- Canada

- /

- Commercial Services

- /

- TSX:KBL

Volatility 101: Should K-Bro Linen (TSE:KBL) Shares Have Dropped 11%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term K-Bro Linen Inc. (TSE:KBL) shareholders, since the share price is down 11% in the last three years, falling well short of the market return of around 18%. There was little comfort for shareholders in the last week as the price declined a further 1.9%.

See our latest analysis for K-Bro Linen

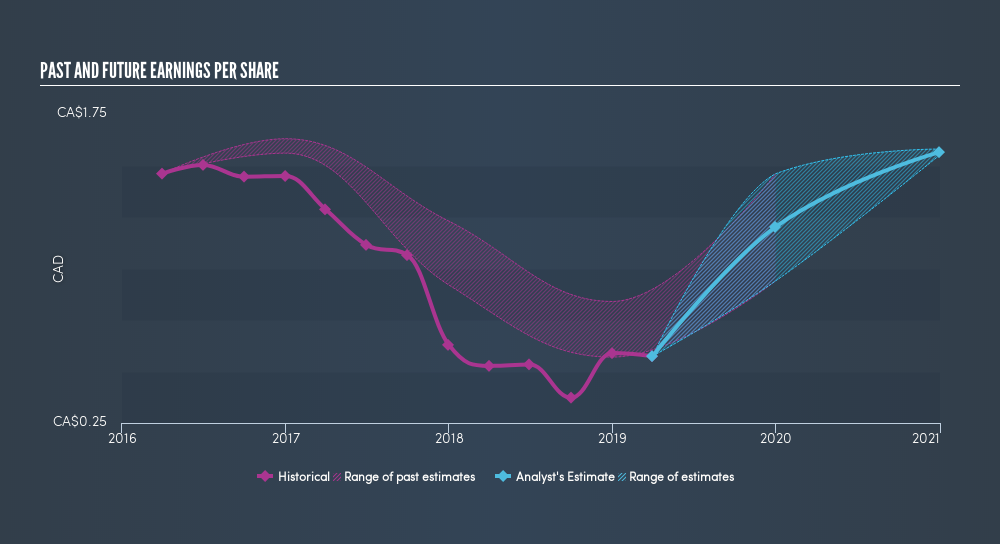

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

K-Bro Linen saw its EPS decline at a compound rate of 27% per year, over the last three years. In comparison the 3.7% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in. With a P/E ratio of 68.38, it's fair to say the market sees a brighter future for the business.

It might be well worthwhile taking a look at our free report on K-Bro Linen's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of K-Bro Linen, it has a TSR of -2.0% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that K-Bro Linen shareholders have received a total shareholder return of 5.3% over one year. That's including the dividend. That gain is better than the annual TSR over five years, which is 3.5%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:KBL

K-Bro Linen

Provides laundry and linen services to healthcare institutions, hotels, and other commercial organizations in Canada and the United Kingdom.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives