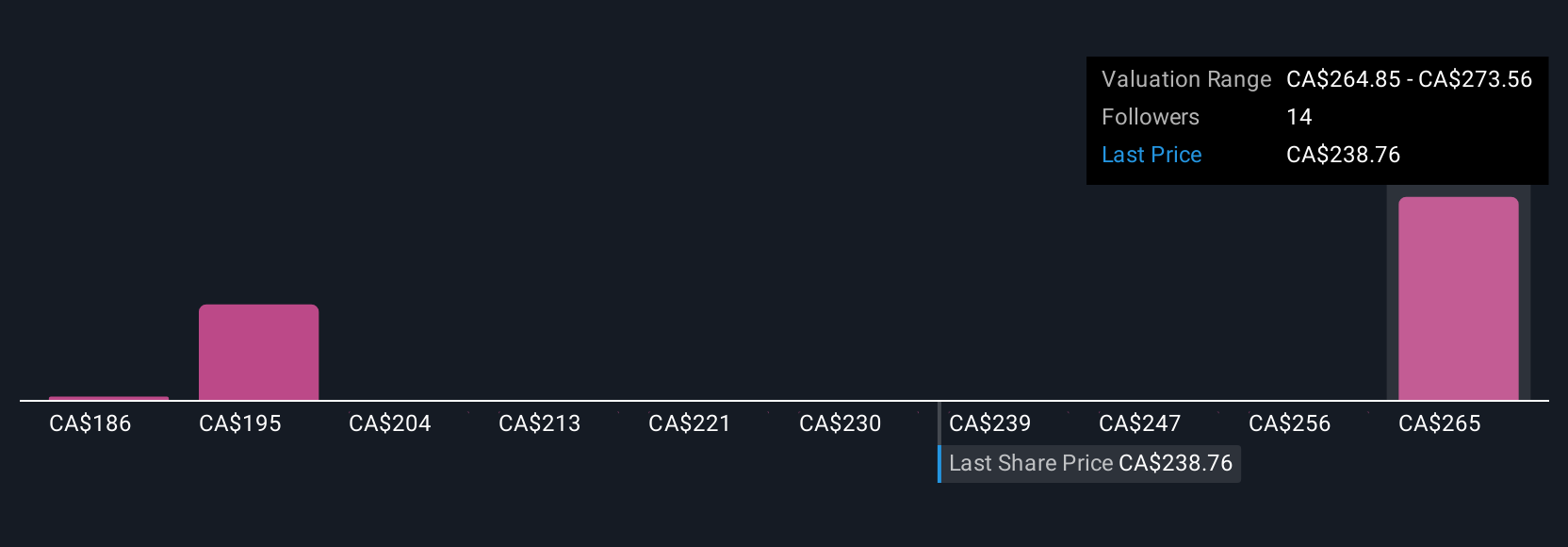

Fair value estimates from four Simply Wall St Community members span US$186.45 to US$276.64, highlighting wide-ranging views on the company's potential. While some see substantial opportunity, remember that persistent competition in legal tech could still weigh on future performance, so weigh these perspectives carefully.

Explore 4 other fair value estimates on Thomson Reuters - why the stock might be worth as much as 28% more than the current price!

Build Your Own Thomson Reuters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thomson Reuters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thomson Reuters' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion