- Canada

- /

- Professional Services

- /

- TSX:LWRK

These 4 Measures Indicate That Morneau Shepell (TSE:MSI) Is Using Debt Extensively

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies. Morneau Shepell Inc. (TSE:MSI) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Morneau Shepell

What Is Morneau Shepell's Net Debt?

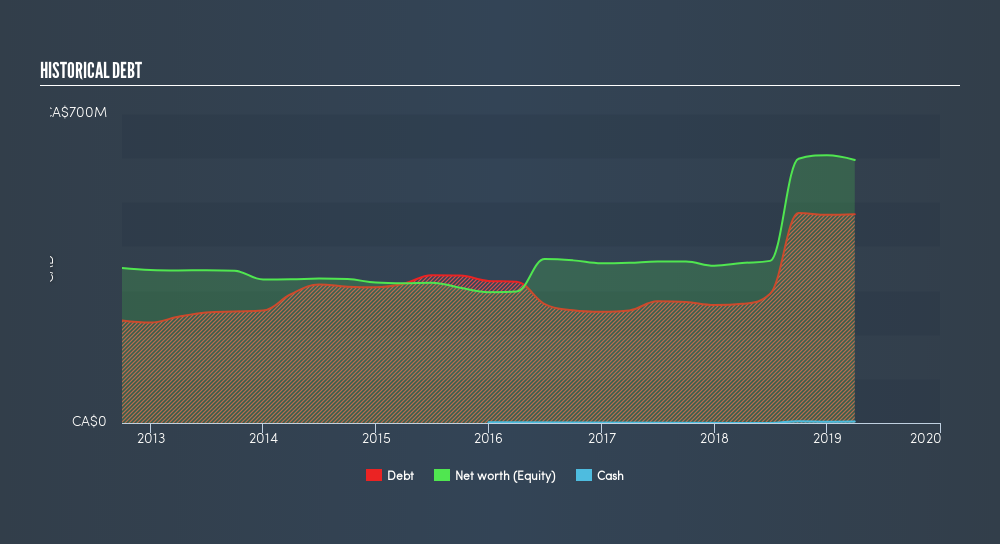

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Morneau Shepell had CA$472.9m of debt, an increase on CA$269.9m, over one year. Net debt is about the same, since the it doesn't have much cash.

A Look At Morneau Shepell's Liabilities

Zooming in on the latest balance sheet data, we can see that Morneau Shepell had liabilities of CA$154.2m due within 12 months and liabilities of CA$659.8m due beyond that. Offsetting these obligations, it had cash of CA$3.33m as well as receivables valued at CA$166.7m due within 12 months. So its liabilities total CA$643.9m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Morneau Shepell is worth CA$1.91b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Since Morneau Shepell does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Morneau Shepell has a debt to EBITDA ratio of 3.99 and its EBIT covered its interest expense 3.37 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Even more troubling is the fact that Morneau Shepell actually let its EBIT decrease by 5.8% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Morneau Shepell's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Morneau Shepell produced sturdy free cash flow equating to 61% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

While Morneau Shepell's interest cover makes us cautious about it, its track record of managing its debt, based on its EBITDA, is no better. But its not so bad at converting EBIT to free cash flow. Looking at all the angles mentioned above, it does seem to us that Morneau Shepell is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Given our hesitation about the stock, it would be good to know if Morneau Shepell insiders have sold any shares recently. You click here to find out if insiders have sold recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:LWRK

LifeWorks

LifeWorks Inc. provides digital and in-person solutions for wellbeing of individuals in Canada, the United States and internationally.

Moderate growth potential unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026