- Canada

- /

- Commercial Services

- /

- TSX:PYR

Should Shareholders Reconsider PyroGenesis Canada Inc.'s (TSE:PYR) CEO Compensation Package?

Key Insights

- PyroGenesis Canada to hold its Annual General Meeting on 27th of June

- Salary of CA$450.0k is part of CEO Photis Pascali's total remuneration

- The overall pay is 162% above the industry average

- PyroGenesis Canada's three-year loss to shareholders was 91% while its EPS was down 53% over the past three years

PyroGenesis Canada Inc. (TSE:PYR) has not performed well recently and CEO Photis Pascali will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 27th of June. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for PyroGenesis Canada

How Does Total Compensation For Photis Pascali Compare With Other Companies In The Industry?

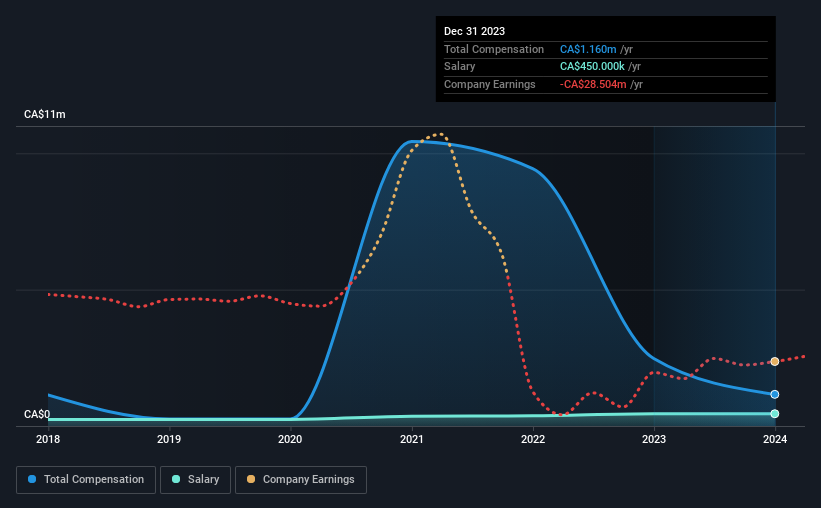

According to our data, PyroGenesis Canada Inc. has a market capitalization of CA$109m, and paid its CEO total annual compensation worth CA$1.2m over the year to December 2023. That's a notable decrease of 53% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$450k.

On comparing similar-sized companies in the Canadian Commercial Services industry with market capitalizations below CA$274m, we found that the median total CEO compensation was CA$442k. Accordingly, our analysis reveals that PyroGenesis Canada Inc. pays Photis Pascali north of the industry median. Moreover, Photis Pascali also holds CA$44m worth of PyroGenesis Canada stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$450k | CA$450k | 39% |

| Other | CA$710k | CA$2.0m | 61% |

| Total Compensation | CA$1.2m | CA$2.5m | 100% |

Speaking on an industry level, nearly 36% of total compensation represents salary, while the remainder of 64% is other remuneration. PyroGenesis Canada is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at PyroGenesis Canada Inc.'s Growth Numbers

Over the last three years, PyroGenesis Canada Inc. has shrunk its earnings per share by 53% per year. In the last year, its revenue is down 24%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has PyroGenesis Canada Inc. Been A Good Investment?

Few PyroGenesis Canada Inc. shareholders would feel satisfied with the return of -91% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 4 warning signs for PyroGenesis Canada you should be aware of, and 3 of them make us uncomfortable.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PYR

PyroGenesis

Designs, develops, manufactures, and commercializes plasma processes and solutions worldwide.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026